- Ethereum is holding near $3,822 after facing resistance at $3,880, with trading volume up 19%.

- Bitmine bought 44,036 ETH worth $166 million during the dip, raising its total holdings to 3.16 million ETH.

- Analyst Michaël van de Poppe predicts ETH could break above $5,000 once it reclaims the $4,000 level.

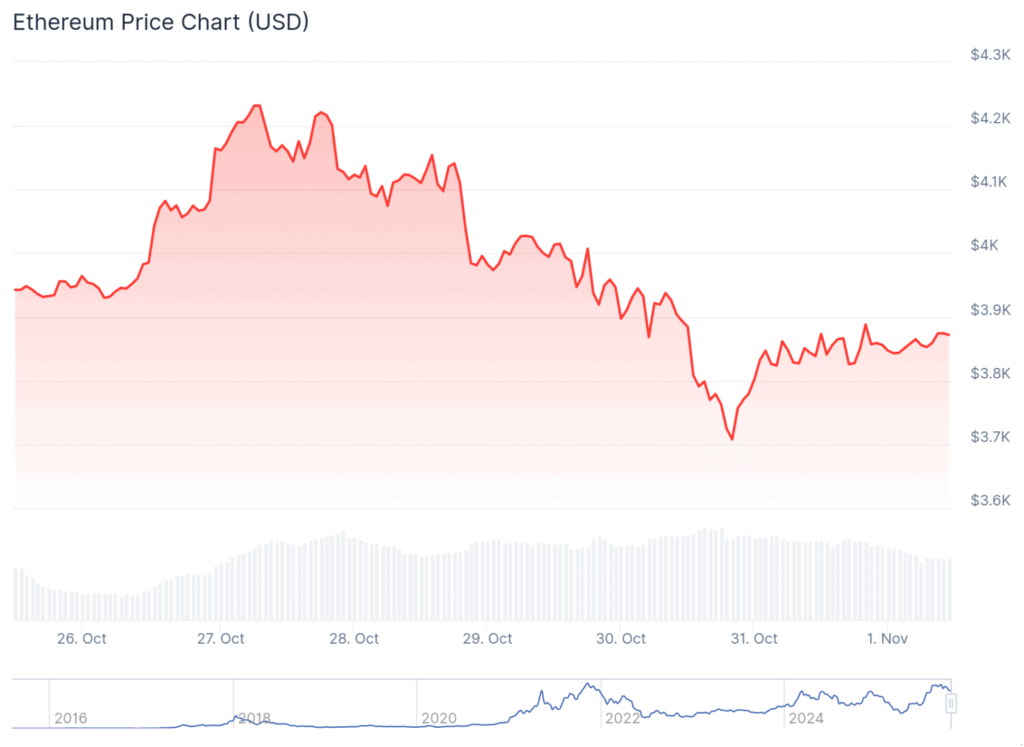

Ethereum’s price has been holding steady around $3,822.60 after facing rejection near the $3,880 resistance band. The asset gained 1.5% on Thursday as volume spiked 19% above the weekly average, showing that traders remain active even as price momentum cools off. After testing a high of $3,887, ETH slipped back to $3,820 in the final hour, keeping the range tight between $3,730 and $3,880. Support currently sits at $3,680–$3,720, with $3,880 now acting as a crucial psychological ceiling.

Bitmine Steps In With Massive $166 Million Purchase

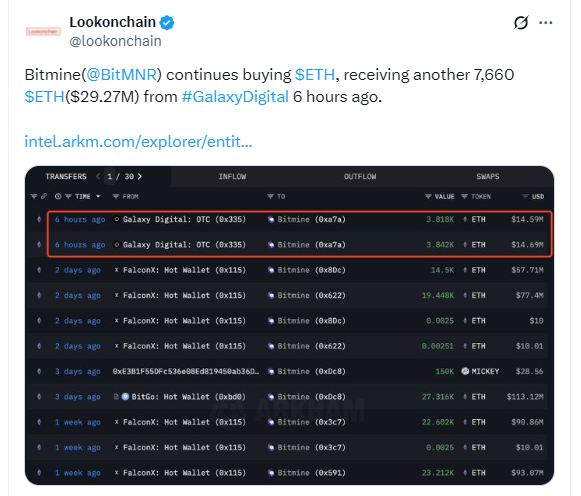

While short-term traders hesitated, institutional player Bitmine saw opportunity in the recent dip. According to Lookonchain data, the firm scooped up 44,036 ETH — roughly $166 million worth — during the pullback. That move boosted Bitmine’s total holdings to 3.16 million ETH, valued at around $12.15 billion. This type of accumulation during weakness reinforces how institutions tend to buy the fear, not the top. It’s a strong signal that big money continues to treat Ethereum as a long-term play despite short-term volatility.

Analyst Predicts Push Toward $5,000

Popular crypto analyst Michaël van de Poppe believes Ethereum could be gearing up for a new all-time high. In his words, “Ethereum remains the strongest ecosystem to invest in.” He predicts ETH could push past $5,000 once it clears $3,880 and reclaims $4,000 with conviction. According to van de Poppe, developer activity, on-chain innovation, and consistent network effects make Ethereum’s upside more sustainable than most altcoins. Still, price will need to prove strength above the current resistance zone before that next leg higher begins.

Technical Picture Still Mixed

From a chart perspective, ETH is walking a fine line. The price recently dipped below the 50-day and 100-day moving averages, hinting at fading short-term momentum. If bulls fail to defend $3,800, the next key demand zone sits around $3,500, with the 200-day MA lurking near $3,200. On the flip side, a reclaim of $4,000 could flip sentiment quickly.

For now, the tug-of-war continues — bears defending the upper band, bulls buying every dip — leaving Ethereum’s next breakout moment just a heartbeat away.