- Fidelity has filed for a spot Solana ETF with the Cboe, signaling strong institutional interest.

- Solana’s price surged 16% this week, hitting $143 after news of the filing.

- If approved, the ETF could push SOL toward $300, following Bitcoin and Ethereum’s ETF success.

Fidelity’s making moves again—this time with Solana. The investment giant has officially filed to launch a spot Solana (SOL) ETF, setting the stage for what could be the next major crypto-backed fund in the U.S.

The filing went through the Chicago Board Options Exchange (Cboe), specifically via the BZX Exchange, and came in the form of a 19b-4 submission to the SEC. It’s not a done deal yet, but it’s a clear signal: they’re serious.

If approved, this would make Solana the third big-name crypto—after Bitcoin and Ethereum—to score a spot ETF listing in the U.S. And with how things have been heating up lately? This could happen faster than people think.

Solana’s Turn in the Spotlight

Over the past few weeks, there’s been a ton of chatter about which crypto might be next to get the ETF green light. Bitcoin and Ethereum already crossed that milestone, so naturally, people started eyeing SOL. Now, with Fidelity stepping in, those rumors just got a lot more real.

And here’s the thing—Fidelity isn’t just another name on the list. They’re managing around $15 trillion in assets, which puts them leagues ahead of other applicants like VanEck, Grayscale, and Franklin Templeton. That kind of institutional weight changes the conversation.

This isn’t a maybe. It’s a “when.”

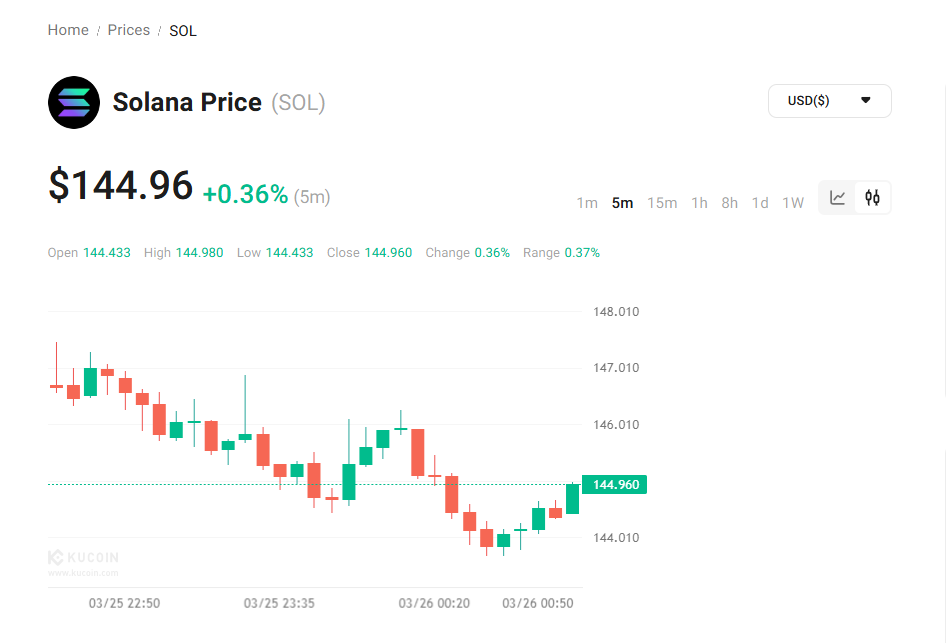

Price Already Reacting

Not surprisingly, Solana’s price jumped on the news—up 16% in the past week, hitting as high as $143 on Tuesday. Market watchers are already buzzing about a possible run toward $300, especially if the ETF gets approved.

Momentum’s building. Hype’s ticking up. And if Fidelity lands the first official spot SOL ETF, the altcoin space might just have its next breakout moment.