- Circle has officially filed for an IPO with the SEC, aiming to go public on the NYSE.

- The company previously tried a SPAC deal in 2022 and was valued at $9 billion at the time.

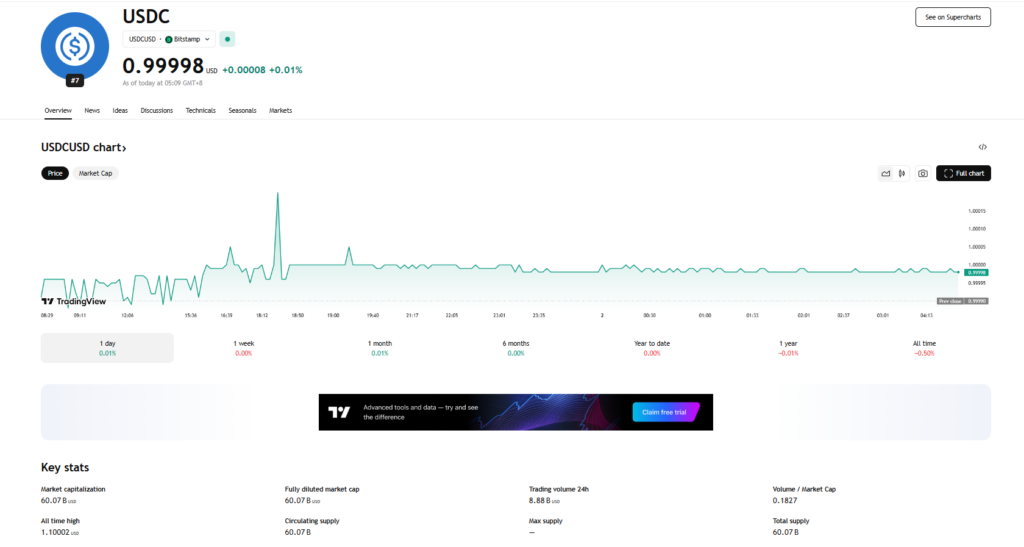

- Since 2018, USDC has powered over $25 trillion in transactions and serves millions of users globally.

Circle Internet Financial, the company behind USDC, just filed a formal prospectus with the U.S. Securities and Exchange Commission (SEC), signaling its plans to go public.

The move comes one day after the firm quietly submitted a confidential draft of its S-1 registration—a pretty standard play for companies prepping for an IPO but still figuring out the finer details behind closed doors.

No Numbers Yet, But the Wheels Are Turning

The actual prospectus didn’t include some of the big questions—like how many shares Circle plans to sell or what kind of IPO price target it’s aiming for. So yeah, we’re still in the waiting game there.

What we do know: the underwriters are heavyweights, including JPMorgan and Citigroup. That’s not nothing.

“Going public on the NYSE is a continuation of our goal to operate with maximum transparency and accountability,” said Jeremy Allaire, Circle’s CEO, in the filing.

Backstory: Circle’s Been Eyeing This for a While

According to Bloomberg, Circle had already been chatting with advisors about a possible IPO as far back as last year. And if this all sounds familiar—it’s probably because Circle tried going public through a SPAC deal in 2022, which fell apart. At the time, they were valued at around $9 billion.

Whether they’ll aim higher or lower this time… unclear.

Timing Feels Kinda Strategic

Circle’s not the only major crypto firm poking at the IPO window. Rumors are swirling that Kraken, another big name in crypto, might raise $1 billion in debt as a runway to its own public debut.

The difference now? There’s a noticeable shift in tone from the U.S. government. With Washington showing more openness toward digital assets lately, the door to regulated crypto finance seems—well, a bit more open.

Circle’s Numbers Are No Joke

Since its launch in 2018, USDC has been used in over $25 trillion worth of on-chain transactions, according to Allaire’s statement in the prospectus.

That’s… a lot.

Millions of users are already using the stablecoin for everything from everyday payments to cross-border settlements and even just storing value in digital dollars.

Circle controls the second largest stablecoin in the world by supply—second only to Tether (USDT)—so if this IPO goes through, it could be a milestone moment for the crypto industry’s crossover into traditional finance.