- Standard Chartered slashed Ethereum’s 2025 price target from $10,000 to $4,000, citing major structural challenges.

- Analysts blame Layer-2 networks, especially Base, for draining $50 billion from Ethereum’s market cap.

- Experts suggest Ethereum may need a “super-tax” on Layer-2 profits to stop ETH from losing value to Bitcoin.

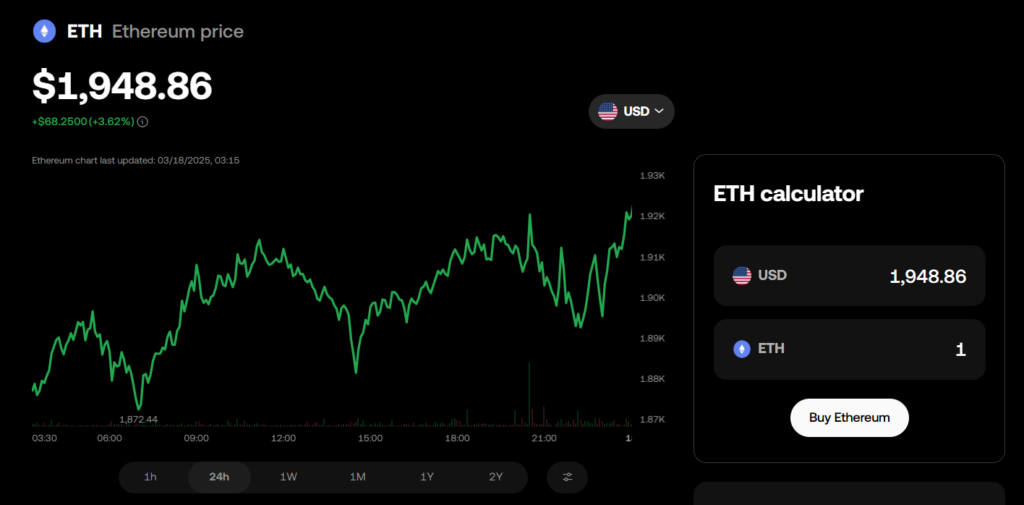

Ethereum just took a major hit—at least on paper. Standard Chartered Bank has dramatically slashed its 2025 price prediction for ETH, dropping it from a bullish $10,000 to a more sobering $4,000. That’s a 60% cut, and the reasoning behind it isn’t exactly reassuring for Ethereum investors.

Why the Sudden Downgrade?

According to analysts at the bank, the rise of Layer-2 networks—especially Base—is stripping Ethereum of its dominance. Standard Chartered’s global head of digital asset research, Geoffrey Kendrick, put it bluntly:

“Base is extracting super-profits from Ethereum’s ecosystem.”

The bank estimates that Base alone has drained roughly $50 billion from Ethereum’s market cap. That’s no small number, and it’s part of a broader trend of Layer-2 networks taking transaction activity (and fees) away from Ethereum’s main chain.

The Bigger Picture

Ethereum, once the unrivaled smart contract king, has found itself competing against its own infrastructure. As Layer-2 solutions grow, transaction fees are increasingly bypassing Ethereum’s base layer. In Kendrick’s view, Ethereum has “commoditized itself” in the Layer-2 landscape, making it harder for the network to retain value.

One possible solution? Kendrick suggests a Layer-2 super-tax—comparing it to how some governments tax foreign-owned mining firms. But unless such a measure is introduced, he warns that Ethereum could continue losing ground to Bitcoin in market dominance.

Final Thoughts

The crypto market remains highly volatile, and Ethereum’s price projection is anything but set in stone. Still, Standard Chartered’s warning suggests that Ethereum’s growth won’t be as smooth as many had hoped. Whether ETH rebounds—or continues to bleed value to its own Layer-2 networks—remains to be seen.