- Ethereum whales pulled large amounts of ETH off OKX and Binance during the dip near $2,050, hinting at accumulation as panic cooled.

- Exchange reserves have dropped to around 16.3M ETH, a multi-year low last seen in 2016, tightening liquid supply across the market.

- Derivatives show deleveraging, not fresh bullish positioning, with falling open interest, over $1B in long liquidations, and negative funding rates.

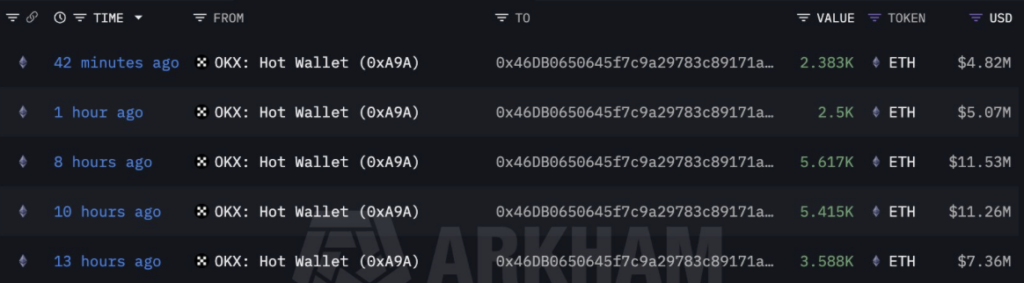

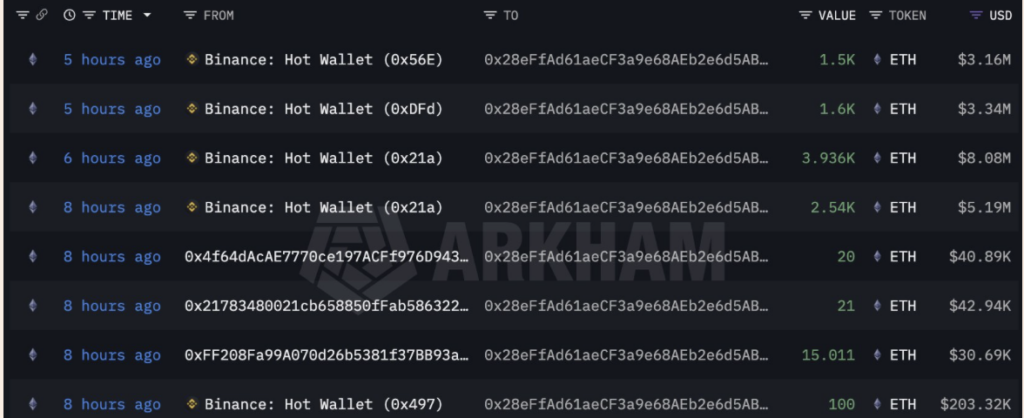

As the panic starts to fade out, something else is quietly taking its place: strategic accumulation. Over the last stretch of trading, whale activity showed up in a pretty clear way, starting with large Ethereum (ETH) withdrawals from OKX hot wallets. Multiple tranches moved within just a few hours, and not long after that, Binance began showing similar outflows. That kind of timing matters. It looks less like random wallet shuffling and more like coordinated off-exchange migration, the kind you typically see when bigger players want to hold, not flip.

Why ETH Leaving Exchanges Can Matter More Than Price

ETH dipped near the $2,050 region right when sentiment was cracking and fear was dominating the tape. That’s the exact environment whales tend to love. Instead of chasing strength, they buy weakness, and they do it when liquidity is thick because retail is selling into them. Once ETH starts leaving exchanges, the available sell-side inventory naturally shrinks, which can ease pressure on price, even if the market still feels ugly for a while.

Reserve compression doesn’t guarantee a rally, but it often sets the stage for volatility expansion… and sometimes, a sharp rebound. And in a post-ETF world in 2026, these withdrawals may also be positioning for staking, DeFi deployment, or longer-term institutional custody. Either way, it’s the same end result: less liquid ETH floating around when demand eventually returns.

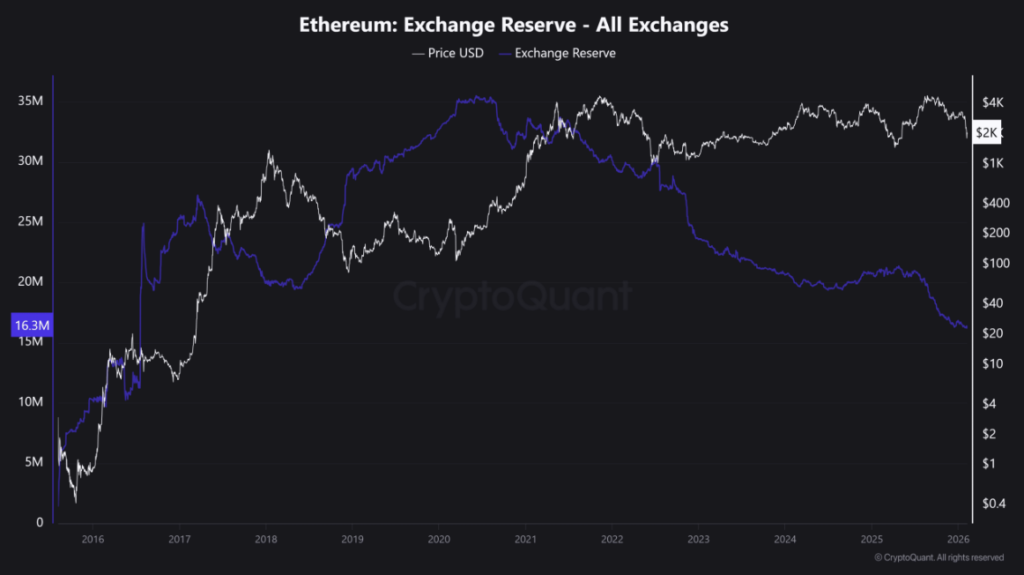

ETH Exchange Reserves Just Hit Multi-Year Lows

Zooming out, the exchange reserve trend tells a pretty dramatic story. ETH reserves expanded heavily between 2016 and 2017, climbing from around 5–10 million ETH as adoption accelerated and exchanges became the default hub for liquidity. That rise continued into the 2020–2021 cycle, when reserves peaked near 35 million ETH during the DeFi and NFT explosion. Back then, everything was traded constantly, and keeping coins on exchanges was just normal.

But then the structure shifted. A slow drawdown began, and by 2024–2025 it had turned into something more persistent as staking, self-custody, and off-exchange storage became the dominant behavior. By early February 2026, reserves dropped to roughly 16.3 million ETH, levels that haven’t been seen since 2016. ETH was trading around the $2,000 region during this tightening phase, which lines up with the volatility and stress the market has been feeling lately.

Supply Tightness Doesn’t Guarantee a Rally, But It Changes the Game

When staking absorbs supply and institutional vehicles remove liquidity, tradable inventory tightens, and that changes how price reacts to demand. These contractions reduce immediate sell pressure and, when sustained, have historically preceded stronger recoveries once demand conditions improve. It’s not a promise, but it’s a shift in the underlying market structure, and traders tend to notice it later than they should.

Derivatives Show Deleveraging, Not Fresh Bullish Positioning

At the same time, Ethereum’s derivatives market is telling a different but related story: this is risk reduction, not new risk-taking. During the February 2026 sell-off, Open Interest slid lower, dropping into the $24 billion to $36 billion range after being much higher earlier in the cycle. That kind of decline usually means traders are closing positions, not opening fresh ones.

And it wasn’t a clean exit either. Long liquidations ripped through the market, with more than $1 billion in long exposure wiped out during the crash phase, which is basically forced deleveraging in real time. Funding rates flipped negative and stayed suppressed, hovering around –0.003% and even deeper during capitulation windows. That’s a pretty classic sign that shorts are in control and longs are paying just to stay in the trade.

What This Setup Could Mean Next for ETH

Put together, the setup is a little tense but also kind of explosive. Spot supply is tightening as ETH leaves exchanges, while derivatives are cleaning out excess leverage. That combination can create the conditions for a squeeze later on, especially if demand returns suddenly. But in the short term, volatility is still the tax you pay for being involved.