- Pump.fun launched PumpSwap, a new token swap service competing with Solana’s major AMMs.

- The move shifts liquidity away from Raydium, which has been a key hub for Solana’s DeFi pools.

- PumpSwap may introduce revenue sharing for token creators, but details remain unclear.

Solana’s most profitable protocol, Pump.fun, is making moves to seize an even larger slice of the chain’s DeFi ecosystem.

Enter PumpSwap: A Game-Changer in Solana Trading

On Thursday, the wildly popular launchpad introduced PumpSwap, a new token swap service powered by its own liquidity pools. This marks a significant shift, putting Pump.fun in direct competition with Solana’s established automated market makers (AMMs), which currently facilitate on-chain token trades.

Rather than directing its most successful memecoins to Raydium—long the go-to hub for Solana’s DeFi liquidity—Pump.fun will now keep them in-house, seeding launch liquidity through PumpSwap. According to its founders, this move will significantly reduce launch costs while reshaping the way the platform generates its historically massive revenue.

PumpSwap’s Big Bet on Permissionless Trading

Pump.fun’s creators envision PumpSwap as the core of permissionless trading on Solana—not just for memecoins but for all tokens. Internal launch documents reviewed by CoinDesk reveal that multiple token projects have already struck deals to set up liquidity on PumpSwap’s rails.

Whether the AMM has some undisclosed technological edge to pull traders and liquidity providers away from Solana’s established platforms remains uncertain—its team wouldn’t spill any secrets when asked by CoinDesk.

Pump.fun’s Influence and Market Impact

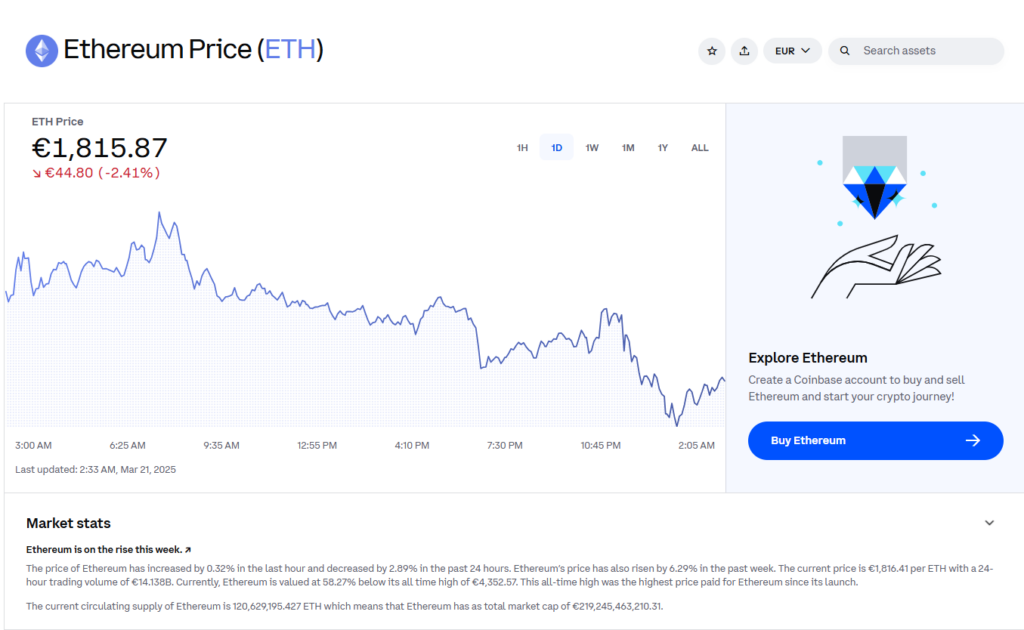

What PumpSwap does have going for it is distribution. For nearly a year, Pump.fun has dictated much of Solana’s trading narrative, leading an explosion of memecoins that reshaped on-chain revenue models. Even in a single day, Pump.fun has posted revenue figures that eclipse those of major crypto protocols—including Ethereum itself.

On Tuesday alone, Pump.fun pulled in $1 million. While that’s a fraction of its peak earnings, it still dwarfs the profits of many top-tier crypto projects. This brand dominance gives PumpSwap a built-in advantage, ensuring strong market traction from the get-go.

Winners and Losers: The Battle With Raydium

The biggest loser in this equation? Raydium. Much of its trading volume in the past year has stemmed from pools first seeded by Pump.fun’s “graduation” system. With PumpSwap now handling in-house liquidity, that trading activity will shift away from Raydium.

However, Raydium isn’t going down without a fight. The protocol recently unveiled its own memecoin launchpad, signaling that it intends to claw back its share of the memecoin frenzy.

Revenue Sharing on the Horizon?

Token creators might come out ahead in the long run. Pump.fun’s founders have teased plans for PumpSwap to introduce a revenue-sharing model, allowing creators to earn a percentage of the platform’s 25 basis point trading fee. However, they declined to specify how much revenue would flow to token creators or when this feature would go live.

For now, all eyes are on PumpSwap. Will it revolutionize Solana’s trading landscape, or will established players like Raydium find a way to fend off this rising challenger?