- Ethereum’s market cap rises to $383 billion as ETH reaches $3,200, overtaking Bank of America.

- ETH supply turns inflationary, marking a 0.42% annual increase in the past week.

- Vitalik Buterin introduces “info finance” concept, highlighting the role of prediction markets.

Ethereum (ETH) surged to $3,200 on Nov. 10, reaching its highest point since August as Bitcoin pushed beyond $80,000. This latest price spike has elevated Ethereum’s market capitalization to $383 billion, putting it approximately $40 billion above the market cap of Bank of America. The growing value of ETH reflects a shift in financial markets, with decentralized finance (DeFi) and crypto assets gaining traction over traditional finance sectors.

The U.S. Securities and Exchange Commission’s (SEC) ongoing consideration of spot Ether exchange-traded fund (ETF) options further underscores the rising acceptance of crypto assets within mainstream finance. As the crypto market expands, ETH’s increasing valuation highlights the broader appeal of blockchain technology and DeFi’s influence on modern finance.

Ethereum’s Inflationary Shift and Price Momentum

Despite Ethereum’s recent price rally, ETH supply has turned inflationary over the past week, with an annual increase rate of 0.42%, according to data from Ultrasound.money. The current burn rate for ETH stands at 452,000 annually, while new issuance totals 957,000 ETH per year. This supply shift marks a reversal from October, when Ethereum’s supply was briefly deflationary.

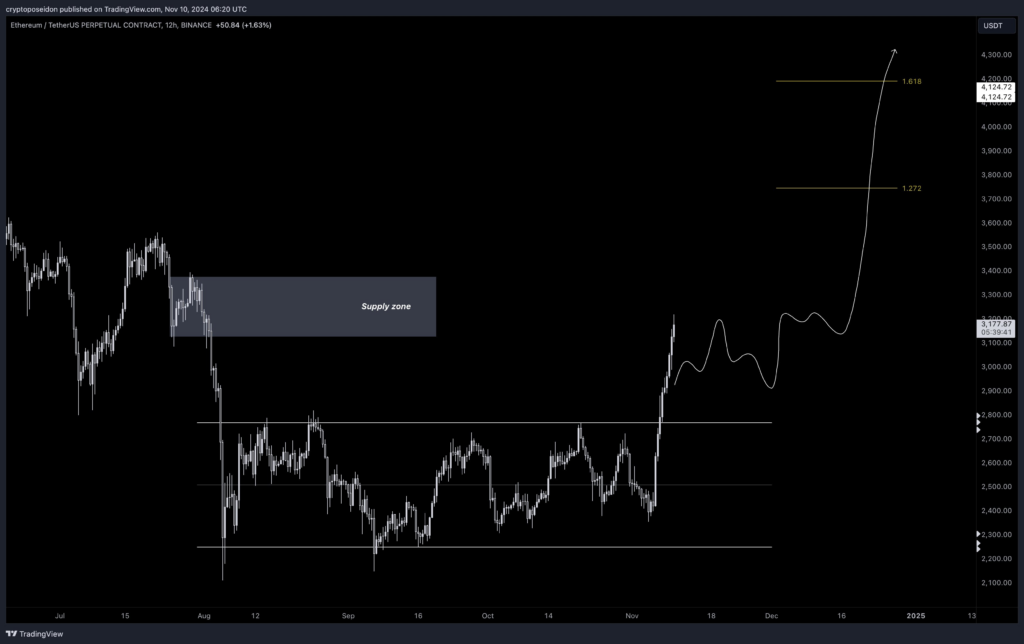

Market analysts and community members remain optimistic about ETH’s trajectory, with some predicting a potential break above $4,000 in the near future. Analyst Poseidon, however, suggested a potential short-term pullback before reaching a new all-time high (ATH) around $4,300.

Source: Crypto Poseidon on X

Vitalik Buterin Introduces “Info Finance”

Ethereum co-founder Vitalik Buterin recently presented a new concept called “info finance,” which he described as a system designed to gather and validate information through markets. Buterin advocates using prediction markets to provide reliable insights on future events without the influence of media sensationalism. He emphasized that info finance could serve as a tool to offer clear public expectations, potentially enhancing transparency in data sharing across sectors.

With Ethereum’s ongoing growth and new innovations from its founder, the network continues to solidify its position in the evolving digital economy. Analysts expect ETH’s momentum to remain strong, as the market shifts towards decentralized solutions.