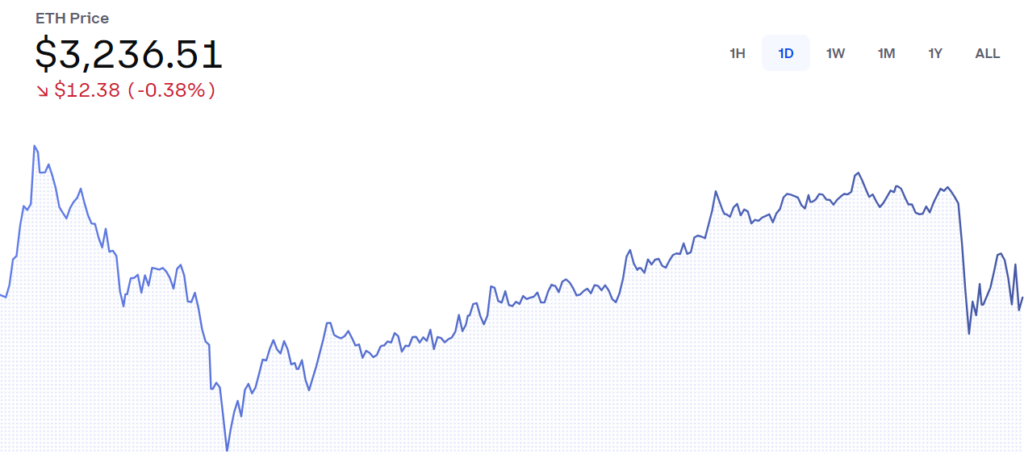

- Ethereum trades at $3,236.51 over the past 24 hours.

- Price action suggests consolidation, with $3,200 acting as a key support level.

- Ethereum’s ecosystem development continues driving long-term market interest and utility.

At $3,236.51, Ethereum is showing its strength even after a minor drop in the past day. While the dip might seem insignificant, what stands out is Ethereum’s ability to hold the $3,200 support level. This stability reflects a balance between active trading and steady advancements in its ecosystem—a mix that keeps it at the forefront of the crypto world.

Consolidation Suggests a Market Pause

According to the Coinbase chart, Ethereum’s recent price movements point to a period of consolidation. Support has formed at $3,200, with resistance hanging around $3,300. This tight range suggests the market is catching its breath, waiting for a clear direction. Interestingly, trading volume has been picking up, showing that investors are still paying close attention, even if overall market sentiment feels a little mixed.

The resilience Ethereum shows in holding this range can largely be attributed to its evolving ecosystem. Decentralized applications (dApps) have been gaining traction, and Ethereum’s transition to staking through its Ethereum 2.0 upgrade has added a new layer of confidence for investors. On the horizon, scalability upgrades like sharding promise to strengthen Ethereum’s role as a foundation for Web3 projects, which could bring more action to the table.

A Growing Ecosystem Fuels Optimism

Ethereum’s story goes beyond price charts—its ecosystem is where the real magic happens. DeFi continues to thrive on the network, with billions locked into protocols that bring new opportunities to users worldwide. NFTs, which have become a household name, also owe much of their success to Ethereum, even though the buzz has calmed down a bit lately.

Of course, Ethereum isn’t operating in a vacuum. Factors like global economic trends and Bitcoin’s movements play a role in shaping its short-term performance. Still, what sets Ethereum apart is its clear focus on ecosystem growth. This long-term strategy gives it a layer of stability that helps it navigate the ups and downs of the market.

A Platform Built for the Long Haul

Ethereum’s current consolidation seems like a natural step before the next market phase kicks in. Its commitment to ecosystem-first development, supported by an active and innovative developer community, makes it more than just another cryptocurrency. From staking opportunities to its role in DeFi, Ethereum has cemented itself as a key player in the digital finance landscape.

While today’s price reflects a cautious market, Ethereum’s broader fundamentals tell a story of potential. Its ecosystem and market trust position it not only as a valuable asset but also as a platform ready for long-term growth. If anything, it’s a reminder that Ethereum’s journey is as much about innovation as it is about investment.