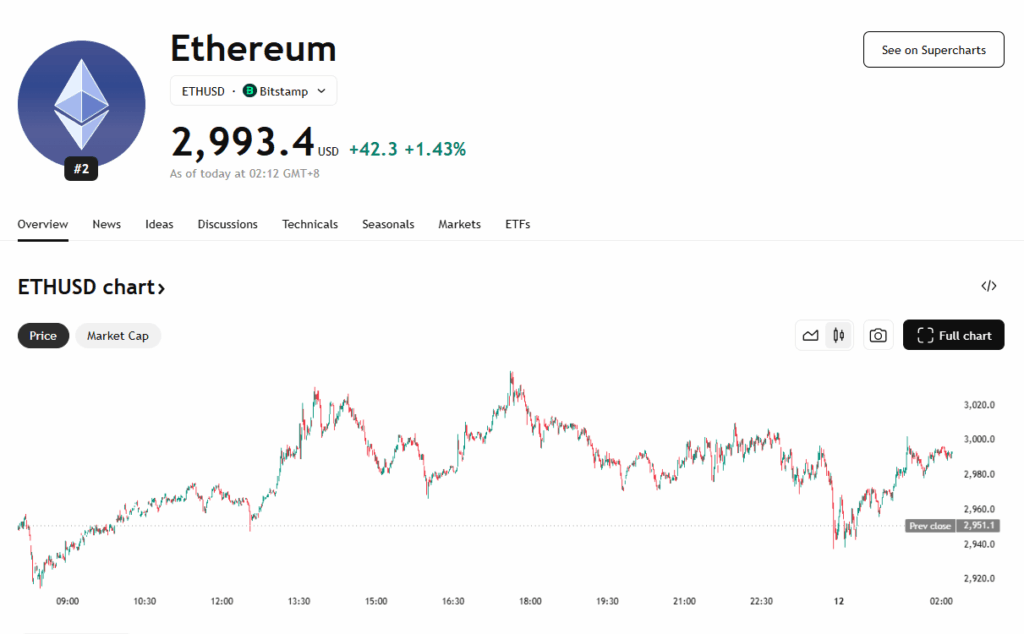

- Ethereum plunged to $1,470 in April, now trades near $2,962 after a volatile recovery.

- Market turbulence was driven by Trump-era tariff fears and massive liquidations.

- A modest 2.9% gain since Eric Trump’s February ETH tweet finally puts the trade in the green.

Ethereum is clawing its way back. After crashing to as low as $1,470 in April amid heavy liquidations and geopolitical tension, the second-largest cryptocurrency is now flirting with the $3,000 level. It’s been a slow, volatile climb—but those who listened to Eric Trump’s call to buy ETH back in February are finally seeing some green.

“In my opinion, it’s a great time to add $ETH,” Eric Trump tweeted on February 4. At the time, Ethereum was trading around $2,870. Fast forward to July 9, and ETH has risen roughly 2.9%—not exactly a moonshot, but considering the rollercoaster in between, it’s a small win.

Market Mayhem: Liquidations, Tariffs, and a Sentiment Crash

Ethereum’s crash began just one day before Trump’s tweet, dropping nearly 18% in 24 hours to $2,544 after overleveraged long positions got wiped out. That dip, fueled by a liquidation frenzy, was worsened by rising macroeconomic fears—mainly President Trump’s aggressive tariff policy shifts, which spooked markets across the board.

A brief pause in the Canada tariff talk gave ETH and other cryptos a quick bounce, but it didn’t last. By March, traders were calling the market action “miserable,” with sentiment at rock-bottom and volatility running wild. Then came April, and with it, another round of tariffs—this time on China. Ethereum bottomed out near $1,470.

The Turnaround: Pectra Upgrade and Institutional Flows

May brought a much-needed reversal. Ethereum surged above $2,700 as buyers returned, fueled by Bitcoin’s rise and fresh optimism around the Pectra Upgrade, which improved network efficiency. However, the upgrade didn’t exactly light a fire under the price—ETH hovered near $2,800 for most of June.

Meanwhile, Eric’s dad, Donald Trump, helped shape the narrative further. His media company filed for a Crypto Blue Chip ETF, with Ethereum making up 15% of the proposed fund alongside Bitcoin, Solana, and others. The move reinforced growing institutional interest in Ethereum as part of a broader crypto portfolio.

Back From the Brink—But Still Chasing Highs

While Ethereum has staged a strong comeback, it remains below its February peak and still hasn’t broken out in a meaningful way. That said, things are looking up. As of now, ETH is trading at around $2,962, with a 6.2% daily gain thanks to Bitcoin smashing through its own record highs.

And if you’d followed Eric Trump’s advice back in February? You’d be up—just barely. But more importantly, you’d have survived one of Ethereum’s messiest five-month stretches in recent memory.