- Ethereum’s network activity and fee burn just hit their lowest levels since EIP-1559 launched.

- Layer 2 networks are drawing users away, cutting into ETH’s demand and market cap.

- Despite the slowdown, Ethereum remains the top platform for real-world asset tokenization.

Ethereum’s on-chain activity has fallen to its lowest point in years, with just 53.07 ETH—equivalent to around $106,000—burned this past Saturday. This marks the lowest daily burn since the EIP-1559 fee-burning mechanism was introduced back in 2021.

The slump highlights a sharp decline in demand for Ethereum’s blockspace, raising questions about user engagement and long-term network momentum.

What Happened to EIP-1559?

Launched with high hopes, EIP-1559 was designed to improve Ethereum’s fee structure by introducing a base fee that gets burned with each transaction, reducing the total supply of ETH over time. When network activity spikes, this mechanism can make Ethereum deflationary—a major selling point for long-term investors.

But the network isn’t exactly buzzing right now. In fact, it’s quiet—almost eerily so.

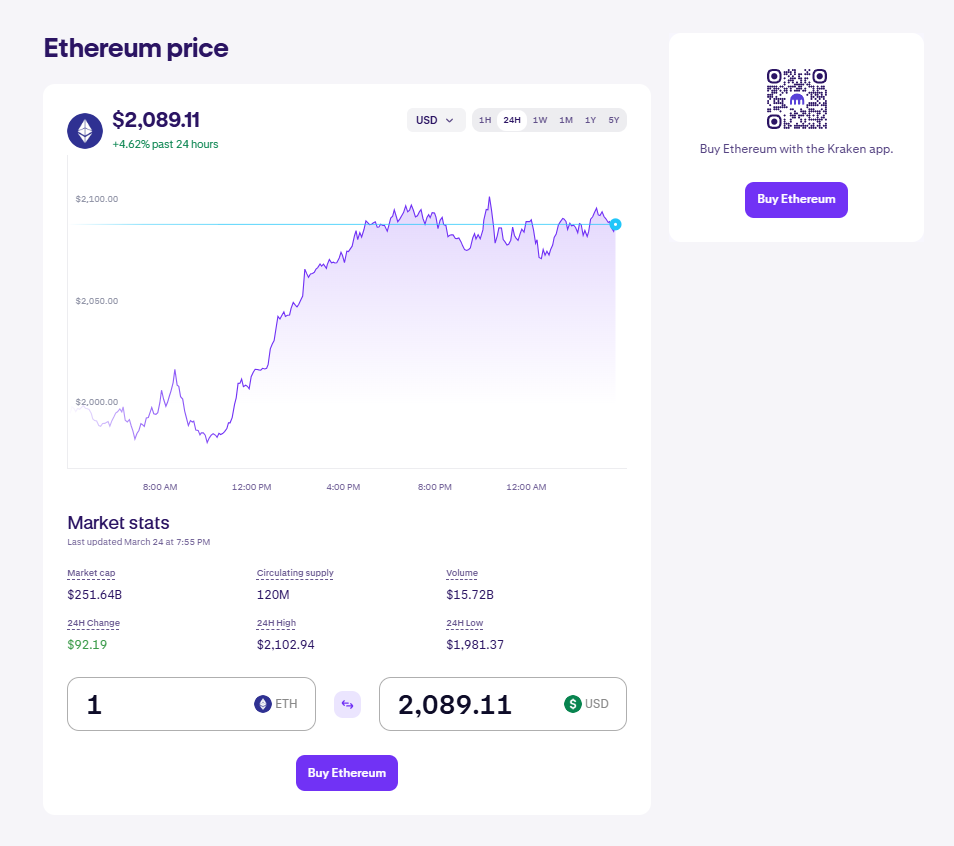

According to data from Ultrasound.money, Ethereum’s supply is now projected to grow by 0.76% annually, reflecting a broader slowdown across key metrics. Active addresses are down. New wallet creation? Also down. Transactions and daily volume? You guessed it—down.

Even transaction fees have nosedived, now averaging just $0.41—their lowest level since late August. For comparison, ETH fees topped out at over $15 in the last two years. The difference is stark and speaks volumes about current activity levels.

Layer 2s Are Eating Into Ethereum’s Core Demand

Ethereum is no longer the only place to build or transact. The rise of Layer 2 solutions like Base, Arbitrum, and Optimism is fragmenting demand, offering users cheaper and faster alternatives that still exist within the Ethereum ecosystem—but don’t necessarily help ETH’s price.

Standard Chartered recently revised its ETH price forecast for 2025, slashing it from $10,000 to just $4,000. The bank cited the rise of L2 networks as a key reason, noting that these platforms are capturing revenue that once flowed through Ethereum directly.

According to Geoffrey Kendrick, the bank’s head of digital asset research, the shift has shaved roughly $50 billion off Ethereum’s market cap. And if trends continue, Ethereum’s dominance could further erode, even if its broader ecosystem continues to thrive.

Still the Leader in Tokenization

Despite the slowdown, Ethereum hasn’t lost its edge completely.

The network remains the top choice for real-world asset (RWA) tokenization, with over $3.3 billion in tokenized assets currently live on-chain. In a notable move, Fidelity Investments recently filed to tokenize its U.S. dollar money market fund using Ethereum—joining the ranks of asset management giants like BlackRock and Franklin Templeton in embracing blockchain for fund infrastructure.

This signals ongoing confidence in Ethereum’s role as a foundational platform, even if its short-term on-chain activity is lagging.

Investors Still Holding

One bullish signal stands out amid the decline: ETH is leaving exchanges. Currently, just 6.38% of Ethereum’s total supply remains on centralized exchanges—the lowest level since the network launched. Historically, this kind of movement suggests that investors are moving coins into cold storage, a strong indicator of long-term holding intentions rather than near-term selling pressure.

Conclusion

Ethereum may be in a lull, but it’s far from out. The drop in activity and burn rate highlights a cooling period, possibly tied to user migration toward more scalable Layer 2 solutions. But at the same time, Ethereum continues to serve as the backbone for institutional experiments in asset tokenization, and long-term holders don’t seem to be going anywhere.

It’s a mixed picture—quiet on the surface, but with currents still moving underneath.