- December rate-cut odds collapse from 97% to ~22% after strong September jobs report.

- Missing October data from the shutdown makes the Fed more cautious.

- Economists expect cuts to resume in January 2026 if trends weaken.

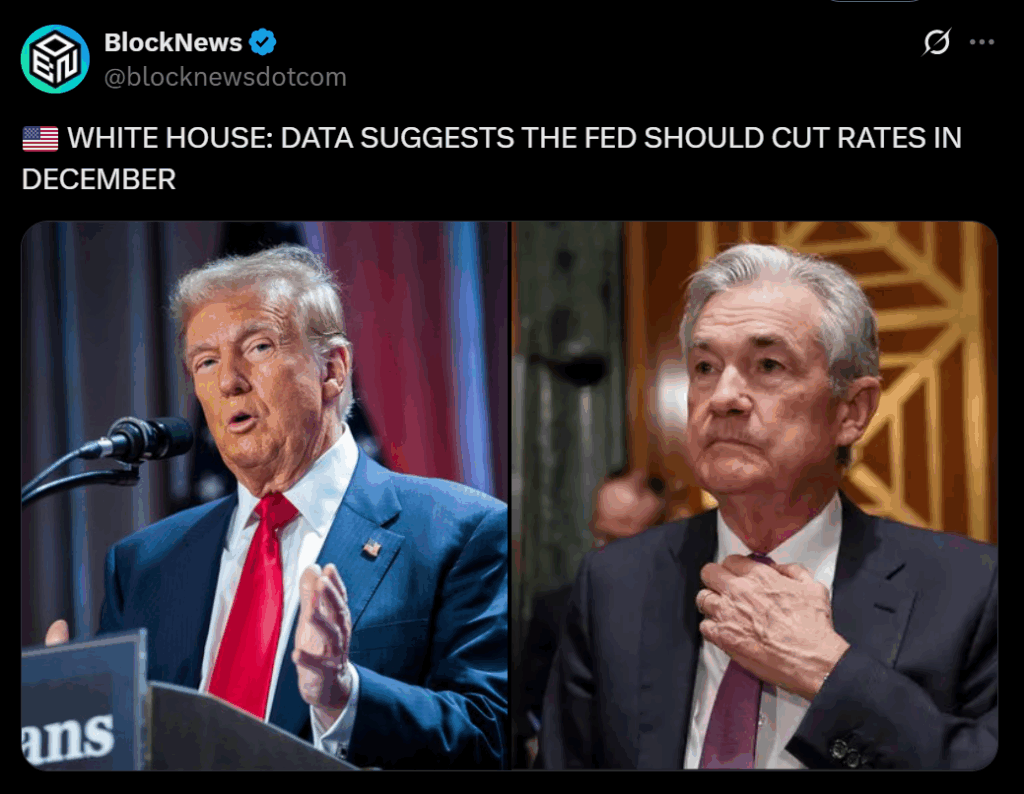

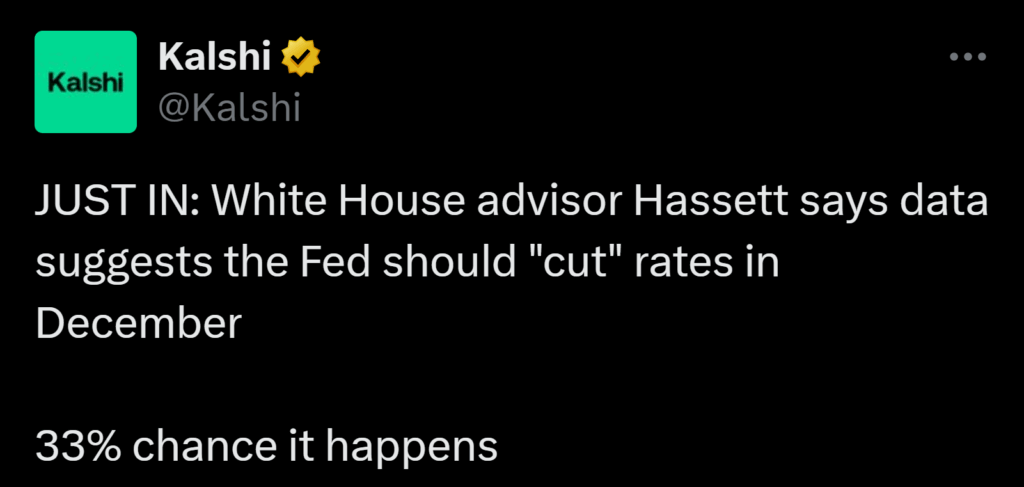

The Federal Reserve’s December meeting is shaping up very differently than traders expected just a few weeks ago. After September’s delayed jobs report showed 119,000 new hires, far exceeding forecasts, the probability of a December rate cut has plunged. Economists polled by FactSet now assign just a 22% chance of a cut — down from 97% in mid-October — while CME FedWatch places the likelihood slightly higher at 41%, but still well below earlier expectations. The shift signals growing confidence that the Fed will keep rates unchanged at its December 9–10 meeting.

Shutdown Fallout Leaves the Fed Flying Blind

The six-week government shutdown has disrupted economic visibility, delaying the October jobs report and forcing the Fed to rely on stale data. Fed Chair Jerome Powell had already warned that a December cut was “not a foregone conclusion”, citing a job market that remained too resilient for comfort.

The Bureau of Labor Statistics has confirmed that October data will now be merged into November’s report — to be released after the December meeting — leaving policymakers to decide without crucial labor information.

A Mixed Economic Picture Complicates the Decision

September’s stronger-than-expected hiring numbers reflect an economy still producing steady jobs, even as the unemployment rate rose to 4.4%, the highest since late 2021. Economists say this likely signals more workers returning to the job market rather than employers cutting roles.

Inflation remains at 3%, keeping pressure on the Fed to avoid easing too quickly before clear disinflation continues. With incomplete data and lingering inflation concerns, many forecasters now believe the central bank will wait until the January 2026 meeting to resume cuts.

What This Means Going Forward

If the Fed skips a December cut, borrowing costs for mortgages, cars, and credit will likely remain elevated into early 2026. Consumer sentiment, already strained by the cost of living, may worsen unless rate relief arrives early in the new year. For now, the federal funds rate remains at 3.75% to 4%, with traders watching the limited incoming data closely.