- Ethereum offers more regulatory clarity and institutional support, but its high valuation limits explosive upside.

- Solana is attracting new developers rapidly and dominates on-chain activity, but a 100x rally from here is unlikely.

- Neither coin is likely to mint new millionaires from small investments, but both remain strong long-term holds depending on your risk appetite.

For anyone still hoping to hit the crypto jackpot, the path ahead kinda splits two ways. On one side, you’ve got Ethereum—the OG smart contract giant that minted plenty of millionaires during the 2021 run-up. It still has the deepest liquidity in the game and a loyal base of developers and investors who aren’t going anywhere. Then there’s Solana, the fast-talking, high-speed network that’s become a haven for meme coin lovers and speed-first DeFi fanatics.

Both chains seem promising at first glance. But here’s the kicker: the odds that either ETH or SOL pulls off another 100x from where they’re priced today? Not great. Still, a few percentage points of compounding growth can separate winners from legends over a decade. Let’s break down which one might have that edge.

Ethereum: Still the Big Dog, But Getting a Little Sluggish

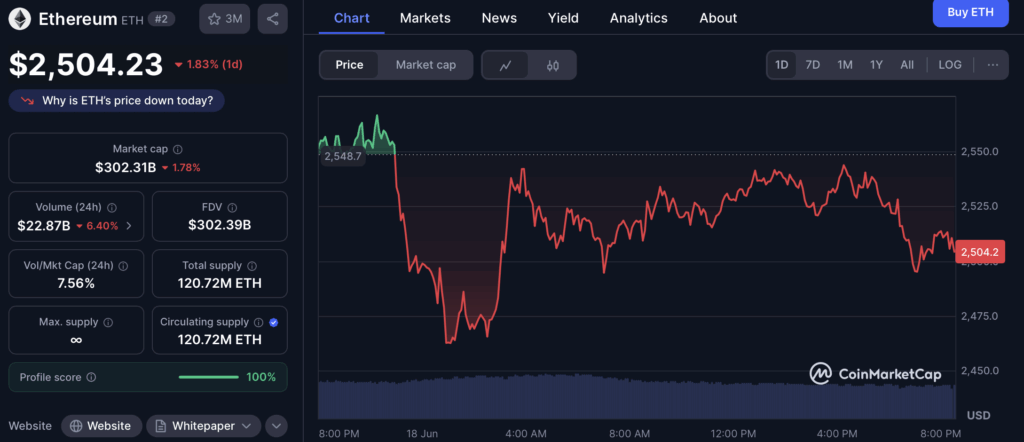

Even now, Ethereum’s kind of the “main capital city” of crypto. It’s got the biggest developer base, a monster market cap (around $300B), and last year it finally got spot ETFs approved without the SEC labeling it a security. That alone gives it a leg up—institutions love stuff that isn’t under regulatory fire.

Since then, over $3.5B has flowed into ETH ETFs, with $450M of that just in the first two weeks of June. That’s solid backing. Still, there’s friction. Gas fees and sluggish speeds are still dragging on usability. Even after the latest big network upgrade, Pectra, Ethereum hasn’t seen a spike in user activity or volume. Demand seems… muted.

And while ETF approval helped reduce existential risk, Ethereum’s current valuation already prices in a ton of optimism. Turning $10K into $1M from here would require a 100x rally—which, let’s be honest, probably ain’t happening with the way things stand.

Solana: Fast, Cheap, and Attracting Builders Fast

Solana takes a totally different route. It’s laser-focused on speed and dirt-cheap fees. And it’s working. In 2024, more new developers jumped to Solana than any other chain. Its developer count soared 83% year over year, and that’s translating to real usage. Solana now handles a massive chunk of all DEX trades and a majority of NFT activity.

And there’s fresh fuel coming. Canary Capital recently filed for a spot Solana ETF, which—if it even gets reviewed seriously—could open the door to more institutional interest. Solana’s architecture also makes it ideal for AI-based projects and sensor-heavy physical networks, which are looking for speed and scalability.

But even here, the 100x dream feels out of reach. Solana’s already pushing a $90B market cap. A 10x might be reasonable in a bullish decade, but expecting $10K to turn into $1M? That’s… a bit much.

So—Which One’s the Better Bet?

Neither of these are bad plays. Ethereum is still the safer grind—it’s got regulation on its side (for now), and big money is clearly still flowing in. Solana, though? It’s scrappier. It’s got serious momentum in tech and talent, and it’s pulling in devs like crazy. If you can stomach the wild swings, it may keep climbing faster.

Just don’t count on either one turning pocket change into millions overnight. Those days are probably behind us.