- Ethereum whales holding at least 100,000 ETH have accumulated a record 57.35% of the total ETH supply, worth around $333 billion.

- Mid-tier wallets holding between 100 and 100,000 ETH have dropped to their lowest-ever supply ratio at 33.46%, while small wallets with less than 100 ETH are at a near four-year low of 9.19%.

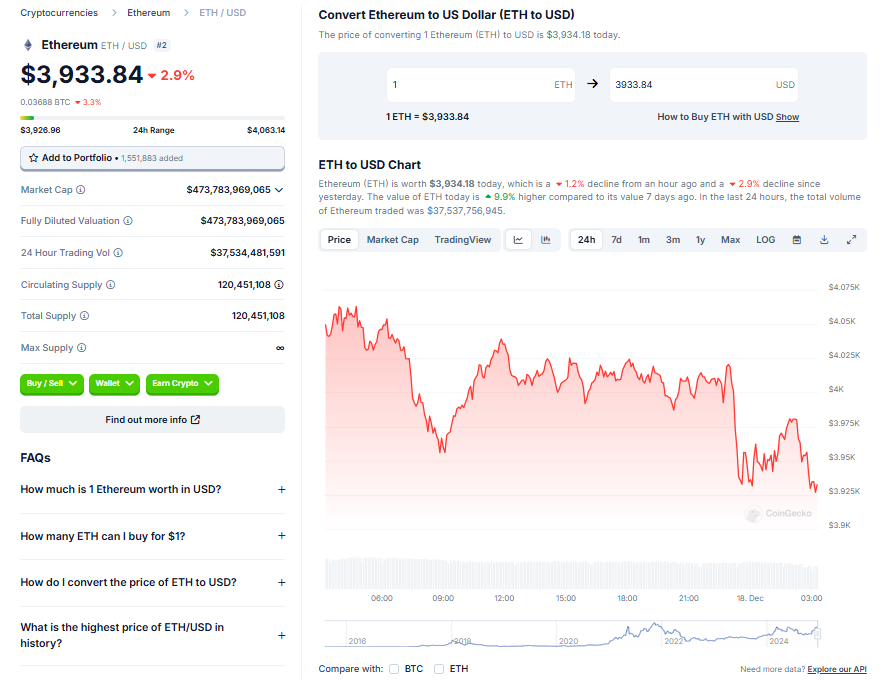

- Analysts suggest Ethereum’s price could see further significant growth based on historical trends of long-term holder sentiment and steady institutional inflows into Ethereum investment products.

Ethereum whales have made a significant move, accumulating a record 57.35% of the cryptocurrency’s total supply. This group of major stakeholders now controls approximately $333 billion worth of tokens, indicating their growing confidence in Ethereum despite the volatility of the cryptocurrency market.

A Shift in Ethereum’s Supply Distribution

With Ethereum’s recent rally, a noticeable change in its supply distribution has occurred. Large Ethereum wallets have been accumulating aggressively, leading to an all-time high in supply ownership. Meanwhile, mid-tier and small wallet holdings have hit record lows. Despite the market’s uncertainty, institutional inflows and historical trends suggest that Ethereum still has a significant potential for growth.

Ethereum Whales Increase their Holdings

Santiment’s latest analysis has shown that Ethereum wallets holding at least 100K ETH now control a record 57.35% of the total supply, equivalent to approximately $333.1 billion. This indicates a growing level of confidence among Ethereum’s largest stakeholders, who continue to accumulate despite market volatility.

Mid-Tier and Small Wallets Witness a Drop

Meanwhile, mid-tier wallets holding between 100 and 100K ETH have seen their supply ratio drop to a record low of 33.46%. Wallets with less than 100 ETH are at a near four-year low of 9.19%. Although the broader Ethereum ecosystem includes a growing number of DeFi and staking wallets, this trend is generally seen as a positive sign for the long-term outlook of Ethereum.

Ethereum’s Potential for Growth

Crypto analyst Ali Martinez points out that Ethereum’s price movements have historically correlated with shifts in long-term holder sentiment. The holders are at the early stage of the belief phase, which suggests optimism about the asset’s price potential. However, the euphoric peaks that typically mark the beginning of explosive rallies are still far off, indicating that Ethereum’s significant upward move could be on the horizon.

Ethereum-Based Investment Products Attract Inflows

In addition to the positive momentum, Ethereum-based investment products have reported seven consecutive weeks of inflows. CoinShares data shows that these products attracted a total of $3.7 billion during this period, with $1 billion flowing in just last week. This highlights steady institutional interest and confidence in Ethereum.

Conclusion

The recent activities of Ethereum whales indicate a bullish sentiment and a potential for significant growth. Despite market volatility, they continue to accumulate, demonstrating increasing confidence in the long-term prospects of Ethereum. This, coupled with the steady inflow into Ethereum-based investment products, suggests that Ethereum’s major upward move could still be on the horizon.