- Ethereum reclaimed the top DEX volume spot in March with $64B traded, but overall market activity and network fees have sharply declined.

- ETH’s burn rate hit a multi-year low, total supply is growing, and Q1 price dropped 45%, raising concerns among investors.

- Long-term outlook remains promising, with Ethereum leading in real-world asset tokenization and potential boosts from staking-enabled ETFs.

Ethereum just pulled ahead again — reclaiming the #1 spot in decentralized exchange (DEX) trading volume for the first time since way back in September 2024. Sounds great, right? Kind of. But like most things in crypto… it’s complicated.

$64 Billion in DEX Volume, but the Bigger Picture? Not So Hot

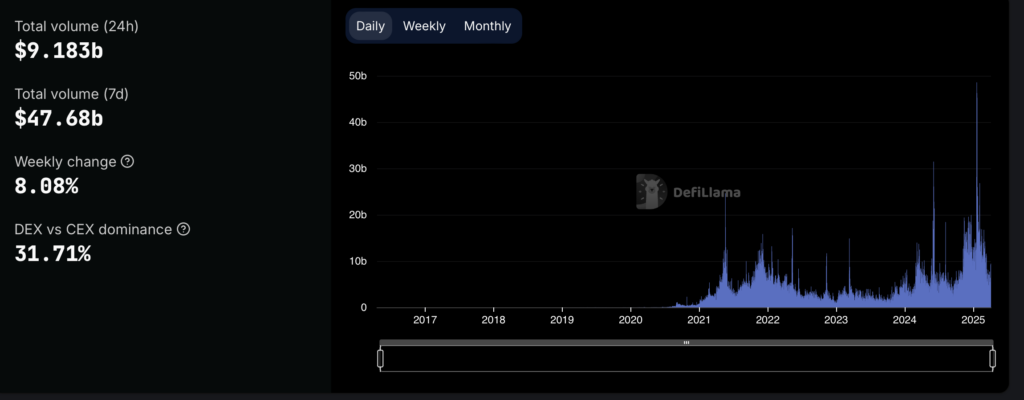

According to DefiLlama, Ethereum-based DEXs racked up $64B in spot trading volume for March. That’s more than Solana’s $52B and BSC’s $44B — so yeah, ETH is still the main stage.

But hold on. Despite this “win,” overall activity in the market is slowing down.

- DEX volume across the board dipped slightly — from $86B in January to $85B in March.

- And the total value locked (TVL)? That slid from $67B to $49B during the same time.

Not exactly the momentum you want heading into Q2.

Fees Are Down. Burn Rate Is Down. Supply’s… Up?

Ethereum isn’t just losing trading volume — it’s making way less money too.

Back in January, the network raked in around $142 million in fees. But by March? That number dropped like a rock to just $21 million. Ouch.

Burn rate — aka how much ETH gets destroyed to keep supply tight — also hit its lowest level since August 2021. According to Ultrasound Money, only 53 ETH per day was being burned last week. That’s basically a trickle.

To top it off, since the much-hyped EIP-1559 upgrade, ETH’s total supply has actually grown by 3%. Yeah… that’s not what long-term holders were hoping for.

ETH’s Price? Let’s Not Sugarcoat It — Q1 Was Brutal

ETH closed Q1 2025 down 45%, losing a massive chunk of market value. According to Coinglass, that’s a $170 billion wipeout, making it one of Ethereum’s worst quarters since 2016. Only two other quarters have been uglier.

This performance hasn’t exactly inspired confidence among the big players either.

Institutions Are Backing Off… For Now

Data from SoSoValue shows that Ethereum-based ETFs had $403M in outflows in March alone. And here’s the kicker — there was only one day the whole month that saw positive inflows.

Meanwhile, Standard Chartered slashed its end-of-year ETH price target from $10K to $4K, citing rising pressure from Layer-2 solutions that are gobbling up users by offering faster speeds and lower fees. Tough competition… from its own ecosystem.

But Long-Term? Ethereum Still Owns a Key Sector

Despite all the doom and gloom in the short term, Ethereum still dominates in a space with massive upside: tokenized real-world assets.

That market is projected to hit $16 trillion by 2030 — and guess what? Ethereum already controls 54% of it, with around $5B in assets tokenized on-chain, per RWA.xyz.

Even BlackRock CEO Larry Fink is bullish here. He’s said before that everything will eventually be tokenized — and Ethereum’s already positioned to be a big piece of that puzzle.

ETFs With Staking: The Plot Twist That Could Change Everything

There’s also a brewing narrative around staking-enabled ETH ETFs. Both the NYSE and CBOE have filed to include staking in Ethereum ETFs — a move that could change the game.

If those filings get the green light? We’re talking about a major demand driver. Locked ETH means tighter supply. Combine that with even modest institutional interest, and suddenly ETH looks… kinda deflationary again.

Which could, over time, start flipping some of the negative price pressure we’re seeing now.