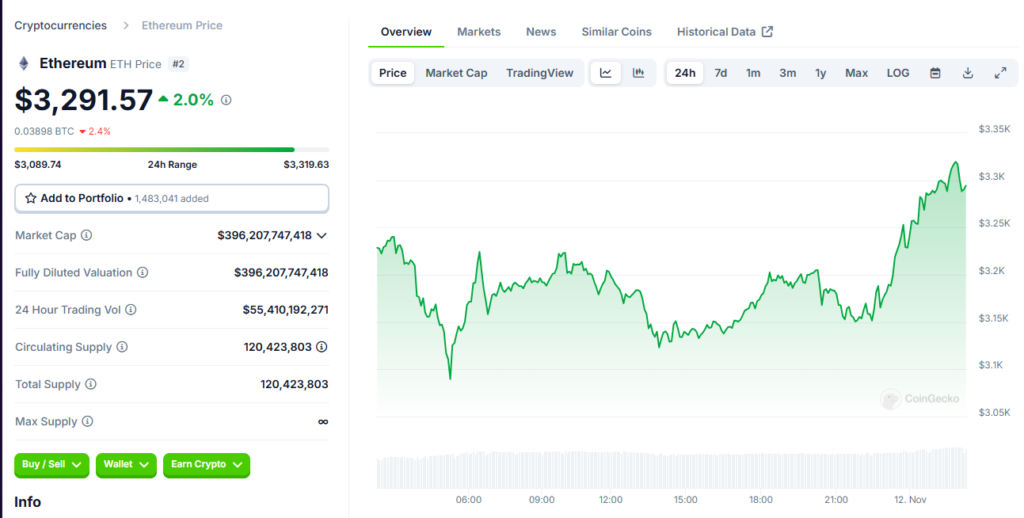

- Ethereum has finally reclaimed the $3,000 price level for the first time since August 2nd, amid Bitcoin’s record-breaking rally and a “surprising upturn in bullish sentiment.”

- President-elect Donald Trump’s favorable stance on digital assets is boosting the broader crypto market, with Ethereum’s price rising 20% over the past week, outpacing Bitcoin’s 10% jump.

- Standard Chartered issued an extraordinarily bullish note, estimating the crypto market could reach a $10 trillion market cap by the end of 2026, potentially aided by a Trump-led SEC adopting a more collaborative approach towards Ethereum and DeFi.

Ethereum has struggled to gain much momentum in recent months while Bitcoin has soared, breaking its all-time price record multiple times in early November, including once late last week. However, the second-largest crypto by market cap finally managed to breach the $3,000 threshold early Saturday for the first time since August 2, peaking out at $3,056.

Breaking Past $3,000

Breaking that mark for only the second time this year, Ethereum had fallen to as low as $2,375 on the eve of Election Day. Yet with President-elect Donald Trump’s favorable stance on digital assets boosting the broader market, Ethereum’s price is beginning to rise on that tailwind, popping 20% over the past week and outpacing Bitcoin’s own 10% jump.

Bitcoin’s Record Highs

Bitcoin continues to push to new all-time highs, again doing so Friday with a new high of $77,239, data from CoinGecko show.

Ethereum Price Action

While Ethereum’s climb past $3,000 was bolstered by Trump’s win, the asset has still underperformed Bitcoin in terms of year-to-date gains. Bitcoin may have set a new all-time high price on Friday, but Ethereum is still chasing a peak of $4,878 set in November 2021. It came within striking distance of its previous all-time high price in March when it crossed $4,000 for a day.

Regulatory Outlook

With a Trump-led change of leadership at the SEC all but certain, Ethereum’s prospects could shift as regulators adopt a more collaborative approach. There are signs that the merits of Ethereum’s proximity to DeFi could be changing with related tokens notching gains.

The governance token for Aave, a leading decentralized crypto lending platform, has increased 29% in price over the past week to $1.83 for example. At the same time, the governance token for Ethena, a decentralized stablecoin protocol, has risen 34% to $0.50 over the same period.

Bullish Sentiment

This shift in narrative to an administration that has signaled they want to address regulatory enforcement actions on a platform like Ethereum is probably more beneficial for Ethereum than it is for other projects like Bitcoin, Kraken Head of Strategy Thomas Perfumo told Decrypt last week.

While Ethereum’s climb past $3,000 was bolstered by Trump’s win, the market maintains a strong bullish sentiment, Nick Forster, founder of onchain options DeFi protocol Derive told Decrypt last week. For Bitcoin option traders are showing a bit of optimism with a slight positive bias for both the 30-day and 7-day outlooks, Forster added. Ethereum, which is often seen as riskier, is flashing even stronger optimism for those same periods. That indicates a surprising upturn in bullish sentiment for Ethereum, he said.

Conclusion

Ethereum has struggled in recent months but is now gaining momentum thanks to a more favorable regulatory environment under the Trump administration. The asset has reclaimed the $3,000 level amid an apparent resurgence in bullish sentiment. While it still trails its all-time high, Ethereum seems to be back on the rise.