- Trump’s “One Big Beautiful Bill” combines tax cuts, border security, and climate rollbacks under one sweeping package.

- The bill heavily favors high-income households and proposes deep cuts to Medicaid and food stamp programs.

- Despite aiming for growth, OBBA could add up to $3.5 trillion to the national debt, sparking fierce debate in Congress.

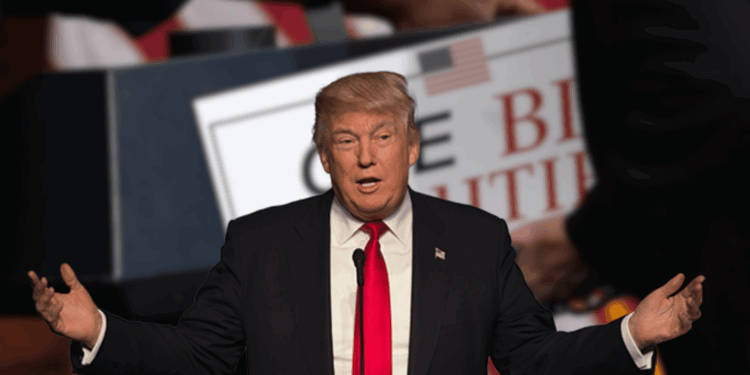

From the start of his second term, President Trump has pushed an ambitious legislative package aimed at locking in tax cuts, rolling back climate policies, and beefing up border security. Branded “THE ONE, BIG, BEAUTIFUL BILL,” or OBBA, the bill seeks to fulfill key campaign promises through the reconciliation process — allowing passage with just 51 Senate votes, sidestepping traditional bipartisan hurdles.

Key Tax Breaks and Conservative Priorities

The bill includes a wide range of provisions that would reshape tax and spending policy. Among them: a higher cap on SALT deductions, a tax exemption on tips and overtime, new MAGA (now “Trump”) savings accounts for children, and expanded Health Savings Account limits. There’s also a new deduction for car loan interest and a bigger standard deduction for those over 65. Notably, the Child Tax Credit would rise temporarily but impose stricter requirements, potentially disqualifying many mixed-status families.

Cuts to Medicaid and Social Safety Nets

To fund these changes, OBBA proposes steep cuts to Medicaid—up to $700 billion over a decade. Work requirements, more frequent eligibility checks, and higher copays for doctor visits would make access harder. The bill also bans Medicaid from covering abortion providers and gender transition care. On top of that, SNAP (food stamp) benefits would be slashed by roughly $230 billion, further tightening the safety net for millions of low-income Americans.

Controversial and Unusual Additions

Some OBBA provisions stray from budget matters entirely. These include removing federal restrictions on gun silencers and preventing states from regulating artificial intelligence independently. Critics say these measures, alongside large Medicaid cuts, make the bill more polarizing than pragmatic. Analysts also warn that despite trimming spending, the bill could add up to $3.5 trillion to the national debt when accounting for interest.

Who Gains — and Who Loses?

High earners stand to benefit most. The Tax Foundation reports households making over $400,000 would receive the largest breaks, with the top 1% seeing a disproportionate gain. In contrast, a CBS/YouGov poll found that most Americans believe the bill favors the wealthy at the expense of low- and middle-income groups. With Senate debate looming and a July 4 target for passage, the fight over OBBA is likely to intensify as the US edges closer to a potential debt ceiling crisis.