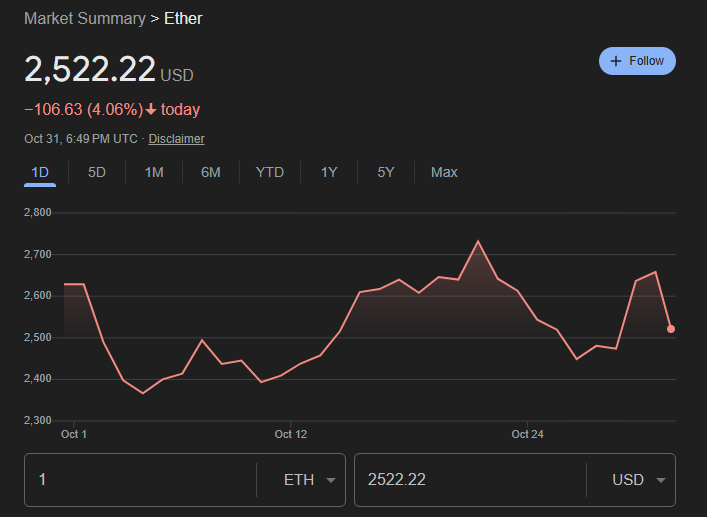

- Ethereum’s price is expected to dip to $2,500 before reaching new all-time highs, according to an analyst.

- A technical pattern suggests an upcoming Ethereum rally to $2,800.

- Ethereum’s price performance lagged behind Bitcoin’s in October, but charts indicate this could change soon.

Ethereum has struggled to gain momentum in recent months, lagging far behind Bitcoin‘s price performance. However, analysts believe the altcoin is gearing up for a sharp rebound.

Current Market Conditions

In October, Ethereum rose a mere 1% compared to Bitcoin’s 14% gains. Lack of interest from investors is weighing on Ether’s price. The ETH ETF saw $44 million in inflows on Oct 30, just 0.49% of the $893 million that flowed into Bitcoin ETFs.

Ether’s Bear Trap at $2,500

According to independent trader Poseidon, Ethereum likely bottomed out after a bear trap to $2,382 over the weekend. The altcoin immediately recovered back above $2,500 within 48 hours. Poseidon notes that ETH reclaimed its 200-day EMA in the 8-hour timeframe.

If Ether holds above $2,600, Poseidon will add more long positions. He believes the current range will ultimately break to the upside. Based on this analysis, Ethereum could see an 88% return on investment from $2,500 to new all-time highs.

Approaching a Historic Support Level

On the ETH/BTC chart, Ether is reaching its lifetime point of control where most transactions have occurred since 2016. This is a key support level where price could reverse sharply, according to analyst MaxBecauseBTC.

Daily Chart Shows Bullish Signs

On the daily timeframe, Ether continues to move higher from its ascending trendline support. It could retest the $2,550 to $2,600 range again. An ascending triangle pattern is forming, which is bullish.

Ethereum’s first target is to flip the 100-day and 200-day EMAs. This would add confluence to the bullish price action. The RSI remains above 50 but below 70, signaling healthy buyer dominance without overextension.

Once ETH closes decisively above $2,800, prices could surge higher as the Bollinger Bands tighten. In summary, analysts are predicting Ether’s final dip before a sharp move to new all-time highs.