The number of open positions (OI) in Ethereum’s (ETH) options market has retracted from the all-time highs reached in late August, despite the long-awaited supposedly bullish “Merge” edging closer to the day.

ETH Open Interest Drops From All-time Highs

Ethereum’s open interest – the sum of all “open” options contracts that have not expired, been exercised, or physically delivered – stood at 4.7 million ETH on September 5. This is a 7.84% retracement from the 5.1 million ETH record highs hit on August 6, according to data from Kaiko.

However, the September report from the crypto research firm noted that “4.7mn [ETH] still represents one of the largest buildups of open positions that we have seen in ETH perpetual futures.”

This uptick in ETH OI options comes at a time when the crypto community is preparing for the Ethereum blockchain’s transition from a proof-of-work (PoW) consensus mechanism to (PoS), an event referred to as the Merge that is expected to take place in mid-September.

The report by Kaiko also reveals that Ether’s funding rates had briefly crossed into the positive region on August 31 and then September 2, indicating a “significant increase from the depressed levels” observed towards the end of last month. This could suggest that sentiments surrounding the altcoin ahead of the Ethereum upgrade are improving among futures traders as “the focus changes from risk hedging pre-Merge to a more optimistic outlook post-Merge,” according to Kaiko analysts.

The notable changes in OI and funding rates come when the ETH spot price rises, now up 7% over the past week and 5.6% in the last 24 hours, according to data from CoinMarketCap.

Ethereum Price Bulls Eye A Return To $2000

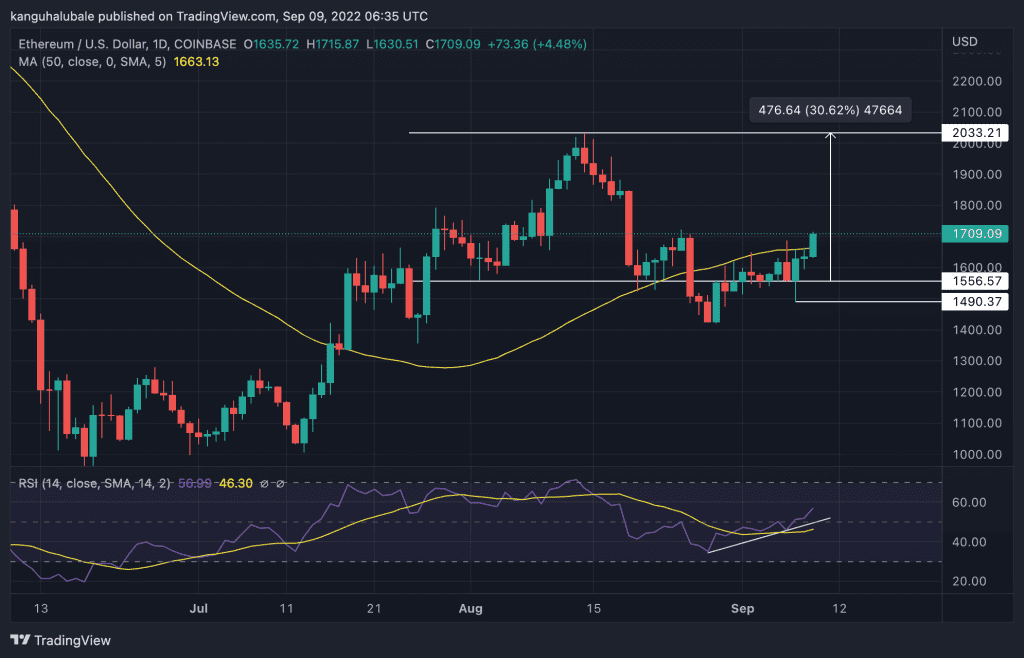

When writing this article, ETH was exchanging hands at $1,709 in a third consecutive bullish session on the daily timeframe. This was 20% higher than the $1,420 low recorded on August 29.

This buildup has seen the token of the smart contracts platform flip the $1,500 psychological level and the 50-day simple moving average (SMA) back into support. This price action signals strength amongst the bulls, as supported by the upward movement of the relative strength index (RSI). The position of this oscillating indicator in the positive region at 57 suggests that the buyers are taking control of ETH.

If Ethereum’s price produces a daily candlestick above the 50-day SMA currently sitting at $1,663, it will bolster the bulls to push higher. However, the hurdles at the $1,850 and $1,900 resistance levels must be overcome before ETH surpasses $2,000 to tag the $2,023 range high. Such a move would bring the total gains to 30%.

On the downside, if ETH turns down from the current price to produce a daily candlestick close below the 50-day SMA, it would drop to the $1,556 support floor. Below that, the cost of the second largest crypto by market cap may fall to the $1,490 swing low and later toward the $1,424 support zone.

Conclusion

In conclusion, it is essential to note that the macro environment continues to cast a shadow on traditional risk assets and cryptocurrencies as the European energy crisis worsens. On Thursday, the European Central Bank (ECB) raised interest rates by an unprecedented 75 basis points, the highest since 2011, following a release of higher-than-expected inflation rates for the Eurozone.

ECB released its regulatory guidelines on licensing cryptocurrencies and other digital assets on August 17. Such developments are likely to suppress ETH price despite the investors’ excitement about the Merge buildup.