- Ethereum spot ETFs have logged steady inflows since July, with only minor August outflows totaling $617.4M.

- Analysts see ETH reaching $4K–$16K by year-end, with some favoring treasury firm stocks over ETFs for staking benefits.

- On-chain and market cap data suggest the rally could continue, potentially triggering a broader altcoin surge.

Since early July, Ethereum spot ETFs have been mostly in the green, logging steady inflows that point to rising institutional and retail demand. Only three days have posted negative netflows in this period, two of them in August, which together accounted for $617.4 million in outflows. The consistent buying shows treasury firms like SharpLink are adding ETH to their books regardless of short-term price moves — signaling conviction in its long-term value.

Analysts Split on Best Exposure Route

While the demand for ETH ETFs is clear, not everyone thinks they’re the smartest way to play it. A Standard Chartered analyst suggested that stocks of treasury firms holding ETH might actually offer better upside, since they can earn staking rewards while ETFs remain passive holders. The bank still sees ETH hitting $4,000 by year-end. On the more aggressive side, Tom Lee, who chairs BitMine — the world’s largest ETH treasury company — has thrown out a bold $16,000 target. This optimism follows Ethereum’s strong rebound from $2.4K in July, a rally that’s gained 15% since August 3 despite a brief pullback.

Market Structure and Cycle Signals

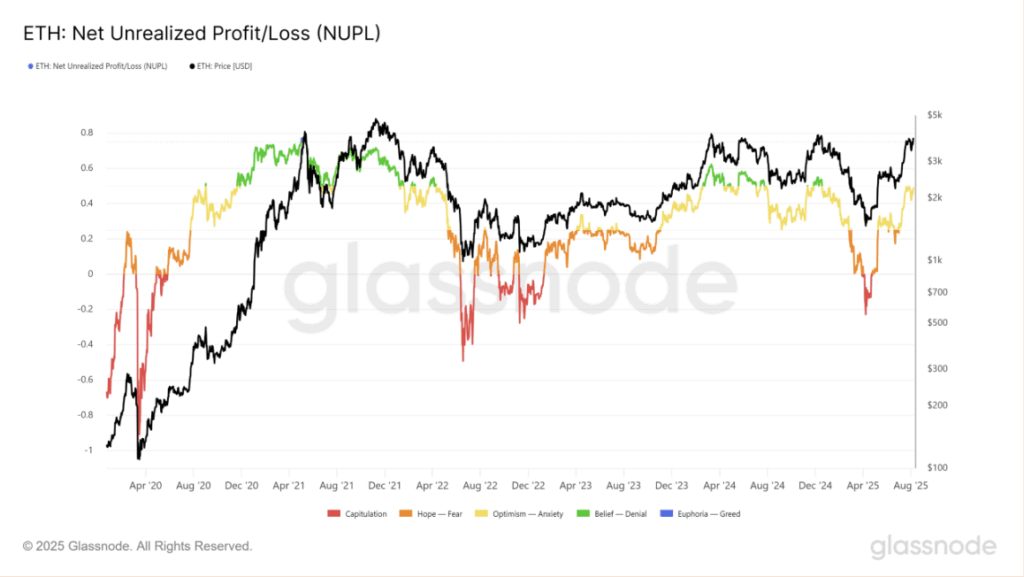

On-chain data adds another layer to the bullish case. Glassnode’s Net Unrealized Profit/Loss (NUPL) indicator shows the market isn’t yet overextended compared to the early 2021 run. While unrealized profits are positive, they’re still well below past cycle peaks, implying room for further upside. Of course, no two cycles are identical, so investors should tread with caution. At the same time, the broader altcoin market has broken through the $1.2 trillion resistance level — a ceiling that held from February to June — reinforcing the idea that ETH’s rise could lift the entire sector.

What This Means for Investors

With sentiment improving, ETF inflows staying healthy, and technical resistance levels falling across the altcoin market, Ethereum appears to be setting the tone for a wider crypto rally. The recent surge in search interest and accumulation by major holders could fuel momentum in undervalued altcoins as well. If the NUPL readings hold and ETH maintains this pace, the next few months could bring a far stronger alt season than we’ve seen this year.