- Ethereum ETFs saw massive inflows this week, with 154,000 ETH added—far outpacing Bitcoin’s 7,800 BTC.

- Institutions seem to favor ETH’s growing utility in DeFi, staking, and Layer 2 tech over Bitcoin’s static store-of-value role.

- This could signal a broader shift in crypto investment strategies, with ETH rising as a serious contender for institutional dominance.

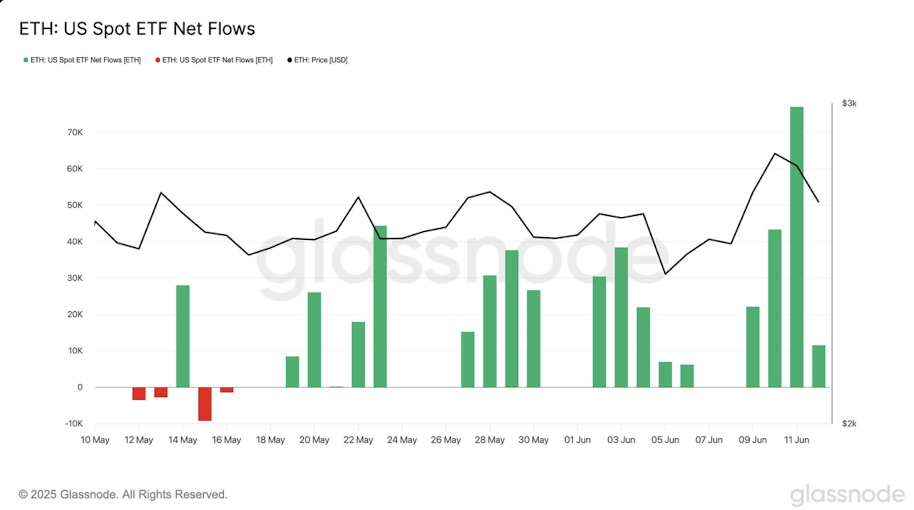

Ethereum’s suddenly stealing the spotlight in the ETF world. This past week, ETH exchange-traded funds racked up around 154,000 in net inflows—yeah, that’s about five times its recent average. According to Glassnode, that includes a record-setting single-day haul of 77,000 ETH on June 11. It’s a serious shift and has people wondering if institutions are finally treating Ethereum as more than just Bitcoin’s understudy.

Meanwhile, Bitcoin? Not so hot. BTC ETFs brought in only about 7,800 BTC over the same week. For comparison, that’s not even close to Ethereum’s one-day total. Some are pointing to Ethereum’s deeper ecosystem—staking, DeFi, dev activity, all that good stuff—as the reason for this momentum. Feels like it’s less about hype now and more about function.

BTC ETF Flows Stagnate While ETH Steals the Show

Bitcoin ETFs aren’t dead, obviously. They’re still the go-to for many big players. But lately, their numbers have been all over the place—sharp redemptions, slower entries, that kind of thing. That 7,800 BTC inflow this week? It’s only a small bump, especially compared to a single-day 7,900 BTC inflow we saw back on May 23. It’s like Bitcoin ETFs are hitting pause while Ethereum picks up speed.

The numbers suggest something more than just short-term noise. There might be a deeper shift happening—a rotation, maybe. Institutions are sniffing out broader use cases and maybe even a bit more upside in ETH, especially if staking-enabled ETFs go live. Bitcoin’s store-of-value vibe still plays, but Ethereum’s flexibility is drawing attention.

Ethereum’s Use Case Could Change the ETF Game

Analysts are taking note of this divergence. It’s not just price or speculation; it’s use-case driven. ETH’s versatility—from powering DeFi to NFTs to smart contracts—is adding layers that Bitcoin doesn’t really offer. That could be why institutional investors are slowly reshaping their portfolios to include more Ethereum exposure. Some even think this might be the start of a bigger shift.

Ethereum still has ground to cover in total ETF volume, sure. But if this inflow streak keeps up? ETH could soon be more than just second place—it might lead the next institutional wave altogether.