- Ethereum is flashing a hidden bullish divergence that analysts say could target $8K.

- Tokenization and stablecoin growth are strengthening ETH’s long-term narrative.

- Analysts argue Ethereum’s value is tied more to future adoption than current price action.

Ethereum is increasingly finding itself at the center of the crypto market’s next big narrative. Beyond price action, ETH is becoming a core pillar in the growing discussion around tokenization, stablecoins, and real-world assets moving on-chain. At the same time, technical signals are starting to line up, with some analysts pointing to a fresh bullish divergence that could set the stage for a much larger move, potentially toward the $8,000 range.

A Hidden Bullish Divergence Takes Shape

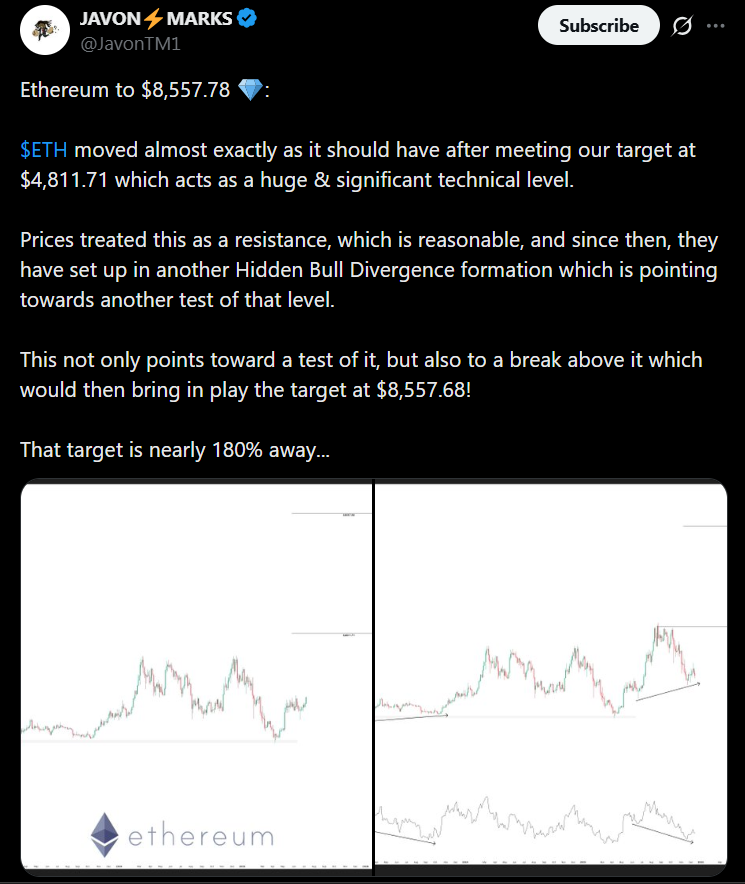

According to financial analyst Javon Marks, Ethereum’s recent price behavior is flashing a hidden bullish divergence, a setup that often appears before strong continuation moves. Marks noted that ETH reacted almost perfectly after reaching a key technical level near $4,811, treating it as resistance before pulling back in a controlled way. Since then, price action has quietly formed another bullish divergence, suggesting a renewed push higher could be building.

If Ethereum manages to clear near-term resistance zones, Marks believes the path opens toward a much larger target around $8,557. That move would represent nearly 180% upside from current levels, a projection that’s catching attention as sentiment slowly improves rather than peaks.

Tokenization Puts Ethereum in the Spotlight

Beyond charts, Ethereum’s broader appeal continues to grow thanks to its role in the tokenization narrative. As Wall Street explores tokenized funds, bonds, and other real-world assets, Ethereum remains the most likely settlement layer for many of these products. Stablecoins, institutional-grade infrastructure, and developer tooling are already deeply embedded in the Ethereum ecosystem, reinforcing its position as the default choice for large-scale on-chain finance.

This structural advantage is part of why long-term investors remain focused on Ethereum’s future rather than short-term volatility. The idea isn’t just about what ETH is doing today, but what it could represent once tokenization adoption accelerates.

Long-Term Optimism Still Runs Deep

Some of the most aggressive long-term forecasts continue to frame Ethereum as a multi-cycle asset. Tom Lee has repeatedly argued that many investors underestimate Ethereum by focusing too narrowly on current conditions. In his view, Ethereum’s value is tied to a coming supercycle driven by tokenization and financial infrastructure, not just speculative trading. While a $100,000 ETH remains a distant and controversial prediction, it underscores how bullish some outlooks remain.

What Comes Next for ETH

Ethereum’s road to $8,000 won’t be smooth, and short-term pullbacks are still possible, especially in a volatile macro environment. Still, the combination of improving technical signals and strong structural narratives gives ETH a compelling setup. If momentum continues to build and resistance levels break, Ethereum could reassert itself as one of the market’s strongest long-term plays.