- Finblox and OpenEden collaborate to unlock a trillion-dollar market for web3 users with the introduction of Tokenized U.S. Treasuries (TBILLS).

- TBILLS will revolutionize the digital asset market and give investors direct experience with several short-term treasury bills, the USD coin, and the dollar reserve.

- The partnership sets the ground for broader adoption of tokenized assets.

OpenEden, a pioneering decentralized finance (DeFi) platform, has partnered with Finblox, a leading Blockchain-based Fintech firm, to introduce a groundbreaking financial solution –Tokenized U.S. Treasuries (TBILLS).

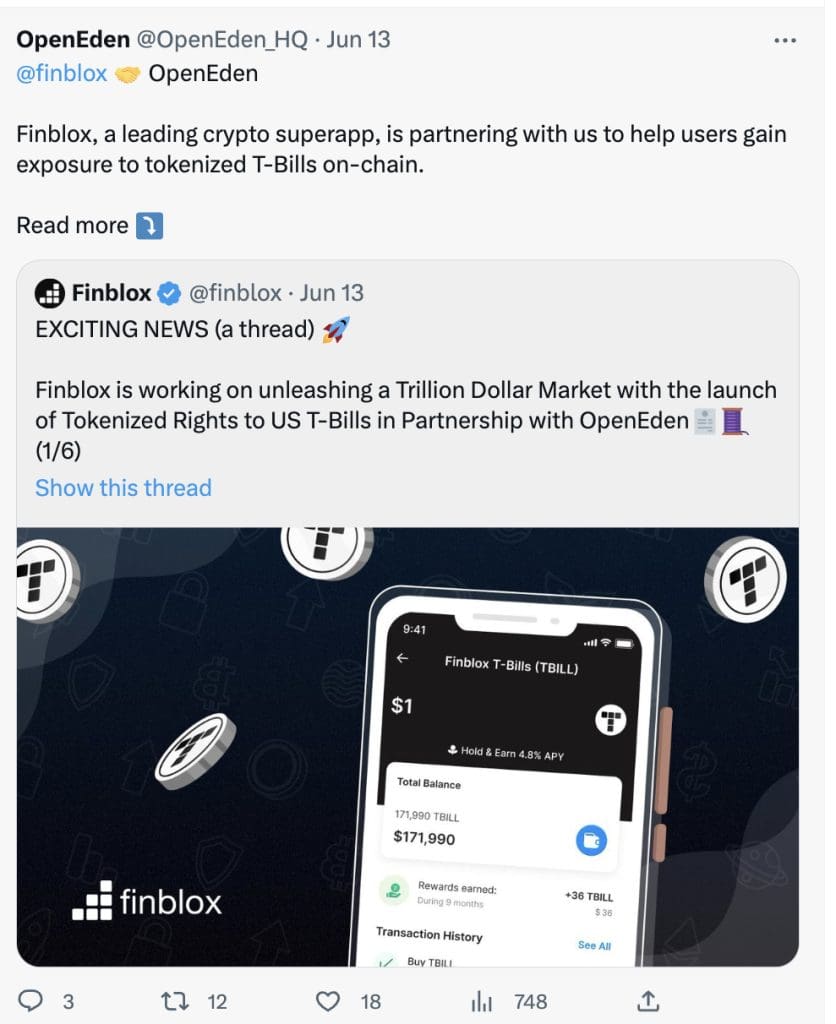

When breaking the news, OpenEden tweeted, saying that the partnership with Finblox will help its “users gain exposure to tokenized T-Bills on-chain.”

The partnership is significant to investors as they will start earning yields on their stablecoin holdings through OpenEden’s TBILL tokens. In its announcement, Finblox said:

“We’re thrilled to launch the tokenized rights to U.S. Treasury Bills (T-Bills) in partnership with OpenEden, which operates the first smart contract vault to offer 24/7 access to U.S. Treasury Bills.”

The announcement was unleashed with excitement to tap into the millions of Web3 users and unlock the trillion-dollar market.

Finblox further indicated;

“This move unlocks a trillion-dollar market for the millions of web3 users starting with our amazing Finblox community.”

The news of this partnership was communicated through many channels, where Finblox’s Twitter account stated that “OpenEden is a trailblazer in the industry.”

What are Tokenized T-bills (TBILLS), and why are they significant for this partnership?

As fronted by OpenEden, the T-BILLS is the first in the world to have a smart contract vault for the United States of America’s Treasury Bills.

The TBILLS give investors direct experience with several short-term treasury bills, the USD Coin stablecoin, and the dollar reserve. In essence, the investors with TBILLS earn returns on their capital reflected by the held assets in the vault.

The TBILLS function as high-yield accounts for savings on the blockchain, making the investors gain through their excess stablecoins stored in short-term government bonds.

The functioning of TBILLS is similar to high-yield savings in blockchains that allow investors to hold their stablecoins in government bonds, which many views as the safest investment to venture into.

In this regard, investors in TBILLS have a high potential of accessing streamlined trading, fractional ownership, and enhanced liquidity as they maintain the stability of U.S. government bonds.

The partnership is very significant to Finblox as it strives to establish itself as a ‘crypto superapp’ with the ability to give its clients a range of financial services.

This new product through Finblox will allow its investors to invest in a platform that allows them to have part ownership in the US Tbills without investing heavily if they cannot pump heavy investment in the service.

Fibblox stated:

“You can now earn from T-Bills with amounts that suit your preferences,”

The company noted that they are looking forward to empowering cryptocurrency investors with comprehensive financial services that will have value for their money.

Implications for TBILLS as they are offered by Finblox and OpenEden partnership

The partnership between the two firms will likely face regulatory scrutiny, as witnessed in the recent cases against Coinbase and Binance.US by SEC. The heightened oversight over tokenized securities will be rattled to establish new guidelines for investor protection.

The introduction of TBILLS in Finblox will set the stage for broader adoption of the tokenized assets leading to more tokenization of financial services.

Investing in tokenized bills can increase access to government bonds, attracting more participants to the industry and ultimately broadening their efficiency.