- Ethereum ETFs logged $241M in net outflows after 15 weeks of inflows.

- Tuesday alone saw $429M in redemptions before a late-week rebound.

- ETH funds still outpace Bitcoin ETFs, pulling $8.2B since July vs. BTC’s $4.8B.

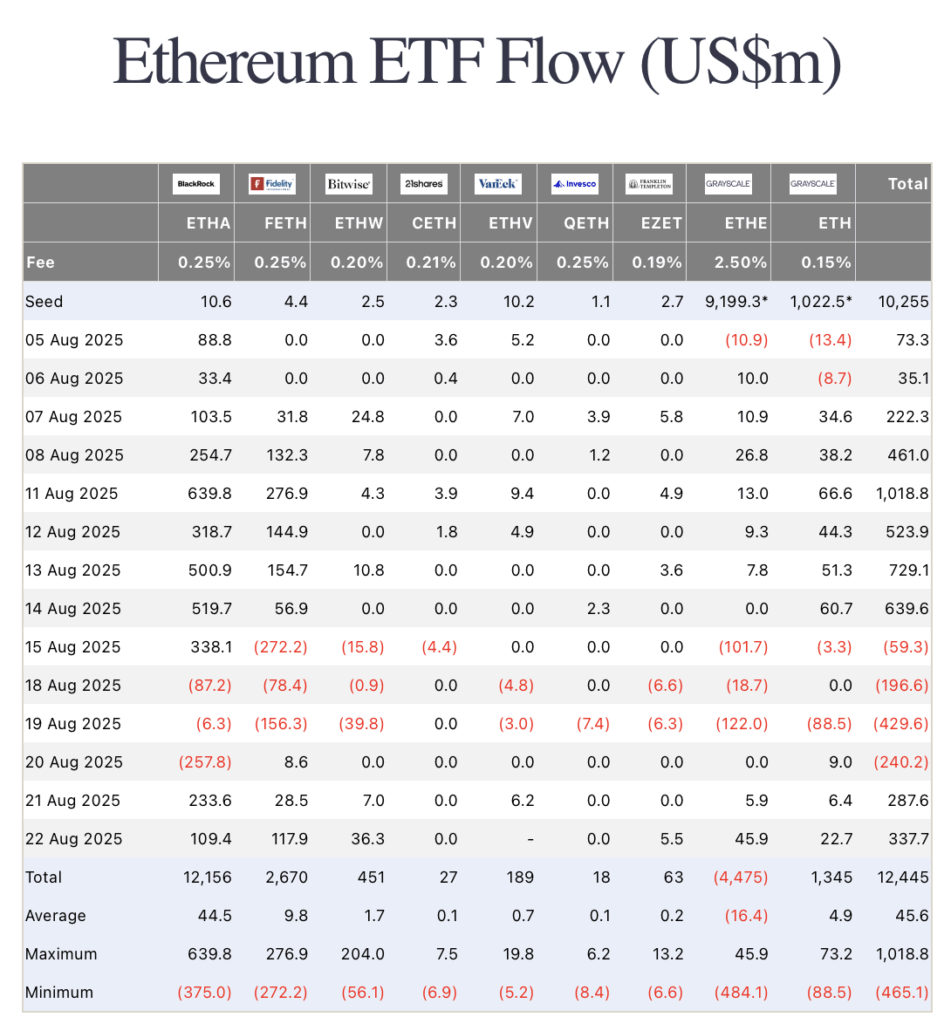

Ethereum ETFs just broke a 15-week streak of steady inflows, posting their first weekly outflow since launch. Data from Farside Investors shows that $241 million exited US-listed Ethereum funds during the week of August 22, as early selling outweighed a late rebound in demand.

The week started rough. Between Monday and Wednesday, the nine ETH funds saw a massive $866 million in redemptions, with Tuesday alone accounting for $429 million—the second-largest single-day outflow on record. But sentiment shifted by Thursday. Inflows of $625 million over two sessions softened the blow, leaving the net outflow at $241 million by week’s end.

Macro Pressure Behind the Moves

The early-week wave of selling came as investors reacted to hotter-than-expected inflation data in the US. That spooked markets, fueling talk of tighter Fed policy and sparking a short-term correction in Ethereum. Later in the week, though, Fed Chair Jerome Powell struck a more dovish tone at Jackson Hole, easing concerns about aggressive rate hikes. ETH responded with a sharp rally to fresh highs, pulling institutional demand back in just before the weekend.

Ethereum Outshines Bitcoin

Even with this temporary stumble, Ethereum ETFs continue to hold up better than their Bitcoin counterparts. Last week, Bitcoin funds suffered $1.1 billion in outflows—over four times the damage seen in ETH products. Nate Geraci, president of The ETF Store, pointed out that the bigger picture still favors Ethereum. Since the start of August, spot ETH ETFs have drawn $2.8 billion in inflows, while Bitcoin ETFs lost $1.2 billion. Looking back further, Ethereum has raked in $8.2 billion since July versus $4.8 billion for Bitcoin.

Institutional Rotation Continues

The numbers suggest a shift in institutional positioning. Even though weekly flows remain tied to macro headlines, capital is rotating into Ethereum with growing conviction. While Bitcoin is still seen as digital gold, Ethereum’s expanding role in tokenization, DeFi, and broader financial infrastructure appears to be pulling more weight with big-money investors. One weak week doesn’t change the trend—ETH is clearly winning more trust on Wall Street.