- Short sellers increase pressure ahead of Ethereum’s Pectra upgrade, with open interest rising 3% and the Taker Buy/Sell Ratio hitting a bearish low of 0.866.

- Spot investors remain bullish, pulling 63,690 ETH off exchanges, while hedge funds are stacking short positions, possibly betting on a post-upgrade sell-the-news dip.

- Price drops below key levels like $1,800 and triangle support; if ETH can’t recover, it may test $1,688—unless bulls manage a breakout above the current structure.

Ethereum’s been under a bit of pressure lately—falling about 2% on Tuesday—just as short sellers piled in ahead of the much-hyped Pectra upgrade, which is expected to go live within the next 24 hours. While spot traders still seem hopeful, futures markets tell a different story.

Shorts on the Rise While Sentiment Splits

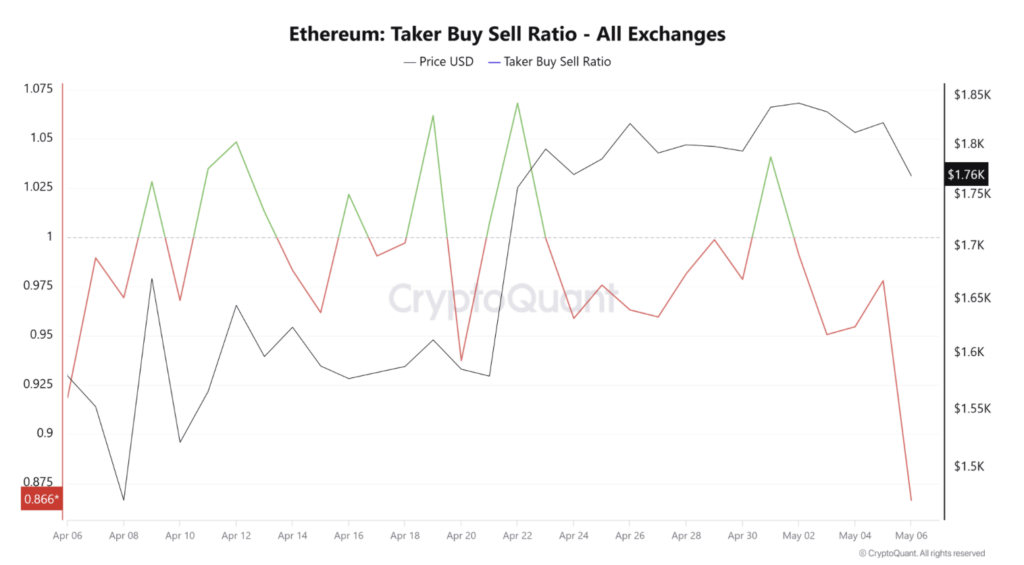

According to Coinglass, Ethereum’s open interest jumped by nearly 3% even though price dipped. That’s usually not a great sign—it means new money is flowing into short positions. The Taker Buy/Sell Ratio dropped to 0.866, its lowest since early February. In simple terms: sellers are clearly outnumbering buyers in the perpetuals market.

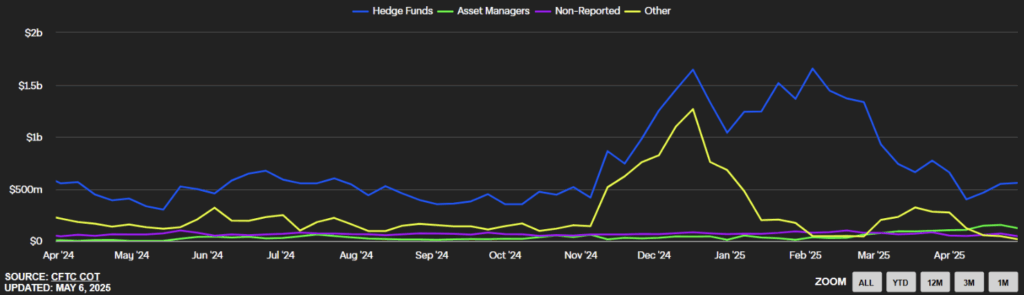

Interestingly, while open interest climbed on most top exchanges, it dropped over 5% on the CME. That’s probably because asset managers and retailers decided to close out their long positions. Meanwhile, hedge funds have been ramping up short bets since mid-April—maybe they’re banking on a post-upgrade sell-off.

Despite this bearish wave, spot investors aren’t backing down. Over the past 24 hours, exchanges saw a net outflow of 63,690 ETH. That kind of outflow usually points to accumulation, possibly in anticipation of the Pectra upgrade.

What’s the Deal With Pectra?

This upgrade is pretty loaded. It’s not just cosmetic—it’ll double blobspace per block from 3 to 6, which should improve data availability. The staking cap will also jump from 32 ETH to 2,048 ETH, which could change the game for validators. Oh, and smart wallets are getting a boost too—features like sponsored transactions, gas fee payments in other tokens, batch transactions, and even wallet recovery are on the way.

Price Outlook: ETH Slips Below Key Levels, $1,688 in Sight?

Ethereum took a hit, with $50.9 million in liquidations over the last day—$39.7 million from longs. Price dropped under some key levels: the $1,800 mark, the 14-day EMA, the 50-day SMA, and it broke beneath a symmetrical triangle support.

If bulls can’t pull it back above those technical lines, ETH might be heading for the next support level around $1,688. The RSI is hovering near neutral, but the Stochastic Oscillator dropped fast from overbought levels—bearish signals starting to stack up.

Still, if Ethereum can push back above the symmetrical triangle and hold a daily close, that’d invalidate the bearish setup and open the door for recovery.