- Ethereum ETF inflows and rising CME futures open interest show institutions are treating ETH like a mature asset, not just a speculative bet.

- On-chain activity remains steady, proving Ethereum’s demand base isn’t just speculation-driven.

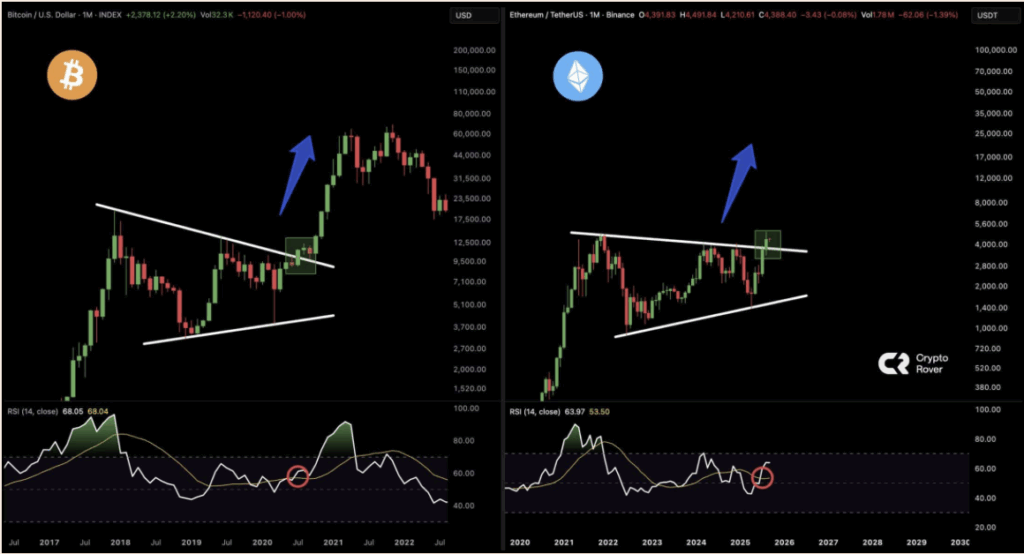

- A breakout from a multi-year wedge, combined with ETF appetite, could set ETH on a path similar to Bitcoin’s 2021 rally.

Ethereum is slowly shaking off that “second place” label and starting to act like a true heavyweight in the market. A mix of ETF inflows, rising CME futures activity, and steady on-chain usage is setting up a narrative that feels eerily similar to Bitcoin’s breakout back in 2021. Still, ETH has its own quirks, risks, and wildcards to consider.

Institutions Are Playing Both Sides

Fresh data from Glassnode shows that over half of recent Ethereum ETF inflows are being mirrored by open interest on CME futures. That’s a fancy way of saying institutions aren’t just buying ETH to hold — they’re hedging, arbitraging, and building structured positions. It looks a lot like what happened when Bitcoin ETFs first exploded, with TradFi players stacking both spot and derivatives. The difference here? ETH hasn’t even reclaimed its local highs yet, which makes this setup look more like a market maturing than a FOMO-driven spike.

Network Activity Refuses to Slow Down

While traders zoom in on candles, Ethereum’s network is just… doing its thing. Transactions keep climbing, even during messy, volatile stretches. This isn’t just speculative churn — it signals a base layer of actual demand that doesn’t evaporate when price dips. That kind of steady usage is what keeps Ethereum relevant, whether it’s at $2,000 or $5,000.

ETH at a Crossroads

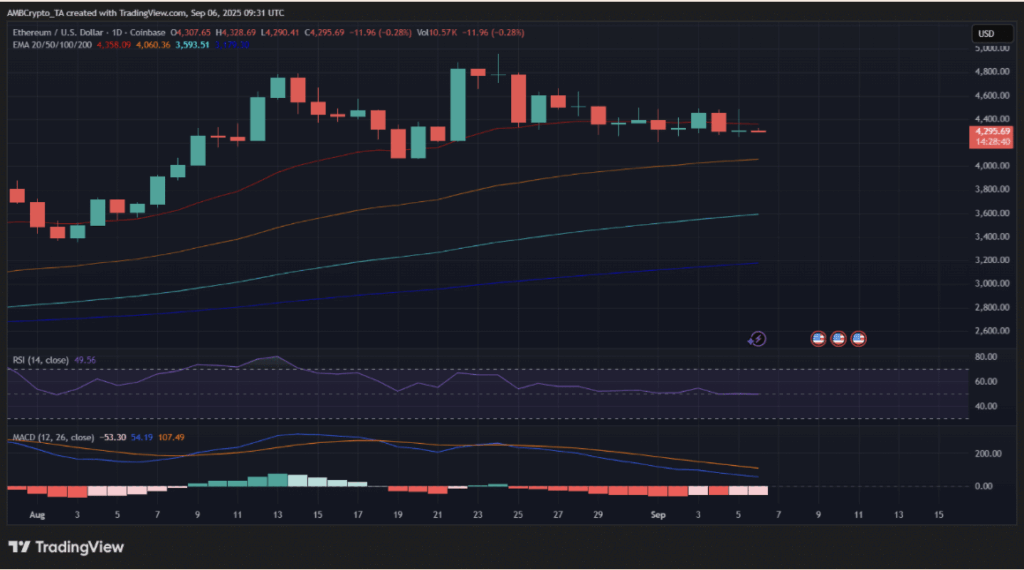

At the time of writing, ETH is hovering around $4,300, with RSI flat and MACD fading. On the surface, that screams hesitation. But zoom out, and you’ll see Ethereum breaking out of a multi-year wedge pattern, not unlike the one Bitcoin broke before its 2021 fireworks. The wildcard? ETF demand. There’ve been a few outflows lately, but net assets are still over $27 billion. If that appetite comes roaring back, ETH could easily catch the same wave that sent BTC into uncharted highs.