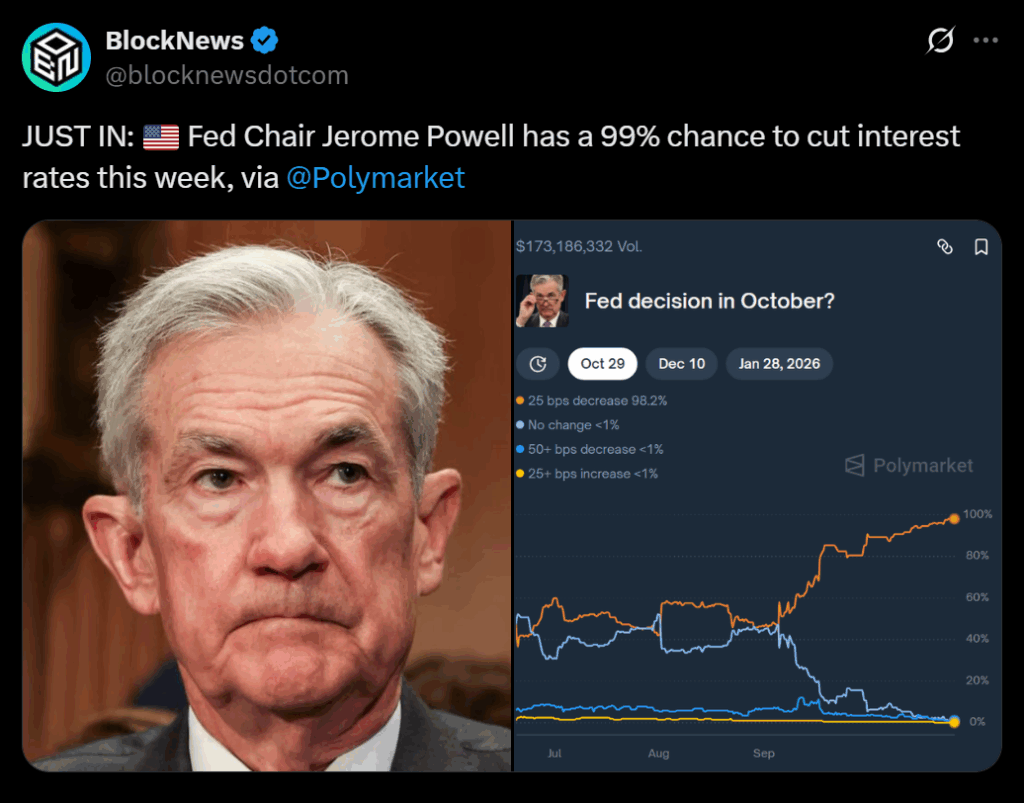

• The Fed is expected to cut rates by 0.25% this week, lowering the policy range to 3.75%–4.00%.

• Soft inflation and labor market weakness fuel expectations for more easing.

• Powell faces internal division and political pressure but will likely keep future rate decisions open — here is what could come next.

The U.S. Federal Reserve is poised to deliver another quarter-point rate cut this week, marking the second easing move of 2025. Policymakers are expected to lower short-term borrowing costs to a range of 3.75%–4.00% as they attempt to cushion the cooling labor market. Rising unemployment insurance claims and a lack of fresh economic data due to the ongoing government shutdown have amplified the Fed’s urgency to act preemptively to avoid deeper weakness.

Inflation Eases, Opening Room for the Fed

Recent data showing 3% year-over-year CPI growth has given the Fed room to ease without reigniting inflation fears. Tariff-related price pressures that once loomed large have now faded, shifting the focus toward growth stabilization. Analysts point to the Fed’s previous statement referencing “additional adjustments” — a phrase interpreted as a green light for further cuts. Fed Vice Chair Michelle Bowman confirmed that language likely foreshadows more easing in the months ahead.

Powell to Walk a Careful Line

While markets are betting on rate cuts in both December and January, Chair Jerome Powell is expected to avoid committing to a specific timeline during his Wednesday press conference. The Fed remains split internally, with hawkish members warning about inflation persistence and dovish policymakers emphasizing labor risks. Deutsche Bank economists believe Powell will keep his tone neutral — leaving the door open to flexibility depending on incoming data once the shutdown ends and economic reports resume.

Political and Policy Crosscurrents

The Trump administration continues to push for lower rates, applying political pressure on Powell and his divided board. Newly appointed Fed Governor Stephen Miran, who previously dissented in favor of a larger half-point cut, may again vote for more aggressive easing before returning to his White House advisory role in January. Alongside rate discussions, the Fed is also expected to end quantitative tightening soon, halting balance sheet reductions as part of a broader shift toward accommodation.