- U.S. CPI rose 0.3% in September, slightly below expectations, with annual inflation at 3.0%.

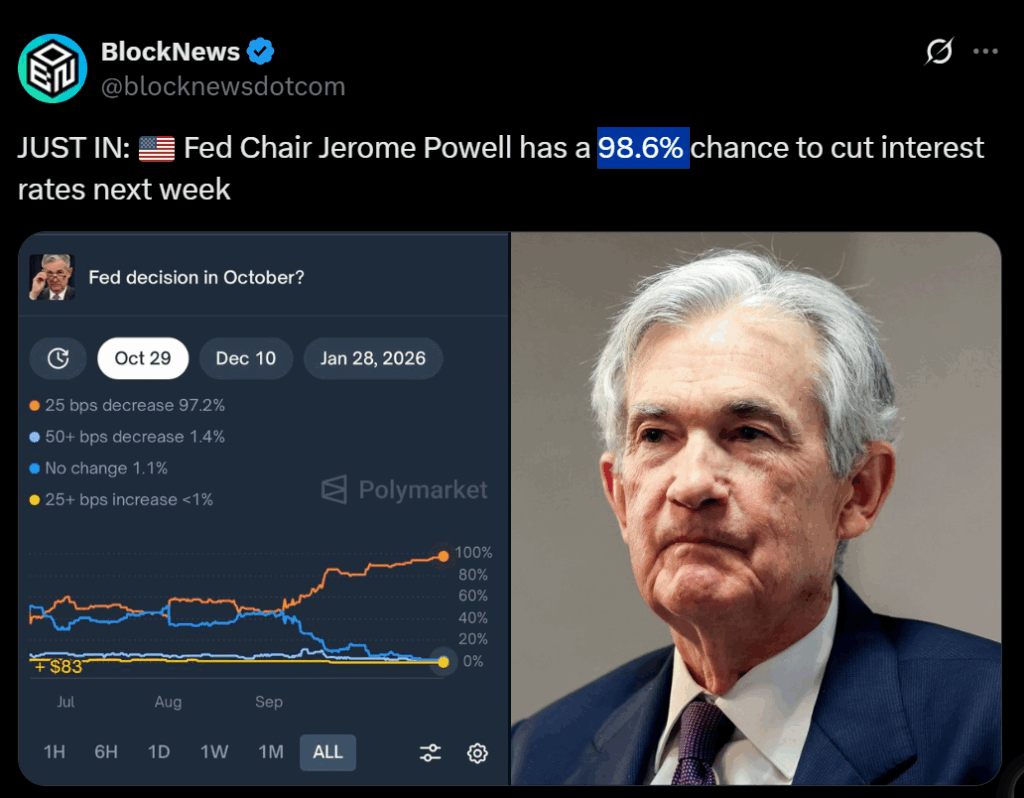

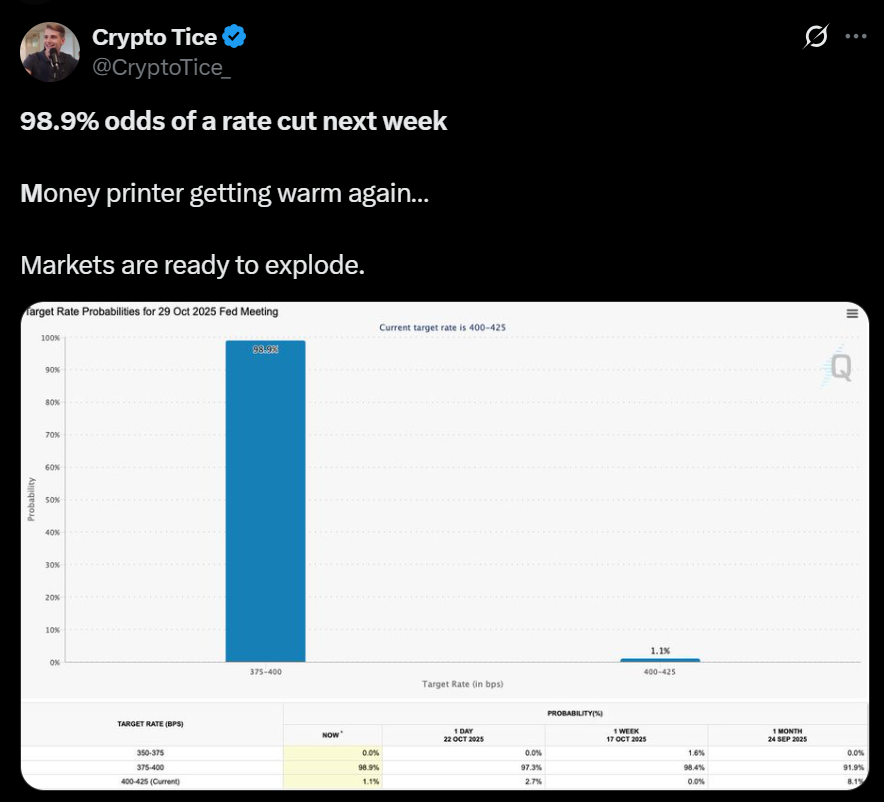

- Rate cut odds hit 98.6% for October and 94.5% for December, per CME FedWatch data.

- Trump’s new tariffs could threaten to reaccelerate inflation despite easing trends.

The Federal Reserve is widely expected to cut interest rates by 25 basis points next week, as new data showed U.S. inflation cooled slightly in September. The Consumer Price Index (CPI) rose 0.3% month-over-month, easing from August’s 0.4% increase and coming in just below expectations. Year-over-year, inflation stood at 3.0%, while core inflation — which excludes food and energy — also rose 3.0%, its lowest level since early 2024.

The CPI report showed that rising gasoline prices (+4.1%) were the main driver of inflation in September, while food and housing costs grew at a more moderate pace. Meanwhile, categories like used cars, communication, and vehicle insurance saw declines, indicating a broad cooling in price pressures across consumer sectors.

Market Bets Surge on Consecutive Cuts

Following the inflation data, traders boosted bets that the Fed will deliver two rate cuts before year-end. According to the CME FedWatch Tool, the probability of an October rate cut jumped to 98.6%, while the odds of another in December reached 94.5%. Futures markets are even pricing in a potential third cut in January 2026, as policymakers seek to balance slower growth with easing inflation.

Still, uncertainty remains. Fed Chair Jerome Powell has struck a cautious tone, warning that the path of rate reductions will depend on sustained progress in inflation and labor conditions. Meanwhile, hiring has slowed modestly, raising concerns that overly aggressive cuts could unsettle wage and employment dynamics.

Trump’s Tariffs Add a New Inflation Risk

Despite optimism around the rate cut cycle, analysts warn that President Donald Trump’s proposed tariffs on Chinese imports — set to begin November 1 — could complicate the inflation picture. Economists say the new tariffs might reignite price pressures in sectors tied to imports, such as electronics and autos, partially offsetting the Fed’s efforts to tame inflation.

The central bank’s upcoming decision is expected to signal whether it prioritizes short-term growth over preemptive inflation control. For now, markets are bracing for a dovish tone, with equities and crypto assets both showing relief rallies ahead of the announcement.