- Ethereum saw $1.4B in stablecoin inflows and a $2.88B TVL increase—signs of growing network demand.

- Spot traders are still dumping ETH ($61M sold recently), applying short-term pressure on price.

- ETH is stuck in a consolidation phase; breakout or breakdown depends on incoming market momentum.

Ethereum’s had a rough stretch lately. Despite solid long-term vibes, the price took another hit—dropping about 1.75%—extending its red streak from the past week. It’s not a major crash, but it’s got people wondering if ETH can shake off this pressure soon.

Now, the bigger picture still leans bullish. But ETH seems to be getting dragged down by some short-term selling pressure, especially from spot traders who aren’t quite aligned with the optimistic outlook. So… what’s really going on under the hood?

Stablecoins Are Flowing In – That’s a Big Deal

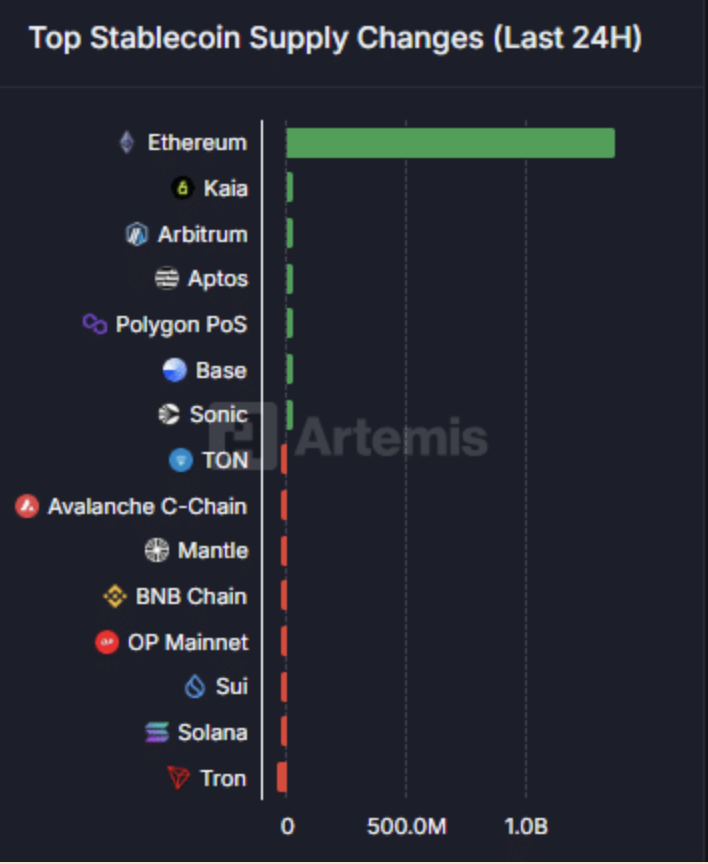

In the last 24 hours alone, Ethereum saw one of its biggest stablecoin inflows—roughly $1.4 billion worth. That’s not nothing. When that much USDT or USDC moves in, it usually means folks are gearing up for something. Could be buying, could be new protocol activity, but either way—it signals movement.

The stablecoin supply flooding into Ethereum shows that people are stacking dry powder, maybe waiting to deploy it. Artemis data also pointed out a nice spike in Bridged Netflow—$114K or so came into ETH, much of it leaving Solana. That’s not just random activity. It suggests bigger players are tilting toward ETH instead of SOL right now.

If that inflow trend sticks, we could see ETH get a lift soon. These sorts of moves tend to precede price rallies—especially when capital’s moving from other Layer 1s into Ethereum.

TVL Pops as Investors Lock In Liquidity

Here’s another one for the bulls: Total Value Locked (TVL) on Ethereum shot up by 3.46% in a day, climbing from $83.6B to just over $86.5B. That’s nearly $3B worth of capital flowing into protocols built on ETH.

That kind of spike doesn’t happen out of nowhere. It shows investors are willing to commit assets—staking, farming, lending, whatever—rather than sitting on the sidelines. When people start locking up ETH, circulating supply drops, which often creates upward price pressure. It’s not rocket science.

Still, it’s not all roses. Some spot traders aren’t convinced. They’ve been offloading ETH—$61 million of it, to be exact. That’s likely folks playing defense, hedging in case the price dips further. But if the selling slows and demand keeps building? Could be explosive.

So… Where’s the Chart Pointing?

Since mid-May, ETH’s just been bouncing around. Sideways grind. But that kind of behavior often shows quiet accumulation. It’s like a pressure cooker—it’s calm until it’s not.

From here, ETH could do one of two things: punch through the top of this consolidation range and push toward resistance… or lose its footing and slide to one of two lower support levels (there’s a dashed line hanging out down there, and then the base of the channel).

Which way it breaks? Honestly, it’ll probably come down to momentum. If enough buyers step in with confidence, this thing could pop. If not, it might dip first before any real rally begins.