- • Ripple partners with Chainlink to enhance RLUSD stablecoin adoption in DeFi

- • Chainlink will provide tamper-proof price feeds for RLUSD on Ethereum and XRP Ledger

- • The integration aims to enable secure real-time DeFi transactions using RLUSD

In a significant move to enhance the role of stablecoins in decentralized finance (DeFi), Ripple and Chainlink have joined hands. This partnership aims to increase the adoption of Ripple’s RLUSD stablecoin, enhancing its utility in DeFi applications by providing tamper-proof price feeds for secure transactions.

The Ripple-Chainlink Collaboration

Ripple, a blockchain-based payment protocol, has teamed up with Chainlink, a decentralized oracle network, to boost the adoption and utility of Ripple’s USD (RLUSD) stablecoin in DeFi applications. Announced on January 7th, the collaboration is designed to provide price feeds for RLUSD on the Ethereum and XRP Ledger. The goal is to support cost-effective transactions and various DeFi use cases for the enterprise-grade stablecoin.

Enhancing RLUSD Stability

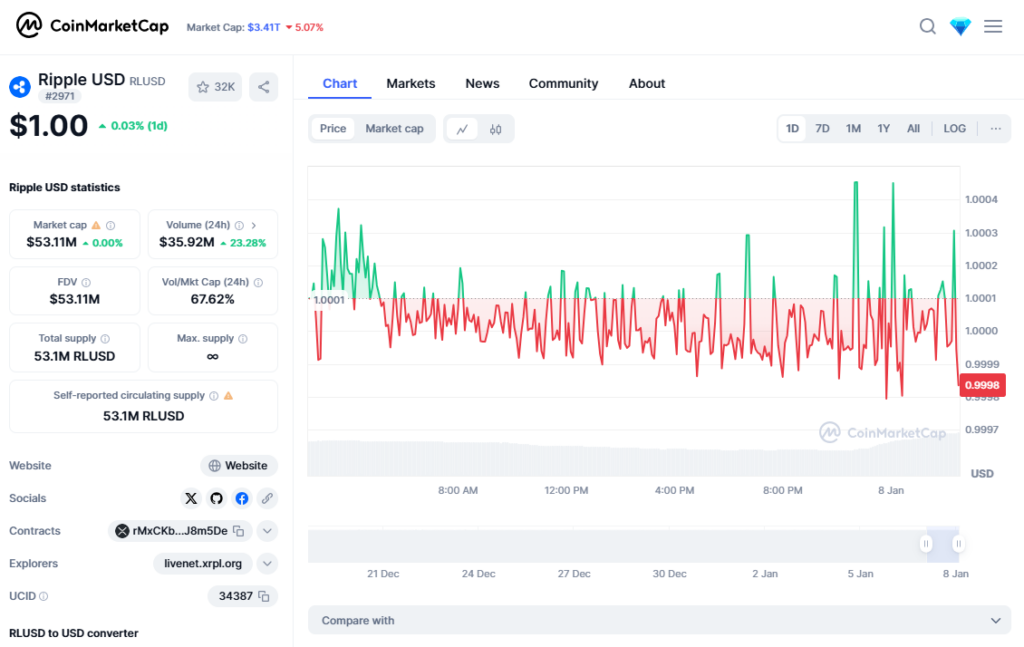

RLUSD, pegged to the US dollar, will receive accurate and tamper-proof data from Chainlink via its decentralized nodes. This integration is expected to minimize the risks of price manipulation or system downtime. Colin Cunningham, the head of tokenization and alliances at Chainlink Labs, expressed the team’s excitement to support the RLUSD launch, calling it a “great signal for the market.”

Ripple’s RLUSD Stablecoin

Ripple’s RLUSD stablecoin is backed 1:1 by the US dollar and is designed to facilitate cost-effective and secure transactions for payments, trading, lending, and other DeFi use cases. As a crucial part of Ripple’s blockchain-based finance vision, the integration with Chainlink will ensure that accurate, real-time market data on the stablecoin is available round-the-clock.

Implication for DeFi

Stablecoins like RLUSD have the potential to bridge the gap between traditional finance and blockchain technology by enabling quick, low-cost, borderless payments. These assets play a critical role in DeFi as a store of value, a hedge against market volatility, and a medium of exchange. Ripple’s adoption of Chainlink’s data standards indicates its commitment to penetrating DeFi markets, with the partnership aiming to accelerate RLUSD adoption.

Chainlink’s Recent Integration with Coinbase

In another significant development, Chainlink integrated with Project Diamond, a digital asset platform for global institutions founded by cryptocurrency exchange Coinbase, on December 10, 2024. The platform is regulated by the Financial Services Regulatory Authority of the Abu Dhabi Global Market. The integration enables full lifecycle management of newly tokenized assets and provides data through Chainlink’s crosschain Interoperability Protocol.

Conclusion

The partnership between Ripple and Chainlink signifies an important step towards stablecoin adoption in DeFi. By providing tamper-proof and accurate data feeds, this collaboration will help increase the utility and security of RLUSD transactions in the DeFi ecosystem. As blockchain technology continues to evolve and integrate with traditional finance, such partnerships will play a crucial role in shaping the future of DeFi.