- DeFAI combines decentralized finance with AI for streamlined automation, personalized tools, and smarter decision-making.

- While promising, challenges like transparency, security, and regulation pose significant hurdles to DeFAI’s growth.

- Many current AI tokens lack real utility, but the future could bring genuine innovations in asset management and financial strategies.

DeFi is surging with fresh ideas in 2025, and one of the most intriguing trends is the marriage of decentralized finance (DeFi) and artificial intelligence (AI)—a combo often dubbed DeFAI. It’s a flashy buzzword, sure, but the promise here is massive: greater accessibility, seamless automation, and hyper-personalized tools for crypto users. But, let’s cut through the noise—are today’s DeFAI projects really delivering, or is this just another hype train?

What’s DeFAI, Anyway?

In a nutshell, DeFAI is where decentralized finance meets AI-powered analytics and automation. Analysts predict that this market could explode from $1 billion to a jaw-dropping $10 billion by year-end. Big names like Griffain, Orbit, and Aixbt are already in the game, integrating AI into decentralized systems to simplify trading, lending, and more.

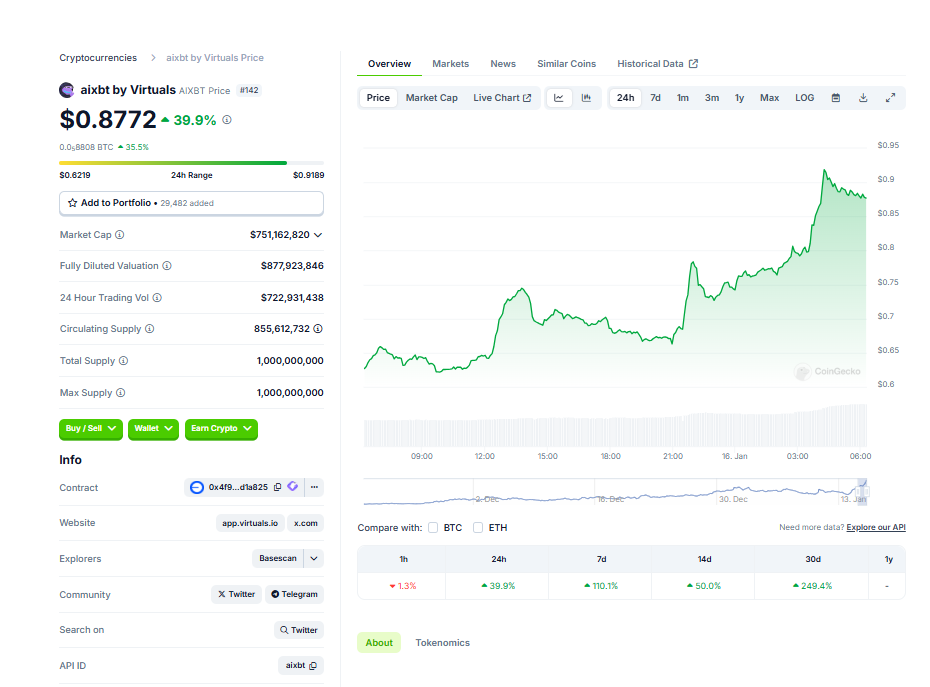

These projects have grabbed traders’ attention. Tokens such as AIXBT, GRIFFAIN, Hey Anon (ANON), Autonolas (OLAS), and GRIFT are showing impressive growth.

For instance:

- AIXBT skyrocketed 50% in a week, boasting a $579M market cap and daily volume near $464M.

- GRIFFAIN edged up 1.53%, with a $422M cap and $69M in 24-hour trades.

- ANON? A jaw-dropping 100% weekly surge, backed by a $246M valuation.

- OLAS added 3% over seven days, reaching a $114M cap.

- GRIFT climbed 80%, with its market cap hitting $112M.

If those numbers made your eyes pop, here’s why: AI in DeFi offers game-changing potential. It’s not just about crunching data but making that data actionable. Think faster trades, smarter lending decisions, and a user experience that doesn’t demand a PhD in computer science.

How AI Enhances DeFi

One of AI’s biggest flexes is its ability to process mountains of data and spit out insights in real time. It merges on-chain (blockchain-based) and off-chain (external) data to help users make sharper decisions.

Take Griffain, for example—it uses natural language processing so users can interact with DeFi through casual, conversational commands. Imagine saying, “Swap 1 ETH for BTC” and having it done without fumbling through complex interfaces.

A Binance Research report recently highlighted how these AI-driven enhancements can lead to smarter governance, sharper analytics, and personalized strategies. Automating portfolios and tailoring risk profiles across different blockchains could open up DeFi to more people by cutting through its usual complexities.

The Roadblocks

Of course, it’s not all rainbows and moonshots. Transparency remains a glaring issue. How do we trust the algorithms making these decisions? DeFi is decentralized by nature, but adding AI introduces new risks—vulnerabilities that bad actors could exploit if developers aren’t careful.

Then there’s regulation. Governments are just starting to notice AI in finance, and as these tools grow more autonomous, accountability gets tricky. Who’s responsible when an AI screws up—a developer, a platform, or the code itself? It’s a murky area.

Crypto + AI: The Bigger Picture

Beyond DeFAI, AI integration is reshaping the crypto landscape. Projects like Injective are creating AI-based risk models, while Ocean Protocol enables decentralized data sharing for AI training. Elsewhere, ai16z, Bittensor, and SaharaAI are crafting tools to streamline AI-enhanced protocols, with a strong focus on security and governance.

Are AI Tokens the New Memecoins?

Let’s be real—some of today’s “AI tokens” are little more than clever branding. Many of these so-called DeFAI projects are hopping on the AI bandwagon without real substance. It’s all momentum trading right now, much like the memecoin craze.

That said, the future isn’t all fluff. As AI agents grow more capable, they’ll likely evolve beyond gimmicks. Instead of just tweeting memes, they could handle multi-step financial tasks, turning DeFi platforms into precision instruments for asset management.

The Takeaway

DeFAI is at the edge of something transformative, blending DeFi’s decentralized ethos with AI’s computational prowess. Challenges like transparency, security, and regulation loom large, but the potential here is staggering. Imagine earning passive income by “hiring” an AI to manage your portfolio while you sip coffee—or binge-watch Netflix. It’s futuristic, sure, but within reach.

Still, tread carefully. The road to innovation is often riddled with scams and missteps. But if DeFAI delivers on its promises, it could rewrite the rulebook for finance, leaving traditional banking in the dust.