- ETH is down nearly 20% in November, revisiting the $3,000 support zone.

- The Mayer Multiple dropped below 1, historically marking strong accumulation phases.

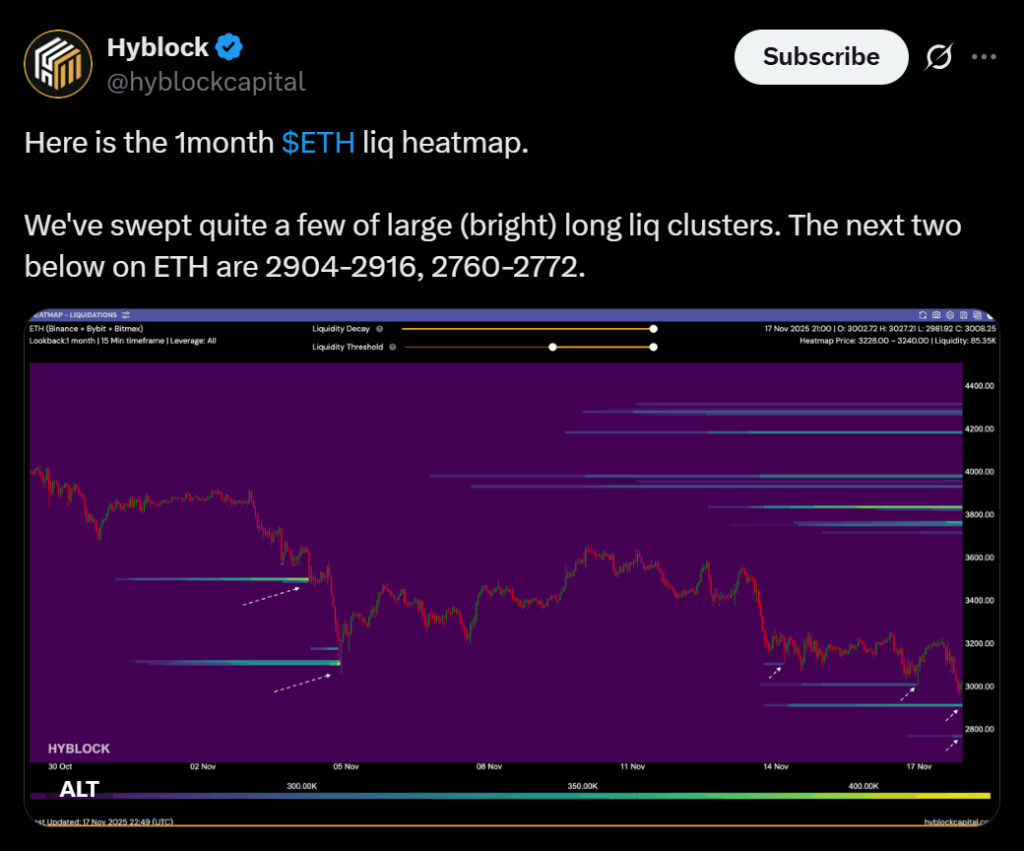

- Liquidity data shows deeper long-liquidation pockets below $3,000, hinting at possible further downside before a bottom forms.

Ethereum’s native token has slipped nearly 20% in November, dropping from $3,900 to retest the $3,000 level for the first time since mid-July. The move confirms a sharp daily downtrend defined by lower highs and lower lows, placing ETH in a fragile short-term structure despite emerging signs of long-term accumulation. With traders growing uneasy about the broader market slide, the latest price action has split sentiment between fear and cautious optimism.

Mayer Multiple Drops Below 1 — ETH Reenters the Historic “Buy Zone”

One of the strongest long-term signals is coming from Capriole Investments’ Mayer Multiple (MM), a metric comparing ETH’s price to its 200-day moving average. A reading below 1 means ETH is trading at a discount to its long-term trend — a level historically associated with major accumulation windows.

ETH’s MM is below 1 for the first time since June, putting the asset back into what has often been a precursor to multi-month recoveries. Outside of the 2022 bear-market collapse, sub-1 readings have reliably aligned with early-cycle resets rather than long-term breakdowns. With MM far from the overheated 2.4+ distribution zone, long-cycle positioning still leans bullish.

Liquidity Flushes Suggest ETH May Not Have Bottomed Yet

Short-term structure remains vulnerable. Hyblock Capital data shows ETH swept major long-liquidation levels at $3,000 but still hovers above dense clusters between $2,904–$2,916 and $2,760–$2,772. Markets often move toward these liquidity pockets before forming durable reversals.

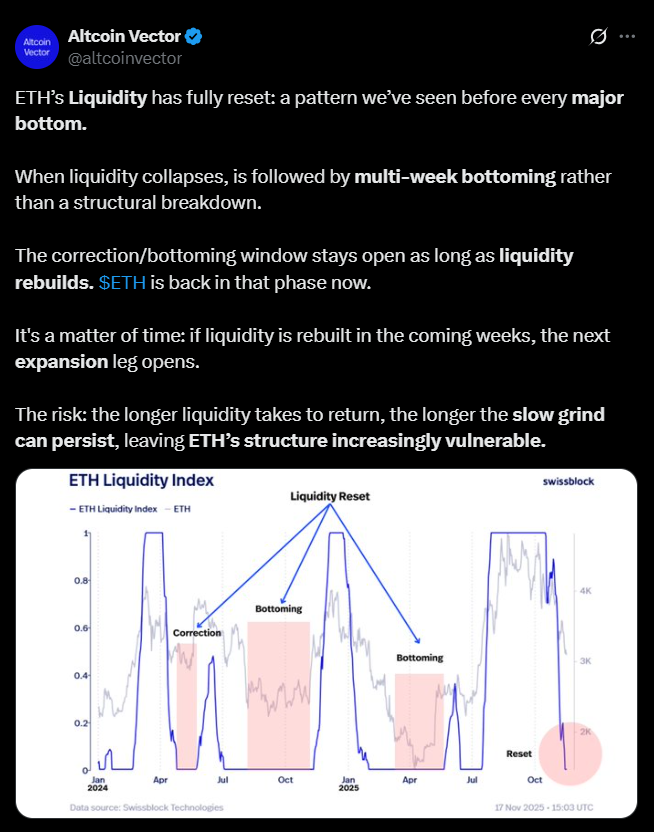

Altcoin Vector also noted that Ethereum’s liquidity structure has “fully reset,” a condition historically present before every major bottom. These resets typically unfold over multiple weeks, suggesting any sustained recovery will take time to develop — and that ETH may dip deeper before momentum turns back up.

A Reset, Not a Collapse — If Liquidity Rebuilds Soon

The broader picture points toward reset conditions rather than structural decay. If liquidity begins returning within the next several weeks, ETH may initiate its next expansion phase. But if liquidity stays thin for too long, the correction window widens — exposing the market to further downside volatility. For now, Ethereum sits in a rare intersection: short-term fragility but long-term opportunity.