- ETH drops over 15% in a week as inflationary supply pressures grow.

- Price hovers near $3,000 support, with RSI signaling a possible rebound.

- Funding rates show signs of recovery, but bearish risks still loom large.

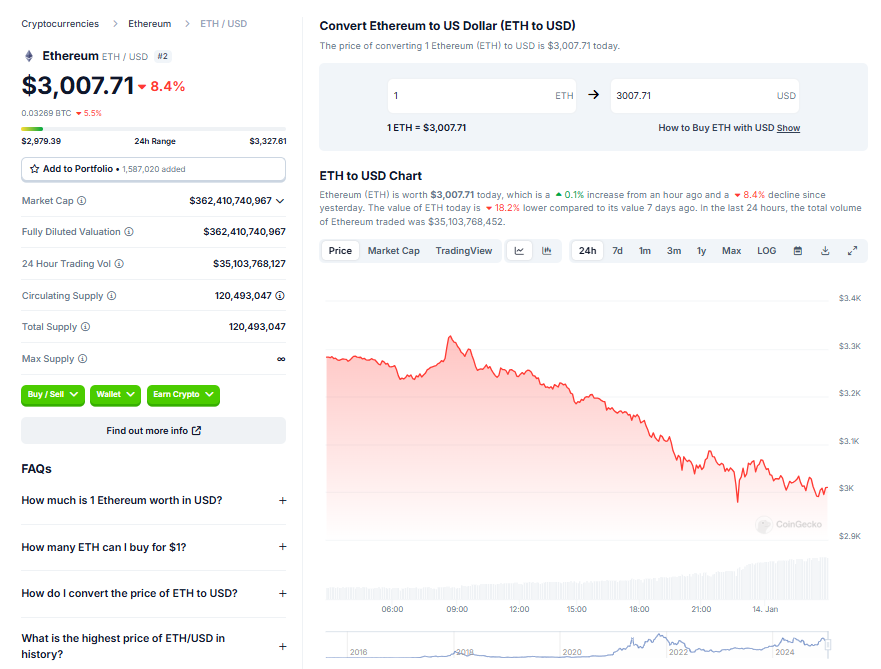

Ethereum has been in a rough patch lately, with its price sliding more than 15% in just a week. This downturn is closely tied to a shift in the network’s supply dynamics. After enjoying a deflationary environment following the Merge, Ethereum’s total supply has been increasing again—up by 0.37% in nine months, now sitting at 120.4 million ETH.

This return to inflationary levels, paired with weaker demand, has left investors worried about ETH’s price trajectory. On the 4-hour TradingView chart, Ethereum has dipped below a key support level of $3,087, signaling a clear downtrend. The big question now is whether ETH can hold this line—or risk falling further.

Technical Signals: Oversold RSI Sparks Hope

From a technical perspective, Ethereum’s price has dropped beneath both its 50-day and 200-day moving averages, further cementing its bearish trend. However, there’s a glimmer of hope. The Relative Strength Index (RSI) on the 4-hour chart has hit 22, putting ETH firmly in oversold territory.

This suggests a possible short-term price reversal, though the longer-term picture remains hazy. On the daily chart, ETH was consolidating between $3,189 and $3,330 before breaking lower. The RSI here is also close to oversold levels at 32, hinting at a potential recovery if buying pressure kicks in soon.

Funding Rates and Market Sentiment: Mixed Signals

On-chain metrics provide an interesting twist. As Ethereum approaches the $3,000 support zone, funding rates—reflecting trader sentiment—have begun to recover. This suggests that some traders are starting to open long positions, betting on a rebound.

However, the recent dip in funding rates had previously signaled growing bearish sentiment, and the market remains at a pivotal moment. If funding rates continue their recovery, we might see the start of a bullish phase for ETH. But if sentiment weakens again, the risk of further price declines remains high.

Final Thoughts: A Crucial Juncture for Ethereum

Ethereum’s price is teetering on the edge. With technicals showing oversold conditions and funding rates starting to recover, a rebound is possible—but by no means guaranteed. The key lies in whether ETH can hold above its $3,000 support and regain bullish momentum. For now, traders should keep a close watch on both price action and on-chain signals.