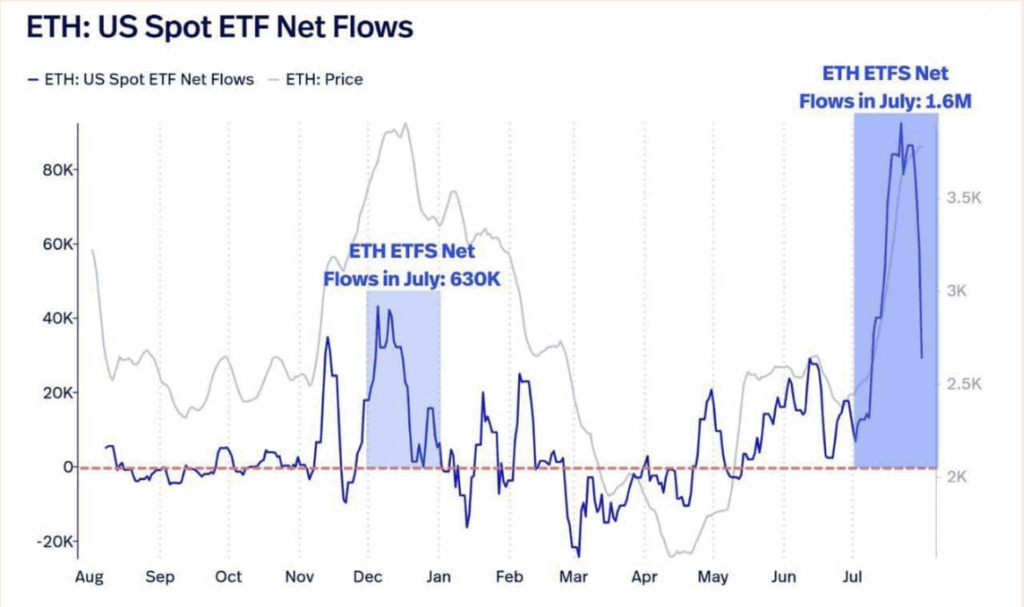

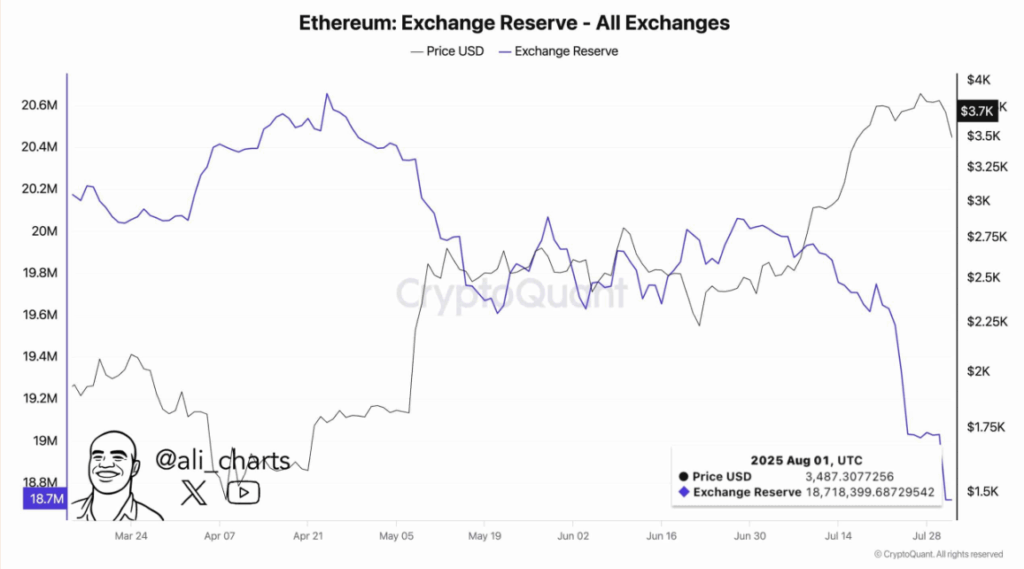

- Ethereum spiked 60% in July, fueled by 1.6M ETF inflows and 1M ETH withdrawals from exchanges—suggesting strong long-term conviction.

- Whale activity and steady futures metrics indicate the market is coiled for a move, with no heavy bias in either direction.

- Despite cooling momentum, ETH is holding key levels, and consolidation could turn into a bullish breakout if sentiment turns.

Ethereum had one heck of a July—ripping nearly 60% higher in one of its best monthly moves in a long time. It wasn’t just hype either. The surge came as spot ETH ETFs saw historic inflows, and more than a million ETH vanished off exchanges in just two weeks. Yeah, that’s a big deal.

What’s even more telling? It’s not just random pumps. This looks like smart money taking control. Retail folks grabbed profits while whales and long-term holders quietly scooped up bags. And now? ETH is sitting tight, like it’s waiting for the next big push.

Big Moves, Big Money, and… Big Withdrawals?

Let’s break it down. Ethereum’s July explosion saw it jump into the top tier of crypto by market cap again. ETF net inflows hit 1.6 million ETH. That’s no small potatoes. Meanwhile, over 1 million ETH left centralized exchanges—gone. That’s usually a sign that people aren’t planning to sell anytime soon.

At the same time, the number of large transactions (we’re talking $1M+) spiked. Whales are circling, and they’re not playing around. This kind of activity usually means they’re seeing structure—something worth parking serious capital in.

Futures Market Looking… Suspiciously Calm?

While ETH’s price action cooled off a bit, the derivatives data still looks strong. Open interest in ETH futures has been steady at around $22.4 billion, with the funding rate chilling near 0.0049. That means the market isn’t overly bullish or bearish—just kinda waiting.

It’s one of those setups where something’s brewing, but no one’s pulled the trigger just yet. Smart traders know: when everything’s calm and balanced like this, the next move can be huge. Up or down? That’s the million-dollar question.

Momentum’s Fading… or Just Recharging?

ETH has been hovering above $3,450, holding its ground for now. The RSI’s at 52.41, sitting neutral—not overbought, not oversold. And while the MACD shows a slight bearish crossover, the histogram’s red bars are shrinking. Basically, sellers are slowing down, but buyers haven’t jumped back in yet.

This consolidation zone? Could be a springboard. If sentiment stays decent and whales keep stacking, we might be looking at a breakout loading. But for now, ETH’s playing it cool, waiting on a cue—maybe another ETF announcement or some macro shift.