- Ethereum overtook Bitcoin in August spot trading, hitting $480B in volume vs. BTC’s $401B.

- Institutional flows and ETF inflows leaned heavily toward ETH, while Bitcoin products saw outflows.

- ETH’s market cap share climbed back toward 25% of BTC, reigniting talk of a potential flippening.

Ethereum just pulled off something traders haven’t seen in years… it actually overtook Bitcoin in spot market activity. For the first time in seven years, ETH isn’t playing catch-up — it’s leading the charge, and that has sparked fresh chatter about whether the so-called “flippening” is still a meme or if it’s creeping closer to reality.

Ethereum Takes the Lead in Spot Volumes

In August, Ethereum’s dominance on centralized exchanges quietly flipped Bitcoin’s. Numbers don’t lie — ETH clocked nearly $480 billion in spot turnover, while BTC lagged behind with $401 billion. Charts even showed Ethereum’s market share creeping up all summer, slowly chewing into Bitcoin’s dominance before outright surpassing it by the month’s end.

And it’s not just a one-off. Weekly volumes across August confirmed ETH’s grip, suggesting this wasn’t random volatility but a shift in where traders are choosing to park liquidity.

Institutional Flows Push ETH Momentum

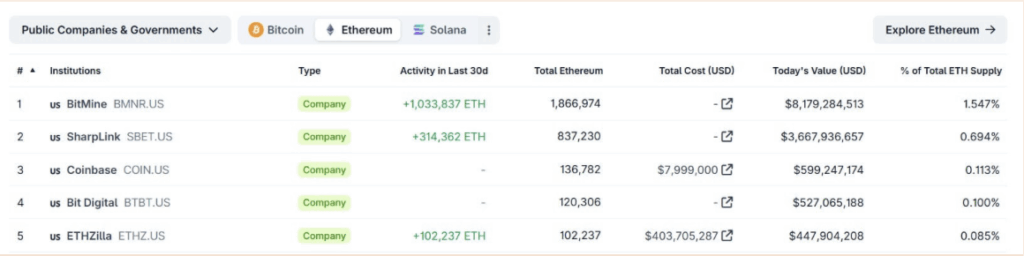

Part of this story comes down to big money. Corporate treasuries — names like BitMine Immersion and SharpLink Gaming — disclosed fresh billion-dollar ETH allocations. That kind of institutional footprint adds weight to Ethereum’s edge.

ETF flows told the same story. Bitcoin products had choppy, inconsistent inflows, while Ethereum-linked funds showed steady green weeks, wrapping up August with stronger aggregate inflows. Simply put: institutions are betting on ETH at a time when Bitcoin’s demand looks shaky.

Is the Flippening Still Just Talk?

So far in 2025, ETH has also outpaced BTC in year-to-date returns. The margin may not look huge at first glance, but paired with Ethereum’s new dominance in spot trading and steady institutional flows, the case for a structural shift is harder to ignore.

Market cap ratios back it up too. Ethereum’s share climbed back toward 25% of Bitcoin’s market cap, levels last seen in mid-2022. That doesn’t scream “flippening” just yet — but it does hint that momentum is building in a way we haven’t seen for a while.

Whether this is just another seasonal pump or the start of a bigger reshuffling of the crypto hierarchy, one thing’s clear: Ethereum is no longer just chasing Bitcoin… it’s setting the pace.