- Over 30% of Ethereum’s supply is now staked, reducing liquid ETH available for trading

- Exchange reserves have fallen to around 16.2 million ETH, easing immediate sell pressure

- Tightening liquidity can amplify future price moves, but it may also increase volatility

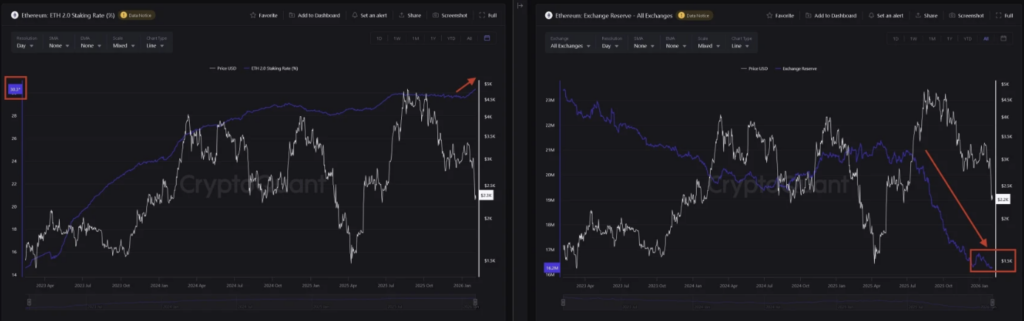

Liquidity movement on Ethereum is starting to look different, and it’s not a small change either. Recent blockchain analytics show that more ETH is being staked while less is being held on centralized exchanges, tightening the available supply that can be easily traded. Current estimates suggest over 30% of Ethereum’s total supply is now staked, while exchange balances continue to slide lower.

This matters because staking and exchange reserves usually reflect how people are positioned. When more ETH is locked up in staking contracts, it becomes less liquid, and when fewer coins sit on exchanges, there’s less “ready-to-sell” inventory. It doesn’t automatically mean price will moon tomorrow, but it does change the market’s structure in a way traders can’t really ignore.

Staked ETH hits record levels as conviction grows

On-chain data shows roughly 30.3% of Ethereum’s supply is currently locked in staking contracts, marking an all-time high. That’s a huge portion of ETH that is effectively removed from day-to-day trading flow. Staked ETH isn’t freely tradable, and even if holders decide to unstake, they still have to go through withdrawal and activation queue mechanics, which adds friction and time.

Analysts often interpret rising staking participation as a sign of long-term conviction. It suggests holders are willing to commit ETH to the network and earn yield rather than keep it liquid for quick trading. It also fits the broader trend of investors showing more interest in income-generating crypto assets, especially as the market matures and “yield” becomes a bigger part of the conversation again.

Exchange balances keep falling, reducing sell-side pressure

At the same time staking has climbed, ETH held on centralized exchanges has dropped meaningfully. Current figures put exchange reserves around 16.2 million ETH, a level lower than what was seen over the past few months. That decline is often viewed as constructive because fewer coins sitting on exchanges typically means less immediate selling pressure.

When exchange balances fall, the tradable supply becomes tighter. In simple terms, there’s less ETH available for buyers and sellers to hit instantly, and that can make prices more sensitive when volume picks up. Traders often watch exchange reserves as a liquidity indicator, because they can hint at whether the market is gearing up for distribution or quietly shifting into longer-term holding behavior.

Tighter liquidity can amplify moves, both up and down

The combination of rising staking and declining exchange balances points to one thing: liquidity is tightening. When a larger share of an asset is locked and the liquid float shrinks, the market can behave differently than it did when supply was more freely available. This is why analysts sometimes treat these metrics as part of an overall “health check” for Ethereum.

Tight liquidity doesn’t guarantee higher prices, and anyone claiming it does is overselling the signal. But it can amplify price action when demand returns. With fewer readily tradable tokens, even moderate buying interest can have a bigger impact, pushing price higher faster than expected. The downside is that the same structure can also increase volatility during sharp sell-offs, because liquidity dries up on both sides.

What this trend means for ETH investors

For long-term Ethereum holders, this shift may be viewed as a fundamental positive. High staking participation suggests confidence in Ethereum’s proof-of-stake model and the long-term appeal of earning yield. Meanwhile, declining exchange inventories imply that holders are not rushing to sell, which can support the idea that supply is moving into stronger hands.

That said, liquidity structure is only one part of the puzzle. Markets can stay irrational longer than metrics can stay bullish, and tight liquidity can sometimes create messy price swings in either direction. Still, as Ethereum continues to lock up more supply and reduce exchange inventory, it’s building a market setup that could become very reactive once demand meaningfully returns.