- SpaceX’s Bitcoin holdings have earned $700 million in profit, reaching a value of $851 million.

- The company stores 8,285 BTC on Coinbase Prime and has conducted over 30 transactions since 2021.

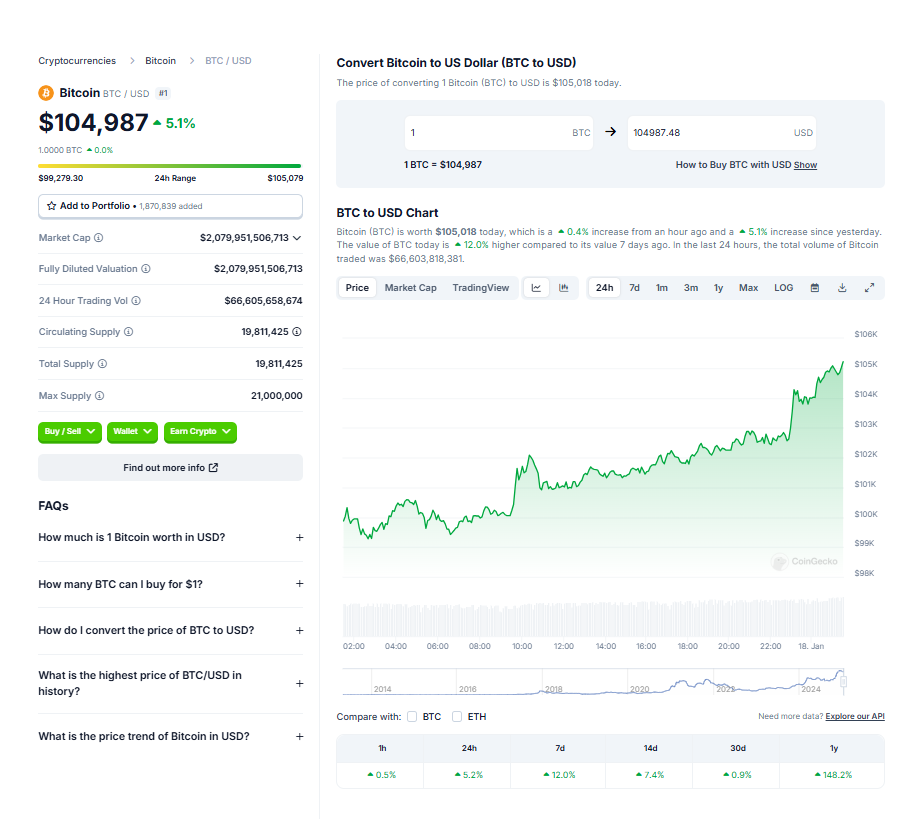

- Bitcoin’s rally near $103,000 could boost profits for SpaceX and Tesla amid rising institutional interest.

Under the leadership of Elon Musk, SpaceX stands out as one of the early corporate adopters of Bitcoin. According to Arkham’s data, the firm now owns 8,285 BTC, with a value hovering around $851,462,677.55. This impressive sum reflects the company’s commitment to Bitcoin, even through its volatile moments.

The data shows that SpaceX’s Bitcoin portfolio hit rock bottom at $134 million on November 29, 2022. Despite this low point, the company has stayed steadfast, holding onto its Bitcoin stash through years of ups and downs. Thanks to the launch of a spot Bitcoin ETF in January 2024 and Bitcoin’s repeated breaches of all-time high prices, SpaceX’s Bitcoin holdings have soared in value. That said, they still fall short of their peak worth, which exceeded $1.6 billion at one point.

It’s worth noting that SpaceX keeps its Bitcoin securely held with Coinbase Prime, per Arkham’s findings. Since 2021, the company has carried out over 30 transactions, with Coinbase Prime acting as the central hub for these activities.

A Brighter Future?

Arkham Intelligence also highlights that SpaceX’s Bitcoin portfolio is priced around $102,766 per BTC, as the cryptocurrency edges closer to a milestone $103,000 mark amidst a powerful rally. This ongoing bullish trend promises potential profits not just for SpaceX but also for Tesla, another Elon Musk-led enterprise with a strong Bitcoin presence.

Tesla itself demonstrated resilience in its Bitcoin investments, maintaining a valuation above $1 billion as of November last year, when Bitcoin hit a fresh local high. As for SpaceX, the company’s commitment to holding onto its Bitcoin could prove even more lucrative in the face of growing institutional interest.

BlackRock, for instance, made waves when its Bitcoin ETF product raked in $527 million on November 16, signaling surging institutional enthusiasm. This growing trend of major players entering the Bitcoin market could serve as a tailwind for SpaceX, provided it continues to “HODL” through the market’s fluctuations.

In an era where Bitcoin adoption is steadily climbing, the choices SpaceX and Tesla make today could pave the way for even larger gains tomorrow.