- WLFI has raised $550 million, with the Trump family set to receive 75% of net revenue.

- Justin Sun increased his WLFI holdings to $75 million as the SEC explores a fraud case settlement.

- Trump’s crypto push includes an executive order for a Strategic Bitcoin Reserve and meme coin launches.

President Donald Trump’s World Liberty Financial (WLFI) crypto project just pulled in another massive haul—$250 million in its second token sale. That brings the grand total of WLFI coins sold to a staggering $550 million.

WLFI: A Trump-Backed Crypto Banking Play?

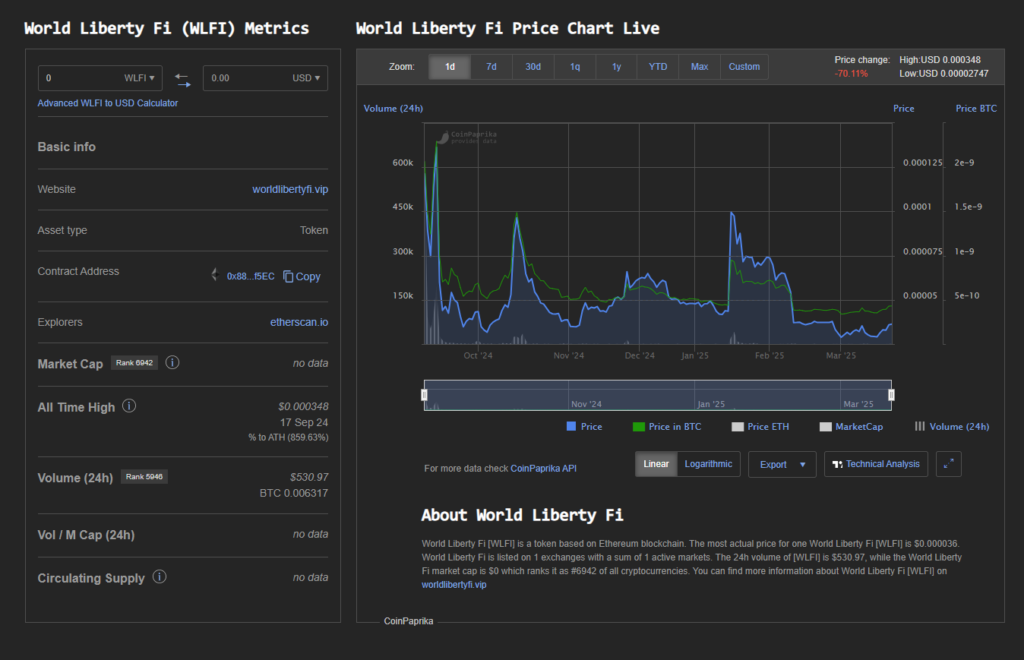

WLFI, a crypto venture tied to the Trump family, first launched in October—just weeks before Trump’s election win. The project describes itself as a sort of decentralized financial platform, aiming to shake up the crypto banking scene.

At launch, WLFI published a document outlining revenue distribution, stating that the Trump family could walk away with a whopping 75% of net revenue.

In Monday’s statement, WLFI revealed that more than 85,000 participants had completed know-your-customer (KYC) verification to join the token sale. Co-founder Zach Witkoff—son of billionaire U.S. envoy Steve Witkoff—boasted that WLFI is “on track to supercharge DeFi.”

Big Players Are Betting on WLFI

In January, Tron blockchain founder Justin Sun increased his WLFI holdings to $75 million. A month later, a court filing showed that Sun and the SEC were in talks to settle the regulator’s civil fraud case against him.

Meanwhile, WLFI is just one of several Trump-affiliated crypto projects hitting the market at a time when the president himself is pushing a pro-crypto agenda.

Earlier this month, Trump signed an executive order to establish a Strategic Bitcoin Reserve—a move that sent shockwaves through both political and financial circles.

A Web of Crypto and Politics

A memo from the White House last week shed light on yet another high-profile crypto maneuver. David Sacks, the Trump administration’s AI and crypto czar, reportedly sold over $200 million worth of digital assets—both personally and through his firm, Craft Ventures—before taking on his new role. Speaking on a podcast, Sacks explained his decision: “I didn’t want to even have the appearance of a conflict.”

Adding to the crypto frenzy, the SEC made headlines in February by officially declaring that meme tokens are not securities. The announcement came hot on the heels of President Trump and First Lady Melania Trump launching their own meme coins just days before the inauguration.

The Future of WLFI and Trump’s Crypto Empire

With Trump pushing hard for crypto-friendly policies and high-profile figures diving deep into digital assets, WLFI’s rise seems far from over. But as with any volatile market, questions remain: Is this the beginning of a major financial shift, or just another high-stakes gamble in the ever-evolving world of crypto?

One thing’s for sure—Trump’s crypto empire is only getting started.