- Ethereum funding rates collapsed to FTX-era extremes as geopolitical tensions triggered a sharp risk-off move across crypto markets.

- Forced liquidations accelerated, wiping out roughly $1.1 billion in ETH positions and pushing price toward key support zones.

- Technical rejection and weakening momentum suggest ETH remains in a deleveraging phase unless macro conditions improve.

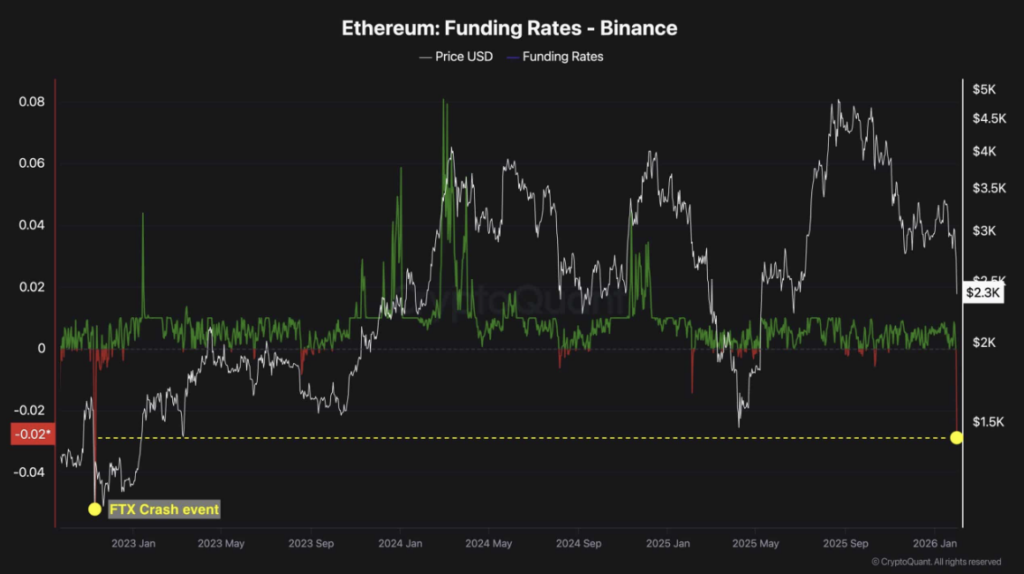

Ethereum’s funding rates collapsed to levels not seen since the FTX fallout, as derivatives markets struggled to absorb a sudden macro shock. Rising tensions between the U.S. and Iran reignited risk aversion across global markets, and ETH felt it almost immediately. Leverage did the rest, amplifying what might have been a sharp pullback into something far more violent.

As price slid toward the $2,300 area, forced selling kicked in. Liquidations accelerated fast, wiping out roughly $1.1 billion in ETH positions and contributing to a broader $2.5 billion market-wide flush. It was one of those moments where liquidity thins out quickly and price gaps do the damage.

The pressure pushed perpetual futures below spot prices, driving funding on Binance down to around -0.028%. That’s deep into negative territory, reflecting aggressive short positioning and a scramble to exit leverage. Bitcoin wasn’t spared either, with BTC seeing similar stress over the weekend under the same geopolitical catalyst.

Together, ETH and BTC moved through a clear deleveraging phase. Panic-driven flows took control, market depth briefly vanished, and price discovery happened fast, maybe too fast for comfort.

BitMine’s ETH Position Slips Into Structural Drawdown

BitMine’s Ethereum exposure now reflects that stress in full. ETH is trading near $2,415, well below the firm’s estimated weighted acquisition price of roughly $3,800. The move didn’t unfold slowly, it came after a sharp risk-off shock tied to geopolitics and forced deleveraging.

Over the past seven days, ETH is down about 17.7%, pushing unrealized losses on BitMine’s $15.6 billion position to roughly $5.9 billion. That puts the drawdown close to 40%, a level that signals structural pressure rather than short-term noise.

At this point, the cost basis acts more like gravity than support. Trading well below it reflects liquidity withdrawal and compressed sentiment across the market. A shift in structure would likely require easing macro risks, fresh inflows, and sustained spot demand, none of which are clearly visible yet.

At the time of writing, ETH was trading between $2,430 and $2,450, extending an 8–9% daily decline. Capital has been rotating out of risk assets and into traditional safe havens like gold and silver, tightening crypto liquidity further. Ethereum absorbed that pressure quickly, maybe faster than most expected.

Failed Breakout Reinforces Bearish Structure

Technically, the picture hasn’t helped. ETH failed to hold a breakout above $3,400 and then slipped back through the $2,780–$2,800 zone as momentum faded. The rejection wasn’t just tired buyers, it was macro stress colliding with leverage.

Liquidations fed into the move, reinforcing a lower-high, lower-low structure on higher timeframes. Momentum indicators echoed the shift. Weekly RSI slipped below neutral, pointing to weakening demand rather than oversold relief.

MACD remains negative and compressed, suggesting bearish momentum is still present, even if the pace is slowing. Support now clusters between $2,400 and $2,600, where buyers are testing conviction rather than stepping in aggressively.

A clean break below that zone opens the door to a deeper slide toward $2,000–$2,200. Stabilization, on the other hand, would likely require calmer macro conditions and renewed spot inflows. Until then, Ethereum remains under pressure, and the market knows it.