- Vitalik Buterin insists Ethereum’s L2s inherit full base-layer security from Ethereum.

- Anatoly Yakovenko argues L2s still face “fundamental” risks similar to cross-chain bridges.

- The debate reignites ETH vs SOL rivalry as both blockchains show parallel market performance.

Ethereum’s layer-2 ecosystem, once seen as the ultimate solution to blockchain scaling, is suddenly under the microscope. A heated back-and-forth between Ethereum’s Vitalik Buterin and Solana’s Anatoly Yakovenko has sparked fresh questions about whether these networks are as secure as people think—or if the cracks are starting to show.

Buterin Stands by Ethereum’s L2 Security

Vitalik Buterin has long been vocal about his confidence in Ethereum’s L2 model. He argues that these networks inherit security directly from Ethereum’s base layer, meaning they’re shielded from typical 51% attacks. In theory, L2s remain protected as long as Ethereum itself stays secure.

However, Buterin did admit that problems arise when L2 validators operate outside Ethereum’s immediate control. Once they start handling off-chain functions independently, the line between inherited and external security starts to blur. Still, he maintains that overall, Ethereum’s rollup-based ecosystem—home to over $35 billion in total value locked (TVL)—is fundamentally sound. And with more than a million validators securing the network, he sees little reason for panic.

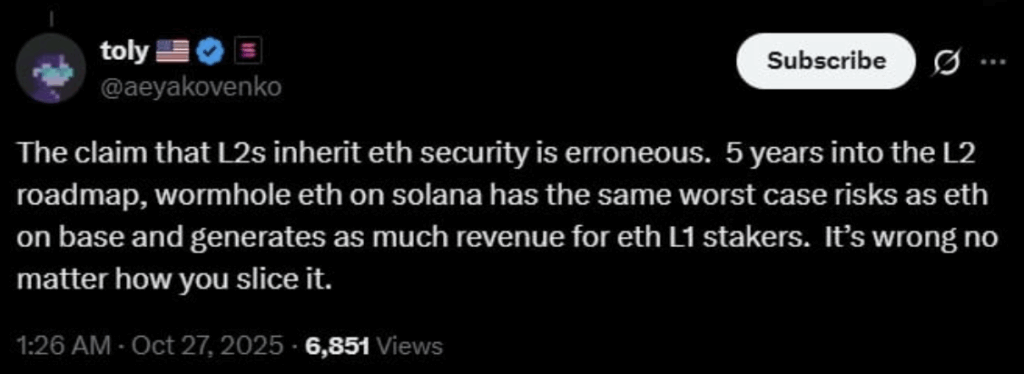

Yakovenko Pushes Back, Calling L2s Risky

Solana’s Anatoly Yakovenko wasn’t convinced. He slammed Buterin’s view as “misleading,” arguing that even after years of iteration, Ethereum’s L2s still face the same vulnerabilities as cross-chain bridges like Wormhole. In his view, the security risks haven’t been solved—they’ve just been repackaged.

Yakovenko pointed to three main weaknesses: overly complex code that widens the attack surface, multi-sig custody setups that could move user funds without direct consent, and off-chain processing that centralizes too much control in the hands of a few. He even floated an idea—turn Ethereum into a “layer-2” for Solana using a specialized bridge to fix interoperability and security at once. It was half a jab, half a challenge, and it definitely got people talking.

Ethereum Supporters Push Back

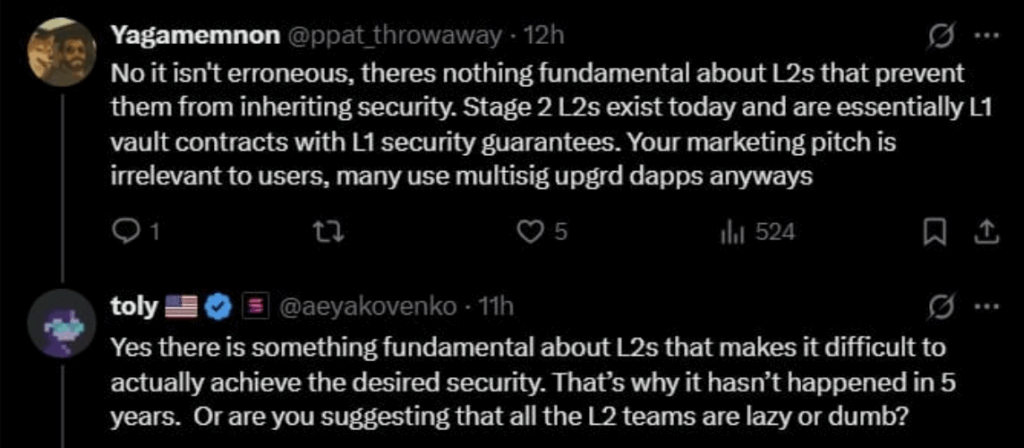

Not everyone agreed with Yakovenko’s take. Several Ethereum developers fired back, saying there’s “nothing fundamental” preventing L2s from achieving full Ethereum-level security. They argued that advanced rollups—so-called Stage 2 L2s—already operate like vault contracts fully protected by L1. Upgrades like fraud proofs and validity proofs, they said, are closing the gap even faster.

But Yakovenko didn’t back down. He doubled down on his claim that the gap is fundamental—a core design limitation that Ethereum still hasn’t solved after five years of trying. His warning echoed across crypto Twitter, reigniting the age-old ETH vs SOL rivalry with a new angle: decentralized scaling versus vertical integration.

ETH vs SOL: Neck and Neck Performance

In the markets, both Ethereum and Solana have moved almost in sync throughout the past year. Ethereum’s up about 15.4% year-to-date, while Solana’s gained around 7.3%. Both saw major rallies during mid-year, cooled off sharply in September, and have been slowly grinding higher since.

As of late October, Ethereum holds a slight edge, but the conversation around its layer-2 security could influence investor sentiment moving forward. Whether Vitalik or Anatoly ends up being right—only time, and perhaps a few exploits, will tell.