- David Brend and Gustavo Rodriguez convicted for their roles in a fraudulent crypto operation, facing up to 20 years.

- IcomTech, claiming to be a crypto mining and trading firm, was exposed as a Ponzi scheme by a New York jury.

- The scheme swindled millions from investors, using funds for luxury lifestyles and hosting grand events to attract more victims.

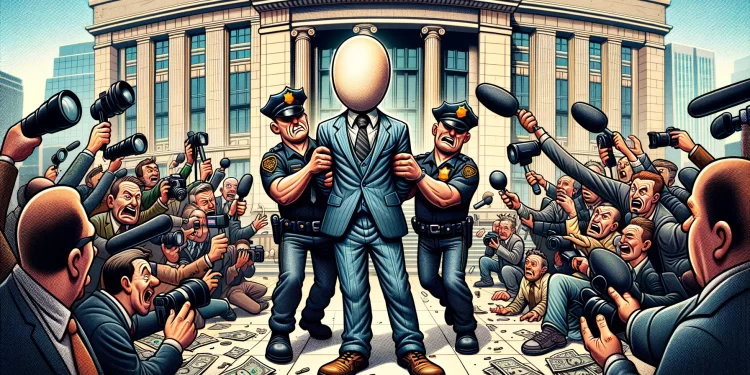

Two individuals linked to the now-defunct IcomTech, which was involved in a fraudulent cryptocurrency operation, have been found guilty of wire fraud conspiracy. According to SDNY, this conviction could lead to each facing a two-decade-long prison sentence, marking a significant development in the crackdown on crypto-related fraud.

The Rise and Fall of IcomTech

IcomTech, initially portrayed as a promising venture in cryptocurrency mining and trading, was later uncovered as a deceptive Ponzi scheme. The company, under the guise of legitimate business, promised investors daily returns from its crypto activities. However, the truth surfaced when it was revealed that no actual mining or trading was taking place. Instead, the operation relied on using new investor funds to pay returns to earlier participants.

David Brend and Gustavo Rodriguez, the convicted promoters, along with other associates, were accused of diverting millions from investors for personal gains. Their lavish lifestyle, funded by the scheme, was flaunted at extravagant events designed to entice further investment into the fraudulent operation.

Legal Consequences and Investor Fallout

The legal repercussions for those involved have been severe. Brend and Rodriguez’s conviction underscores the justice system’s commitment to addressing fraudulent activities in the emerging crypto sector. Meanwhile, investors, lured by the promise of consistent profits, faced the harsh reality of inaccessible funds and worthless digital tokens as the scheme unraveled.

As the legal proceedings continue, with sentencing for Brend and Rodriguez scheduled for mid-2023, the case serves as a cautionary tale about the potential pitfalls within the volatile cryptocurrency market. It highlights the importance of due diligence and the risks associated with ventures promising guaranteed returns in the ever-evolving crypto landscape.