- Ethereum continues to stall below the $3,000 level as repeated breakout attempts lose momentum.

- New wallet creation is rising sharply, but transaction activity remains weak, creating a valuation imbalance.

- Without stronger on-chain usage, ETH risks renewed downside pressure despite growing investor interest.

Ethereum is still wrestling with the same stubborn problem near $3,000. Every bounce toward that level looks promising for a moment, then fades just as quickly. ETH is hovering right below this psychological barrier, and the mood around it feels cautious, almost hesitant, as traders wait for something real to push it through.

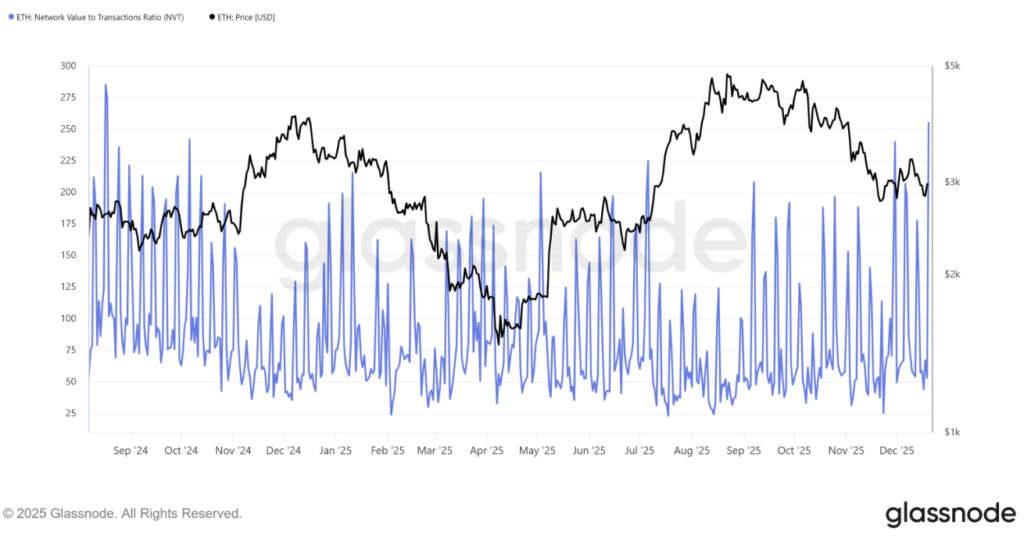

What’s interesting is the disconnect forming under the surface. Investor interest is clearly picking up, but the network itself isn’t showing the same energy. That gap is starting to raise eyebrows. Without stronger on-chain activity, Ethereum risks looking stretched, like price is trying to run ahead of its fundamentals.

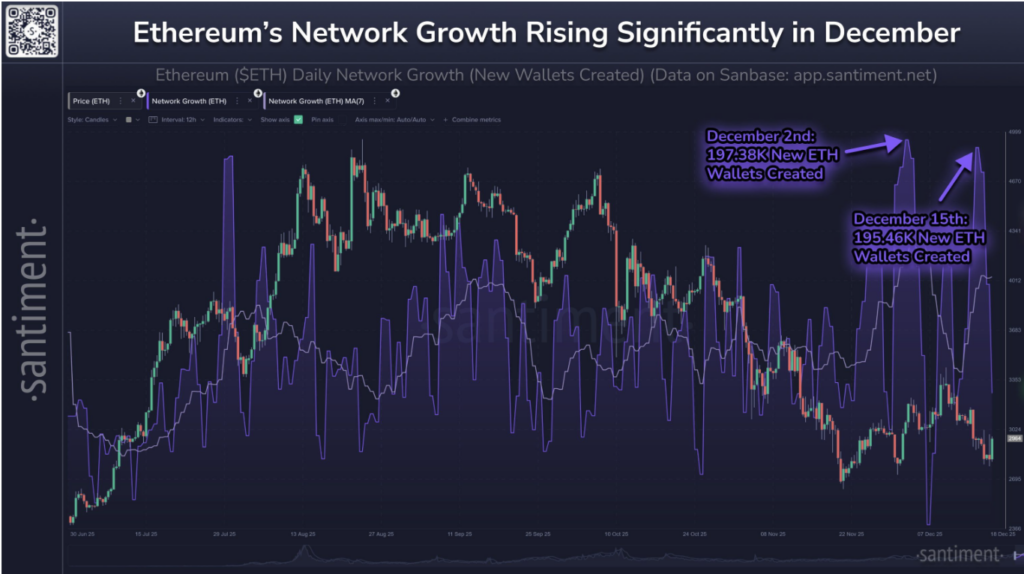

New Wallets Keep Coming, Even as Activity Lags

Ethereum is quietly seeing a surge in new wallet creation. On average, the network is adding around 163,000 new addresses every day. That’s a noticeable jump from roughly 124,000 daily additions back in July, which was already considered a strong growth phase.

This kind of increase suggests curiosity hasn’t gone anywhere. People still want exposure to ETH, even with price action going sideways. But new wallets alone don’t tell the full story. If those addresses aren’t transacting, staking, or interacting with apps, the impact on price can be limited.

Macro signals underline that concern. Ethereum’s network value-to-transactions ratio has climbed to its highest level in about 16 months. That’s usually a warning sign. A rising NVT ratio means valuation is growing faster than actual usage, which often points to optimism running ahead of reality. Without a pickup in transactions, rallies can lose steam pretty fast.

Price Action Remains Trapped Below $3,000

At the time of writing, Ethereum is trading near $2,986, once again parked just under $3,000. This level has been tested over and over, and each rejection adds to the sense of uncertainty. Traders are watching closely, but conviction is still missing.

If network activity stays muted, ETH could continue chopping below resistance or even slip back. A failure here would put the $2,798 support zone back in focus, reinforcing the idea that the market hasn’t resolved its underlying imbalance yet.

That said, the picture isn’t all negative. A clear rise in transaction volume could change things quickly. If Ethereum manages to flip $3,000 into solid support, it opens the door toward $3,131. Push beyond that, and the bearish narrative starts to fall apart, with $3,287 becoming a realistic next target.

For now, Ethereum feels stuck between interest and execution. People are showing up, wallets are growing, but the network needs to wake up too. Until then, $3,000 remains the line everyone’s watching, and the next move likely won’t be subtle.