- Ethereum’s battling resistance at $2,600, with short-term dips likely before any bounce.

- Michaël van de Poppe warns of weekend volatility but sees potential for a rebound from demand zones.

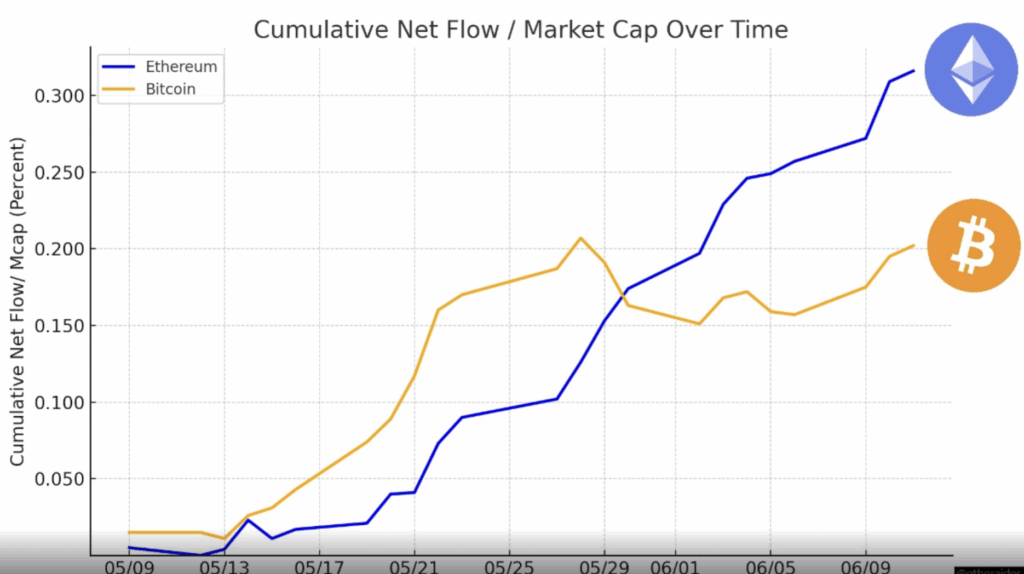

- Institutional inflows into ETH ETFs are rising sharply, outpacing Bitcoin and hinting at long-term bullish momentum.

Ethereum’s price action lately? A little rocky. Right now, all eyes are glued to that stubborn $2,600 resistance level. According to crypto analyst Michaël van de Poppe, this zone could be make-or-break if ETH wants to keep the bullish vibes going. His take? If ETH doesn’t crack above it soon, we might see it dip a bit lower before any real bounce—especially over the weekend when the crypto market tends to go a bit… unpredictable.

His latest chart shows ETH hitting a wall around that same level. It’s not crashing, but the rejection is clear. Traders are unloading at the supply zone, which is throwing cold water on upward momentum. Van de Poppe pointed out that Ethereum might dip into one of its previous demand zones first before gearing up for another push.

Weekend Dips Don’t Always Mean Doom

The thing is—short-term weakness on the charts doesn’t mean ETH is cooked. Van de Poppe actually mentioned weekends being prime time for weird price behavior. So a pullback, even down to those green demand zones, doesn’t necessarily mean bearish territory. Sometimes, that’s where reversals brew. And when you add in what’s happening behind the scenes with institutions, the whole story starts to shift.

Institutions Quietly Favoring ETH

Enter Merlijn the Trader. He’s been watching the Ethereum ETF space, and the data looks promising. According to him, ETH has seen a 56% increase in inflows compared to BTC over the past 30 days. That’s not a small edge. When big institutions move money, they usually do it early and quietly—and it looks like ETH is where they’re placing their chips right now.

A chart he shared shows a pretty telling trend: starting May 9th, ETH inflows were steady, but by late May, they really started to ramp up and pass Bitcoin. By mid-June, ETH had clearly pulled ahead, with the gap only getting wider.

Short-Term Resistance, Long-Term Optimism

So yeah, ETH might be stuck just below $2,600 for now. But with growing institutional backing and ETF interest heating up, that resistance might not last forever. The momentum from big players could end up being the fuel ETH needs to break through and start building a stronger uptrend. It’s not just about the charts—it’s about the capital flows too. And right now, those flows are leaning in Ethereum’s favor.