- Polymarket shows 98% odds the Fed will cut rates by 25 bps on Wednesday.

- Updated 2025 SEP projections could shift expectations for next year’s rate path.

- Traders are watching for signs of growing disagreement within the FOMC.

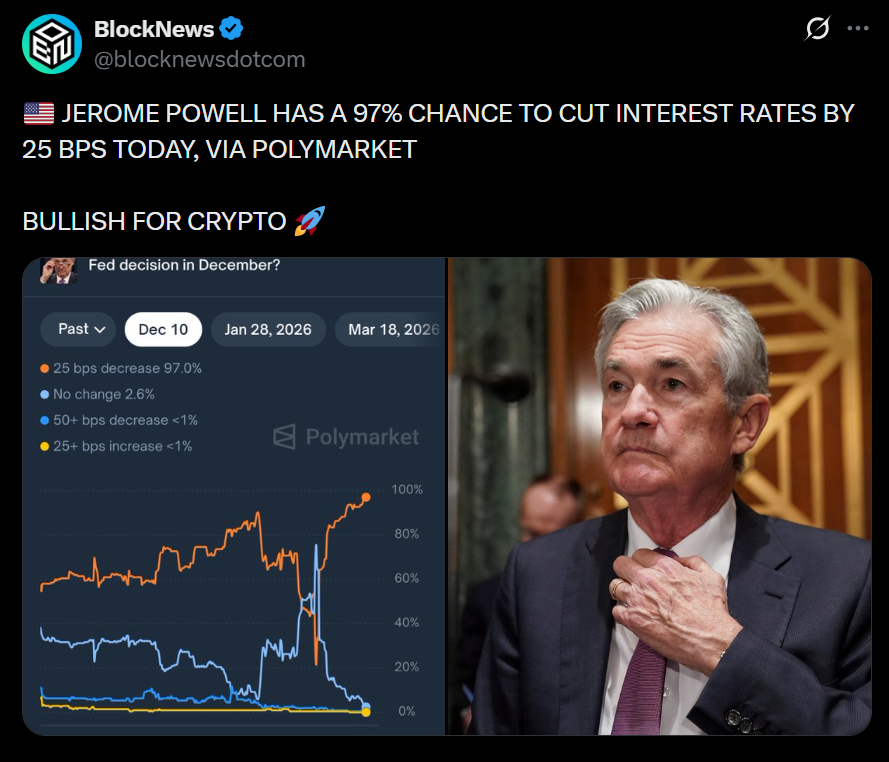

The Federal Reserve’s final meeting of the year kicked off Tuesday morning, with the central bank set to announce its last monetary policy decision of 2025 on Wednesday at 2:00 p.m. ET. Traders overwhelmingly expect a 0.25% interest-rate cut — the Fed’s third of the year — with prediction market Polymarket pricing in a 97% probability of a cut. This level of confidence marks one of the strongest consensus readings of the year across macro markets.

All Eyes on the Fed’s Updated 2025 Summary of Economic Projections

Alongside the policy decision, the Fed will release its updated Summary of Economic Projections (SEP), outlining officials’ expectations for GDP growth, inflation, unemployment, and the interest-rate path through 2026 and beyond. The last SEP, published in September, projected just one rate cut for 2026 after three cuts in 2025. Any upward or downward revisions could significantly reshape market expectations for next year’s liquidity environment.

Internal Divisions at the Fed Could Resurface

Another key focus will be whether dissent resurfaces within the FOMC. The October meeting revealed two members voted against the previous 25 bps cut, signaling rising internal disagreement over the pace of easing. Markets will be watching whether the split widens — or whether Fed leadership presents a more unified stance heading into 2026.