- Jerome Powell reaffirmed the Fed’s wait-and-see approach on rate cuts despite Trump’s harsh criticism.

- Powell warned that new tariffs are likely to drive up prices but said their ultimate economic impact remains unclear.

- The Fed left rates unchanged but hinted at potential cuts later this year, emphasizing economic data over political pressure.

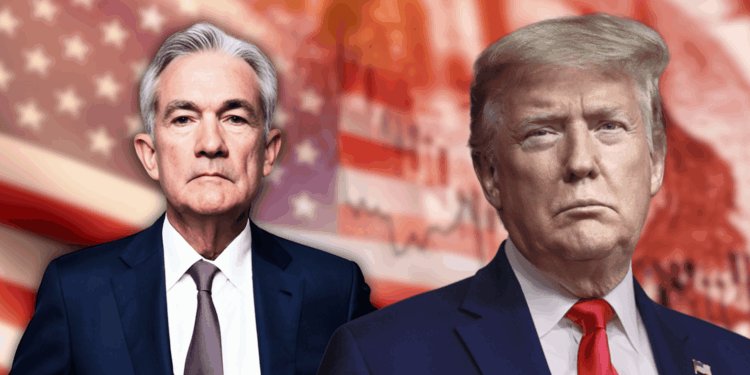

Federal Reserve Chair Jerome Powell said Tuesday the central bank is in no rush to cut interest rates, opting instead to wait and assess the economic impact of Trump-era tariffs. Despite persistent pressure and personal attacks from President Trump, Powell maintained that the Fed’s position remains guided by economic data, not political demands. He emphasized the uncertainty surrounding policy shifts from the administration, noting that such volatility complicates forecasting.

Powell acknowledged that new tariffs are likely to increase consumer prices and slow economic activity, but he reiterated the Fed’s mandate to keep long-term inflation expectations anchored. The central bank left rates unchanged in its last meeting but hinted at two possible cuts later this year, based on inflation trends and growth forecasts. Trump, however, lashed out on social media, calling Powell “very dumb” and blaming him for economic instability.

During his testimony before Congress, Powell was cautious in speculating on the full impact of tariffs, stressing that it remains too early to draw conclusions. He reinforced that the Fed’s duty is to maintain price stability and that any short-term inflation shocks from tariffs should not dictate policy adjustments. Powell, appointed by Trump in his first term, refused to engage in a political back-and-forth and kept the focus on economic fundamentals.

Despite political noise, Powell made clear that the Federal Reserve will act when the time is right, not under presidential pressure. “We are well positioned to wait,” he told lawmakers, underscoring that while risks remain, abrupt decisions could create more instability. For now, the Fed appears resolute in its independence and cautious in its economic approach.