- Ethereum ETFs saw $795.6M in outflows, led by Fidelity’s FETH ($362M) and BlackRock’s ETHA ($200M).

- ETH slipped below $4K, trading at $3,990.17 after a 10.78% weekly drop, reflecting short-term volatility.

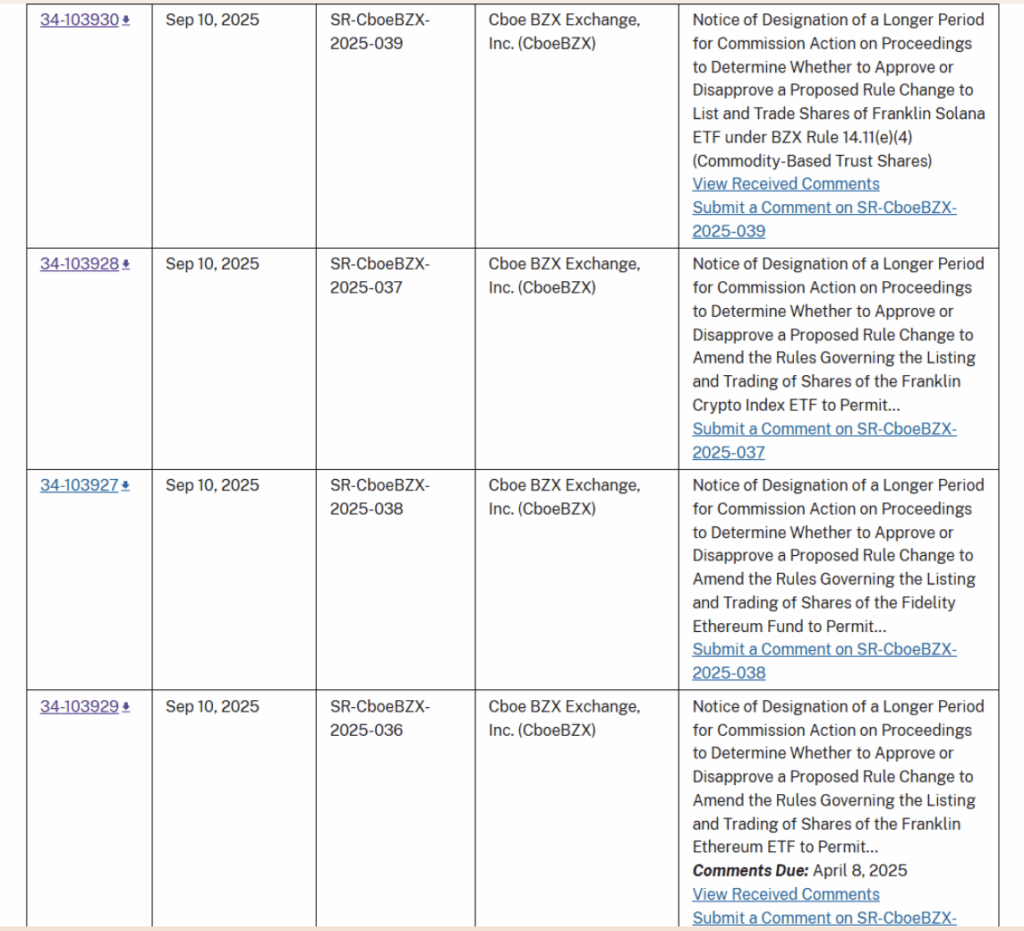

- SEC delays on multiple crypto ETF applications added pressure, though new filings like a Dogecoin ETF kept market optimism alive.

Ethereum ETFs had a rough week, logging their biggest outflows on record. Data from Farside Investors showed that for the week ending September 26th, spot Ethereum funds lost about $795.6 million. That’s a hair more than the $787.7 million drained earlier in September, which at the time was the largest weekly drop. Trading volume still topped $10 billion, but the redemptions sent a clear signal of caution.

The Fidelity Ethereum Fund (FETH) was hit the hardest, with over $362 million leaving in just a few days. BlackRock’s ETHA fund, which still holds more than $15.2 billion in assets, saw $200 million pulled. Grayscale’s ETHE also bled capital, underscoring how widespread the withdrawals were across different issuers. This all lined up with Ethereum’s price slipping under $4,000, landing at $3,990.17—down 0.58% on the day and nearly 11% for the week.

Ethereum Price Struggles Amid ETF Redemptions

The timing couldn’t be ignored. As investors yanked cash from ETH products, Ethereum itself mirrored the sentiment. Falling under the $4K mark rattled traders who were hoping ETH’s strong network activity might cushion the dip. Instead, the charts showed weakness, with weekly losses nearing double digits. Analysts noted the move reflected short-term volatility rather than a structural breakdown, but it still stung.

The pullback also echoed what was happening across broader crypto ETFs. Bitcoin products weren’t spared either. Spot BTC funds saw $902.5 million exit during the same week. Fidelity’s FBTC led those outflows, while Bitcoin itself held at $109,352—flat on the day but down 5.53% on the week.

Broader Market and Regulatory Pressures

Behind the scenes, regulatory delays added fuel to the cautious mood. The SEC pushed back decisions on several crypto ETF and staking applications, shifting deadlines into late October and November. Major issuers like BlackRock, Fidelity, Franklin Templeton, Grayscale, and 21Shares are all waiting on green lights. These extensions likely weighed on sentiment, as traders dislike uncertainty almost as much as bad news.

Still, optimism hasn’t completely vanished. Ripple futures hit record highs during the same stretch, showing selective bullishness. On top of that, VanEck filed for a Spot Hyperliquid ETF, and the first-ever U.S. Dogecoin ETF application entered the pipeline. Even with money leaving Ethereum ETFs, the broader market keeps testing new ways to expand access.

Outlook for Ethereum ETFs and Price

For now, Ethereum is caught between heavy outflows and its own strong fundamentals. The $4,000 level remains a psychological barrier, and whether ETH can reclaim it may depend on how ETF flows stabilize in the weeks ahead. Traders are watching closely—if the $795 million bleed was just a shakeout, ETH could rebound quickly. If redemptions continue, though, price might struggle to stay afloat in Q4.