- Ethereum is emerging as the leading chain for institutional tokenization

- Banks, tech firms, and payment giants are actively deploying on ETH

- Tokenization is increasingly seen as a long-term driver for ETH’s price

The narrative around Ethereum as the next major breakout chain is no longer theoretical. It’s starting to show up in real institutional behavior. Ethereum is rapidly positioning itself as the preferred blockchain for tokenization, payments, and financial experimentation, and its pace of institutional adoption now outstrips every other major crypto network. For many large players, ETH is no longer an alternative bet. It’s becoming core infrastructure.

Ethereum’s Institutional Flywheel Is Spinning Faster

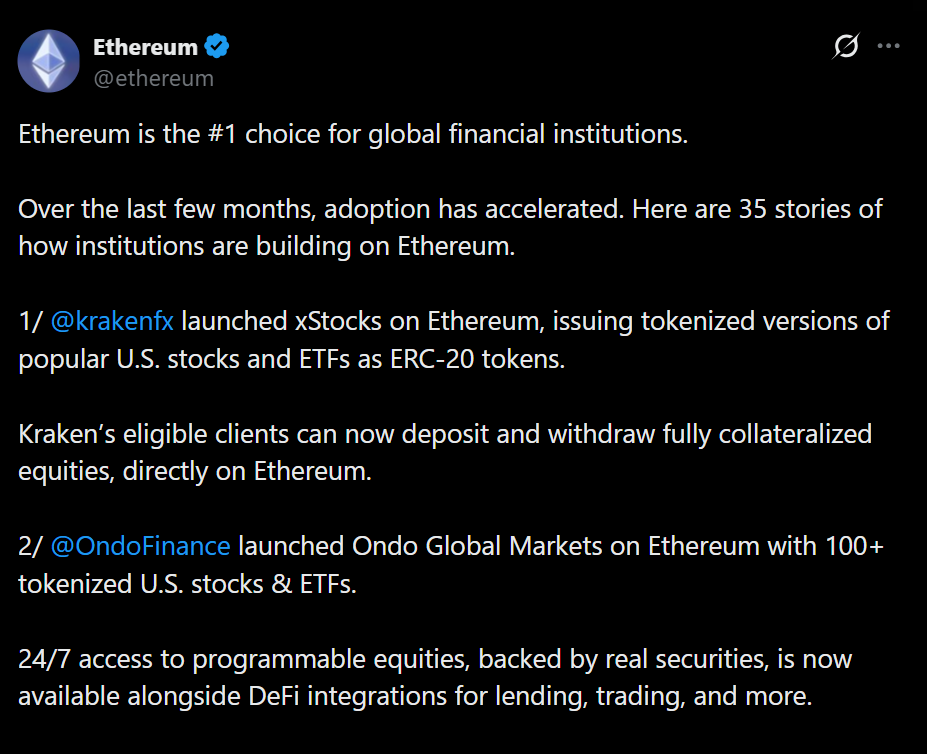

According to a recent update shared by Ethereum’s official X account, the network now sits at the center of the global tokenization push. Major financial and technology firms are actively deploying products on Ethereum, not just testing concepts in isolation. Kraken has launched xStocks on Ethereum, issuing tokenized versions of popular US equities and ETFs as ERC-20 tokens. Eligible clients can deposit and withdraw fully collateralized stocks directly on-chain, blurring the line between traditional brokerage and decentralized infrastructure.

At the same time, Google has entered the picture with its Agent Payments Protocol, built on Ethereum. The system allows AI agents to autonomously execute stablecoin payments, developed in collaboration with the Ethereum Foundation, Coinbase, MetaMask, and other ecosystem players. It’s a concrete step toward automated finance operating on public blockchain rails.

Banks Are Using Ethereum, Not Just Studying It

Beyond crypto-native firms, traditional banking institutions are also moving past pilot rhetoric. UBS, Sygnum, Post Finance, and the Swiss Bankers Association have successfully tested deposit tokens on Ethereum, demonstrating legally binding, cross-bank settlement using public blockchain infrastructure. That proof-of-concept shows Ethereum can support programmable, instant settlement between regulated institutions, a capability legacy systems struggle to match.

American Express has also joined the wave, launching blockchain-based travel card NFTs through its Amex Passport initiative on Ethereum’s Base layer. The project brings loyalty programs and travel records on-chain, blending traditional consumer finance with digital ownership in a way that feels practical rather than experimental.

Tokenization Is Starting to Matter for Price

Ethereum’s expanding role in tokenization is increasingly being viewed as a long-term price catalyst. The ecosystem now includes initiatives from JPMorgan, Mastercard, and other global financial heavyweights, all using Ethereum as the settlement and issuance layer. Fundstrat’s Tom Lee has repeatedly pointed to tokenization as the defining growth driver for Ethereum, arguing it could eventually push ETH into the $7,000 to $9,000 range over the long run.

Why Ethereum’s Position Is Different

What sets Ethereum apart isn’t hype, it’s convergence. Financial institutions, payment networks, AI developers, and consumer brands are all choosing the same base layer. That kind of alignment is rare in crypto. As more real-world assets and financial flows migrate on-chain, Ethereum is quietly becoming the default venue where it all settles.