- Abraxas Capital pulled 74,304 ETH worth $135.46 million from Binance and Kraken, signaling bullish sentiment.

- Ethereum broke above $1,600 and now eyes $2,250 as momentum indicators like RSI surge from 56 to 66.

- Network activity is up, with TVL rising 41% to $52.8 billion and daily transactions increasing by 22% to 1.34 million.

Ethereum’s caught the eye of some big players lately, with Abraxas Capital diving in heavy through Heka Funds, snapping up ETH in what looks like a calculated bet on a major price surge.

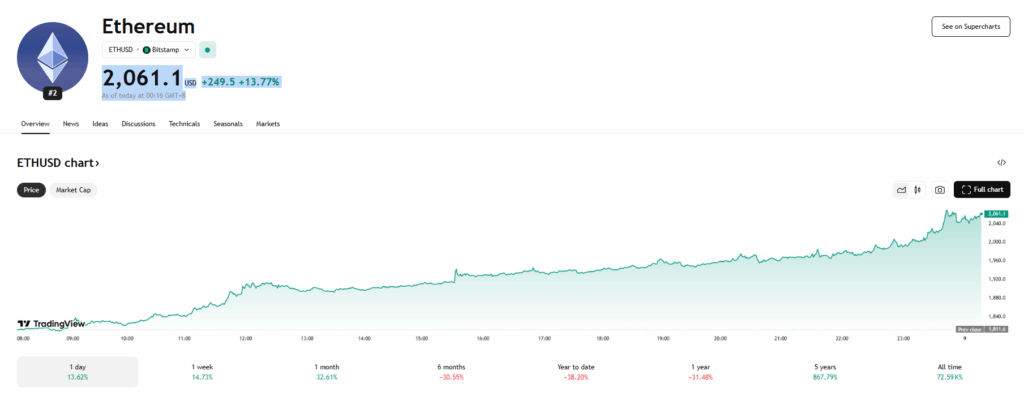

According to Lookonchain, Abraxas pulled out 74,304 ETH — worth around $135.46 million — from Binance and Kraken. The timing? Not exactly a coincidence. Ethereum just broke free from a six-month downtrend, finally punching through that stubborn $1,600 mark on April 7 as market conditions eased. Now, it’s hovering around $2,000, with analysts watching key resistance levels at $2,250.

Technicals Align, Momentum Picks Up

It’s not just about the whales buying in — the charts are flashing bullish signals too. The Relative Strength Index (RSI) shot up from 56 to 66 in just 24 hours, suggesting buyers are stepping up. The 50-day SMA is now solid support at $1,775, while the 100-day SMA is holding the line at $2,100. And then there’s the 200-day SMA sitting in the $2,500 to $2,800 zone — the last major hurdle before the big $3,000.

Network Growth and Institutional Moves

On the fundamentals side, Ethereum’s not slacking off either. Total value locked (TVL) has jumped 41% in the past month, now sitting at $52.8 billion. Daily transactions are up 22%, hitting 1.34 million — a clear sign that the network’s getting more action.

Meanwhile, projects like BlackRock BUIDL, Spark, and Ether.fi are showing renewed interest in Ethereum’s financial ecosystem. Lower fees might be slowing down ETH’s burn rate, but with institutional players like Abraxas Capital coming in strong and on-chain metrics lighting up, Ethereum might just have enough juice to push for that $3,000 mark.