- Stablecoin supply on Ethereum hit a record $130B, with PayPal’s PYUSD and USDT leading fresh inflows across chains.

- Analysts project stablecoins could make up 10% of global money supply by 2030—about $3 trillion, boosting the whole crypto market.

- With Bitcoin dominance falling and stablecoin dominance near exhaustion, conditions may be lining up for the next big altcoin season.

Stablecoins are suddenly back in the spotlight. With the U.S. rolling out the GENIUS and STABLE Acts, regulation is looking a bit cleaner—bringing transparency, some protection for investors, and maybe even a fresh wave of confidence. But it’s not just rules that have shifted. Supply itself is climbing fast, and traders are whispering the same thing: this could be the fuel for the next altcoin run.

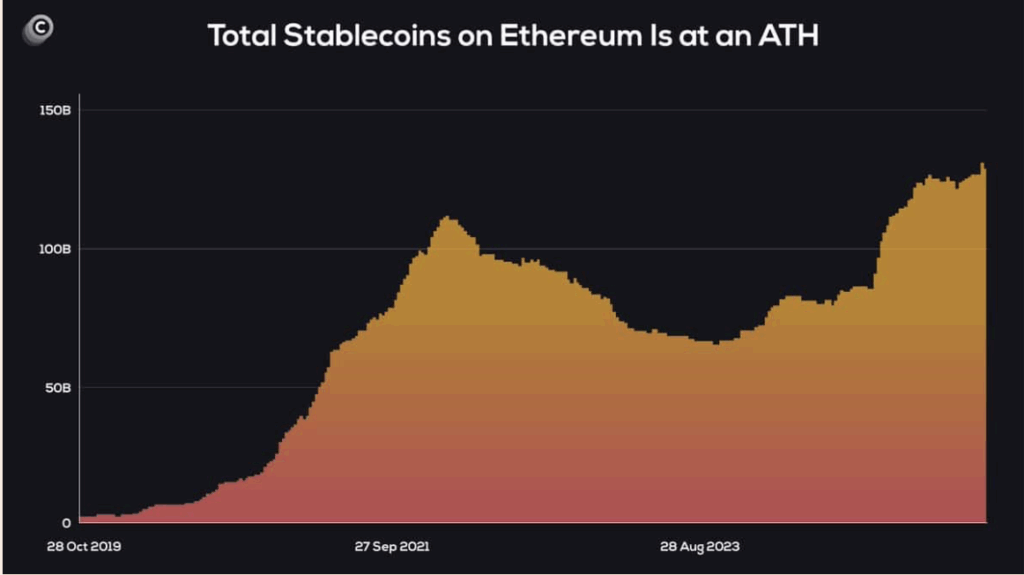

Ethereum Leads as Stablecoin Supply Hits Record

On Ethereum, total stablecoin supply just cracked an all-time high near $130 billion, bouncing from the low we saw back in August 2023. ETH still dominates issuance, and that’s not just symbolic—it shows how much infrastructure is being built on top of the network, especially by bigger, public-facing companies.

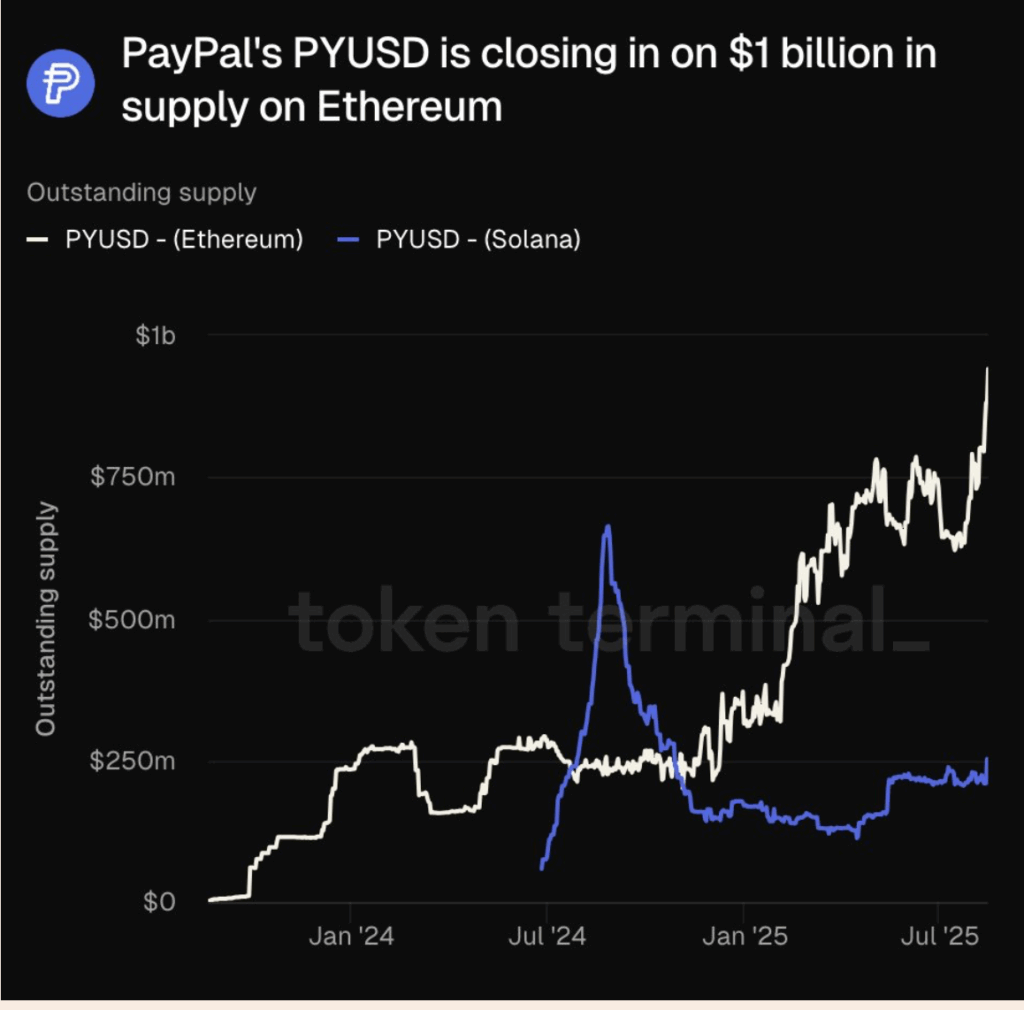

And when flows into stablecoins spike? It usually means two things: investors are cashing out profits, or they’re loading dry powder to rotate into higher-beta coins. In this case, it looks like a mix of both. PayPal’s PYUSD is creeping toward the $1 billion mark on Ethereum, while Solana holds about $250 million. USDT is back in growth mode, mostly fueled by rotations out of Bitcoin, with TRON carrying much of that flow. Even USDC isn’t sitting still—its monthly transfer volume on Aptos hit $8.6B, with 23.2 million transfers.

Liquidity, Regulation, and the Bigger Picture

All of this sits inside a much bigger story. Analysts think stablecoins could make up nearly 10% of global M2 money supply by 2030, which would mean something like $3 trillion in circulation. If that plays out, the impact across crypto would be massive.

Meanwhile, the U.S. is quietly stacking. As of now, it holds roughly $347 million in stablecoins—part of its slow build toward what some call a “crypto reserve,” anchored by BTC and ETH. Stablecoin liquidity may be the piece that makes that possible.

Could This Be the Altcoin Trigger?

The real question: does this mark the start of alt season? Stablecoin dominance sits around 4.22%, showing signs of exhaustion. A break below key levels in that metric could flip the switch for altcoins, since the two often move in opposite directions.

Bitcoin dominance has already slipped—from 62.5% to just under 60% in two weeks. If that slide continues, and stablecoins keep flowing, the setup for an altcoin rotation looks stronger by the day.