- Fartcoin dropped 16.57% after smart money dumped over $5M, but a whale reinvested nearly $2M despite previous losses.

- Technical charts show a possible bullish reversal, but price must reclaim $0.986 to confirm it.

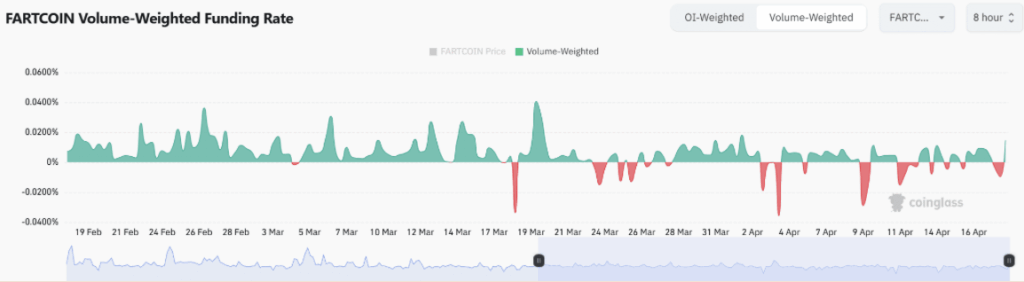

- Funding rates flipped positive, yet heavy long liquidations suggest caution still dominates market sentiment.

Fartcoin [FARTCOIN] got wrecked over the last 24 hours—dropping a rough 16.57% and landing around $0.7592. The crash? Fueled mostly by a mass exodus of smart money. We’re talkin’ over $5 million worth of FARTCOIN offloaded in a single day. Oof.

It even became the most dumped token by seasoned wallets and institutions. Not exactly the title you wanna flex.

But here’s the twist—while everyone else was running for the hills, one bold whale went the opposite way. Yep, despite already losing $701K on previous Fartcoin trades, they just tossed in another $1.98 million to grab 2.22 million FARTat $0.89.

So far, that decision’s racked up an unrealized loss of around $297K. Either this whale’s got diamond hands… or a serious case of hopium.

Buyers Show Early Signs of… Fatigue?

Now, zooming into the chart, Fartcoin was actually showing something interesting: an inverse head-and-shoulders pattern. Usually that’s a classic bullish reversal. Price even climbed above the $0.679 support level and made a run at the neckline around $0.986.

But then—momentum just fizzled.

Buyers couldn’t keep the pump alive, and price slid back to the $0.75 zone. Could be a sign of exhaustion setting in.

If bulls want to keep hope alive, they need to reclaim that $0.986 level with strong volume. If not? Breaking down past $0.679 could be the start of a deeper flush.

On-Chain Data: Mixed Bag

Some glimmers of hope though. Funding rates flipped back into the green after being negative earlier this month. That shows some traders are regaining confidence and willing to pay to stay long.

But let’s not get carried away. At the moment, long trades made up just 54.75% of the volume—barely edging out shorts. That’s not exactly a parade-worthy stat. Until we see more conviction, it’s still shaky.

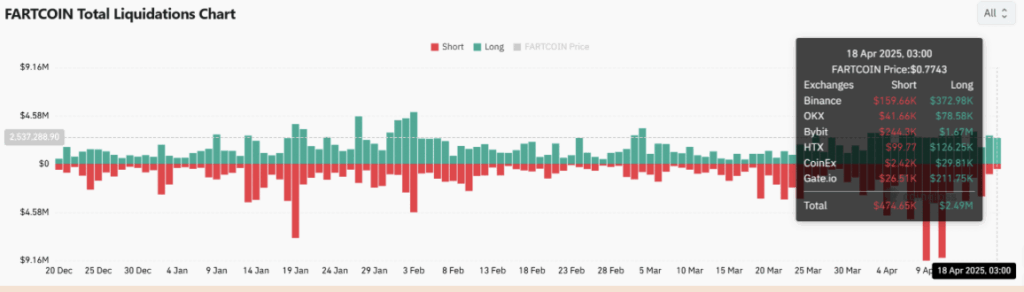

Liquidation Data Ain’t Looking Great

Here’s where things get dicey. On April 18th, long-side liquidations hit $2.49 million. In comparison? Shorts got burned for just $474K.

That kind of imbalance means too many traders went long too fast—and got wiped. These cascading liquidations tend to snowball, triggering more sell pressure and shaking out weak hands.

If this keeps up, Fartcoin could struggle to find a solid footing anytime soon.

The Bottom Line

Fartcoin’s sitting on a knife’s edge right now.

✅ A big-name whale is doubling down.

✅ Technicals are teasing a breakout (maybe).

✅ Funding rates are trying to lean bullish.

❌ But smart money’s bailing fast.

❌ Buyers are losing steam.

❌ Liquidations are stacking up against longs.

Unless price reclaims that $0.986 level with conviction, the safer move for most traders might be to just chill and wait this one out.

Because right now? It’s anyone’s guess whether Fartcoin is prepping for a bounce—or heading for the drain.