- Preston Pysh says skepticism is “part of Bitcoin’s culture” as institutions jump in.

- Early adopters who held through 80% crashes worry Bitcoin is being co-opted.

- Institutions will use Bitcoin differently, with 83% planning to boost allocations in 2025.

Old-school Bitcoiners aren’t letting their guard down just because Wall Street finally showed up. Preston Pysh, co-founder of Ego Death Capital, said in a recent chat with Natalie Brunell on the Coin Stories podcast that skepticism is still baked deep into Bitcoin culture. “Part of that culture that brought it to where it is, is looking at where this is all going and saying no, no, no… this is moving in a bad direction,” Pysh said.

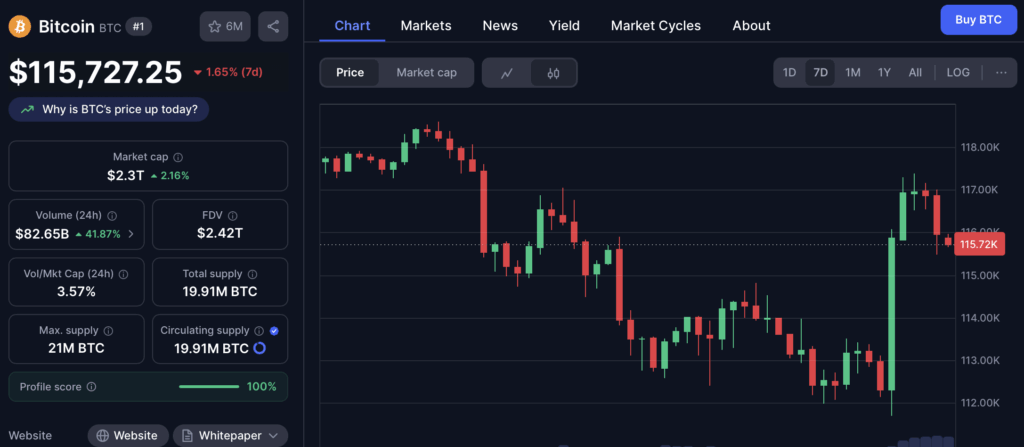

For many, the rise of institutional products like Bitcoin derivatives feels like a shift away from what Bitcoin was meant to be—a decentralized, self-sovereign asset you could hold without trusting anyone else. Some early adopters even ask themselves, “Am I being scammed, like all the other scams that preceded this wave?” The unease is clear, even as Bitcoin itself trades over $116,000 and institutions pour in.

The Culture Clash

Pysh noted that the people who pushed Bitcoin past the $1 trillion milestone weren’t hedge funds or corporations—they were individuals. These were the ones who self-custodied, held through brutal 70%–80% drawdowns, and refused to sell when markets crashed. “The term we like to throw around is we’re Bitcoin psychopaths,” he joked, capturing the extreme conviction that defined early holders.

But that conviction has collided with a new reality. Crypto analyst Scott Melker, “The Wolf of All Streets,” recently argued that Bitcoin has been co-opted by the very financial elite it was built to resist. Meanwhile, others like Ryan McMillin from Merkle Tree Capital see it differently, saying that old coins moving to new institutional wallets is simply Bitcoin integrating with the financial system.

Institutions Play by Different Rules

Pysh admitted the tension is unlikely to fade anytime soon. “Institutions are going to use it very differently to how individuals use it,” he explained. For long-time Bitcoiners, that’s a tough pill to swallow. The ethos of questioning everything, distrusting authority, and holding your own keys doesn’t line up neatly with the way Wall Street treats Bitcoin—as just another asset class to package, trade, and arbitrage.

Still, adoption keeps growing. A Coinbase and EY-Parthenon report from March found that 83% of institutional investors plan to increase crypto allocations in 2025. Whether that’s a good thing or not depends on who you ask. To some, it’s validation. To others, it feels like Bitcoin’s spirit is being watered down.

The Road Ahead

Bitcoin culture has always thrived on skepticism, and that isn’t changing. Institutions may bring liquidity, legitimacy, and global scale, but they’ll never carry the same ethos as the individuals who built Bitcoin from nothing. The tension between the two worlds—grassroots believers and financial giants—will likely define the next chapter of Bitcoin’s story.